National Grid 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report

Financial review continued

11/12

1

0/11 12/13 13/14 14/15

13.0

13.6 13.6 12.7 13.7

UK return on equity

%

US regulated return on equity

The US RoE has decreased 60bps to 8.4%,

reflecting the additional costs incurred this year as a

result of the severe winter weather and the additional

gas mains leak investigation and repair work required,

together with rate base growth.

2011

2

010 2012 2013 2014

8.8

8.3 9.2 9.0 8.4

US return on equit

y1 %

1. Calculated on a calendar year basis.

Cash generated from operations

Cash generated from operations was £5,350 million

(2013/14: £4,419 million). Changes in working capital

improved by £360 million over the prior year,

principally in the US (£441 million) due to the

collection of high winter 2014 billings and other

settlements including Superstorm Sandy reinsurance

claims and LIPA receipts. Cash outflows relating to

exceptional items were £133 million lower, as the

prior year included reorganisation costs in the UK

and LIPA MSA transition costs in the US.

Net debt and credit metrics

Our net debt levels will continue to grow for the

nextfew years as we fund our capital investment

programmes and enhance our networks. We continue

to borrow at attractive rates when needed and the

level of net debt remains appropriate for our business.

During 2014/15, net debt has increased by £2.7billion.

This is predominantly due to movements in foreign

exchange rates as the US dollar strengthened

against sterling. Gross borrowings are relatively

consistent year on year, reflecting the current year

net refinancing of maturities and bond repurchases,

while cash and investment levels have been actively

managed down.

With the commencement of the RIIO price controls

in2013 and the slow down in our planned near-term

UK capital investment programme as the industry

assesses the impact of Electricity Market Reform,

wereviewed and restructured the Group debt

portfolio. The review resulted in a £924 million bond

repurchase programme, of which £295 million was

achieved through a cash tender offer for five bonds.

The net repurchase cost of £131 million has been

presented as exceptional finance costs in the

incomestatement, as noted on page 104.

A key measure we use to monitor financial discipline is

retained cash flow divided by adjusted net debt (RCF/

net debt). This is a measure of the operating cash

flows we generate, before capital investment but after

dividends paid to shareholders, compared with the

level of debt we hold. The principal adjustment made

to net debt is to include pension deficits. RCF/net

debt was 11.2% for the year (2013/14: 10.5%;

2012/13: 11.4%). For the current year we have used

this measure to actively manage scrip uptake through

buying back shares when supported by sufficient

headroom. Deducting the cost of buying back these

shares reduces RCF/net debt to 9.9% for the year.

Our long-term target range for RCF/net debt is to

exceed 9.0%, which is consistent with the A3 rating

threshold used by Moody’s, the rating agency.

We additionally monitor interest cover, which is a

measure of the cash flows we generate compared

with the net interest cost of servicing our borrowings.

Interest cover for the year was 5.1 times (2013/14:

4.1times; 2012/13: 3.9 times). Our target long-term

rate for interest cover is in excess of 3 times.

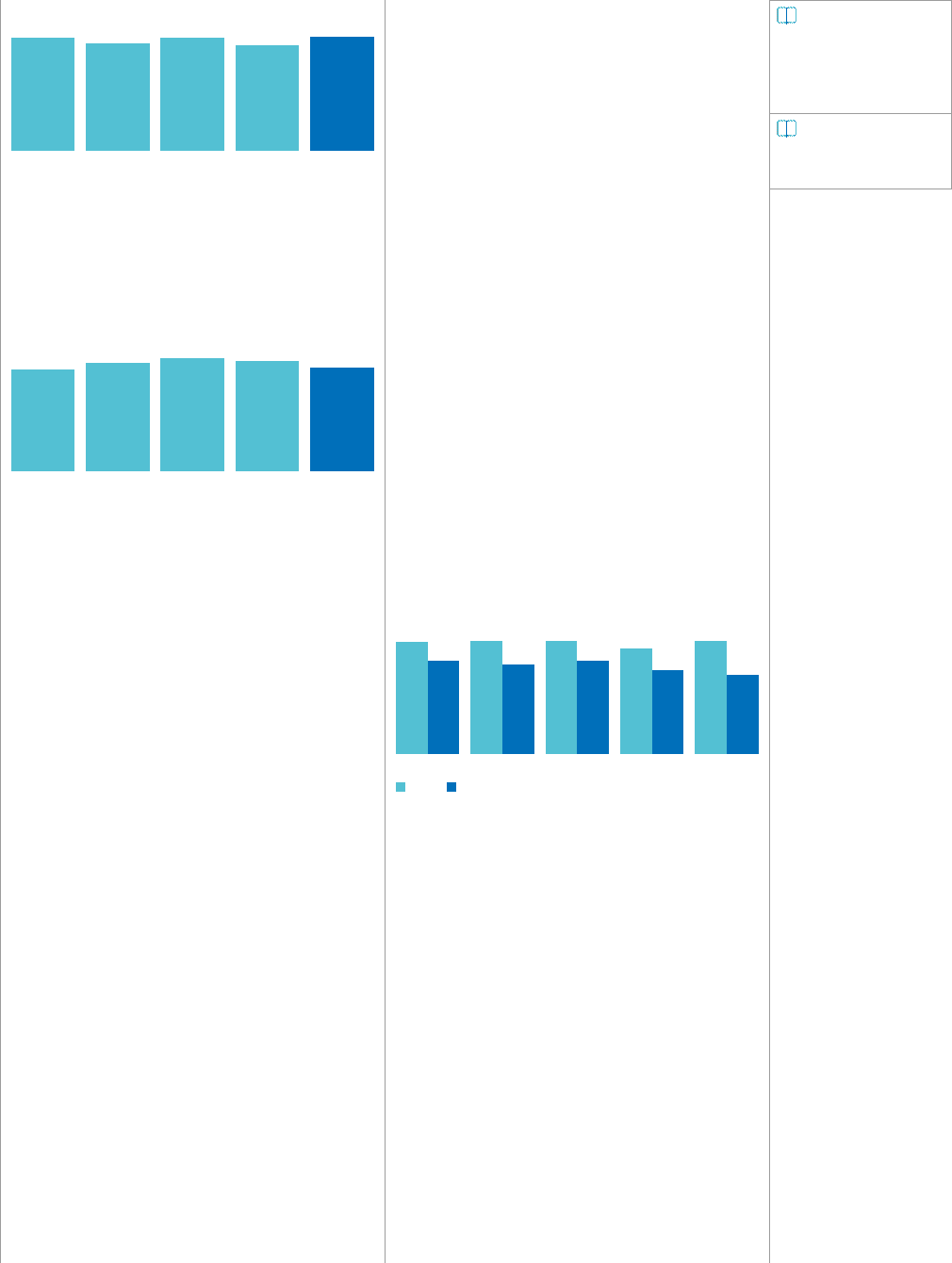

Return on capital employed

RoCE provides a performance comparison between

our regulated UK and US businesses and is one of

the measures that we use to monitor our portfolio

ofbusinesses. The table below shows our RoCE

forour businesses over the last five years:

11/12

1

0/11 12/13 13/14 14/15

8.5

7.1

8.6

6.8

8.6

7.1 8.0

6.4

8.6

6.0

Return on capital employed

%

UK US

The UK RoCE has increased from 8.0% to 8.6%

in2014/15. This reflects the strong incentive

performance in Gas Transmission and further totex

outperformance in Electricity Transmission, together

with one-off benefits of legal settlements in the year.

US RoCE has decreased by 40bps in the year to

6.0%, as a result of the additional maintenance to

improve reliability and safety and bring regulatory

filings up to date, together with rate base growth

driven by capital expenditure spend.

Capital expenditure

For the year ended 31 March 2015, capital

expenditure of £3,470 million was at a similar level to

last year, with reductions in spend in UK Electricity

Transmission being offset by increases in capital

spend in our US Regulated businesses.

The reduction in spend in UK Electricity Transmission

reflected delays in the manufacture of cable for

theWestern HVDC link and a reduced level of

overhead line work, with a number of projects

havingcompleted over the last two years. In addition

Commentary on

the consolidated

cash flow

statement

page 93

Commentary

on borrowings

page 125

22