National Grid 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate Governance

Directors’ Remuneration Report continued

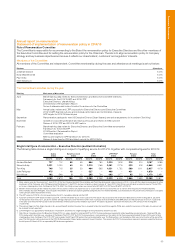

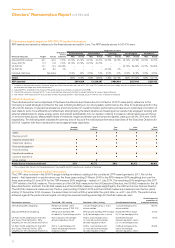

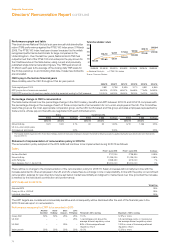

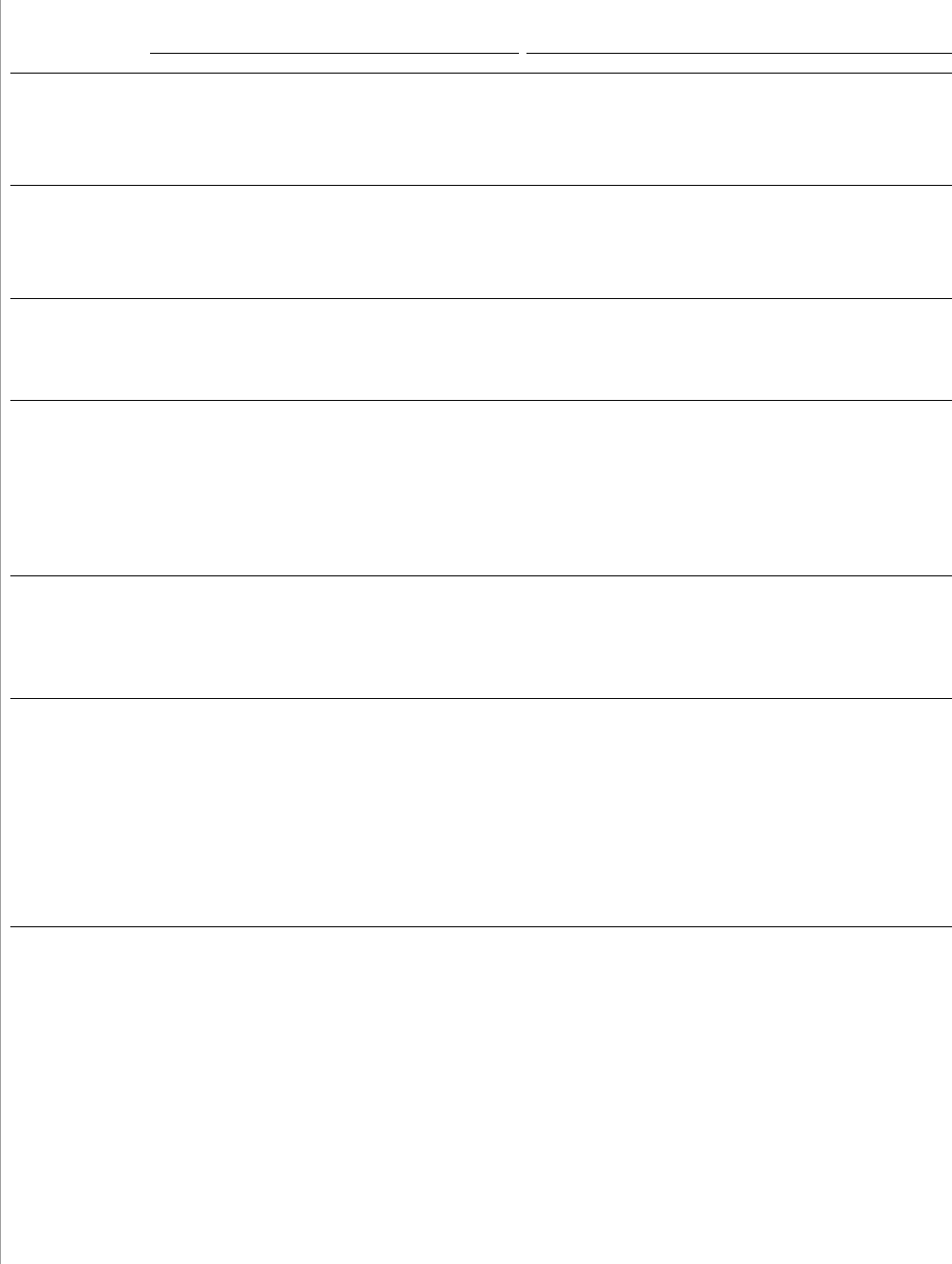

Performance conditions for LTPP awards granted during the financial year (audited information)

Weighting Conditional share awards granted – 2014

Performance measure Andrew Bonfield Steve Holliday Tom King John Pettigrew Threshold – 20% vesting Maximum – 100% vesting

Group RoE 50% 50% 25% 25% 11.0% 12.5% or more

UK RoE 25% 1 percentage point above the

average allowed regulatory return

3.5 percentage points or more above

the average allowed regulatory return

US RoE 25% 90% of the average allowed

regulatory return

105% or more of the average allowed

regulatory return

Value growth 50% 50% 50% 50% 10.0% 12.0% or more

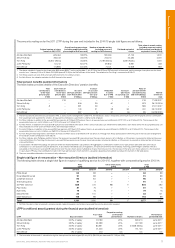

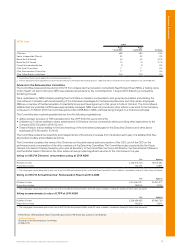

DSP (conditional award) granted during the financial year (audited information)

The 2014 award (granted 17 June 2014) is the final DSP award that will be made and relates to the 2013/14 award made under the previous

remuneration policy.

DSP Basis of award Face value ’000 Number of shares Release date

Andrew Bonfield 50% of APP value £395 47, 0 4 8 17 June 2017

Steve Holliday 50% of APP value £585 69,653 17 June 2017

Tom King 50% of APP value $482 6,566 (ADSs) 17 June 2017

John Pettigrew 33% of APP value £120 14,350 17 June 2017

Nick Winser 50% of APP value £352 41,924 17 June 2017

1. The face value of the awards is calculated using the share price at the date of grant (17 June 2014) (£8.3922 per share and $73.4150 per ADS).

2. The award made in 2014/15 is 50% of the 2013/14 APP value except for John Pettigrew.

3. The award made in 2014/15 for John Pettigrew is 33% of the 2013/14 APP value to reflect his terms before his appointment to the Board on 1 April 2014.

Conditions for DSP awards granted during the nancial year

DSP awards are subject only to continuous employment.

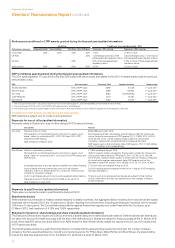

Payments for loss of office (audited information)

Payments made to Directors for loss of office during 2014/15 were as follows:

Description Amount

Tom King Payment in lieu of notice.

Remuneration Committee exercised its discretion to award ‘good

leaver’ status for outstanding 2011, 2012, 2013 and 2014 LTPP

awards and DSP awards.

Date of leaving: 31 March 2015.

$692,388 paid in April 2015.

86,043 awards remain outstanding, having beenprorated for time served

during the performance period (LTPP awards: 2011: 11,385; 2012: 40,200;

2013: 22,542; 2014: 11,916). Awards remain subject to performance

conditions, measured at normal performance measurement date.

DSP awards vest on the termination date (DSP awards: 2012: 11,332 (ADSs);

2013: 7,119 (ADSs); 2014: 6,566 (ADSs)).

Nick Winser Statutory redundancy payment.

Remuneration Committee exercised its discretion to award ‘good

leaver’ status for outstanding 2011, 2012 and 2013 LTPPawards and

DSP awards.

Immediate payment of accrued pension benefits from date ofleaving.

In accordance with the scheme rules, and as for all scheme

members, there is no enhancement to or reduction of the accrued

benefits for redundancy leavers.

Option to exchange pension for lump sum payable at date of leaving.

Stepped down from the Board at 2014 AGM on 28 July 2014.

Date of leaving: 31 July 2015.

£11,925 payable in August 2015.

295,047 awards remain outstanding, having been prorated for time served

during performance period (LTPP awards: 2011: 43,746; 2012: 154,049;

2013:97,252). Awards remain subject to performance conditions, measured

at normal performance measurement date. DSP awards vest on the

termination date (DSP awards: 2012: 39,682; 2013:33,741; 2014: 41,924).

£715,000 lump sum payable in August 2015.

£24,000 residual pension payable monthly from 1 August 2015 increasing

annually with inflation.

The lump sum and residual pension figures are subject to final member

option confirmation and may vary depending on the changes in inflation

atdate of leaving.

Payments to past Directors (audited information)

There were no payments made to past Directors during 2014/15.

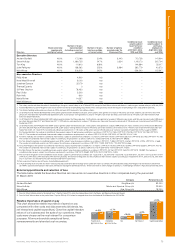

Shareholder dilution

Where shares may be issued or treasury shares reissued to satisfy incentives, the aggregate dilution resulting from executive share-based

incentives will not exceed 5% in any 10 year period. Dilution resulting from all incentives, including all-employee incentives, will not exceed

10% in any 10 year period. The Committee reviews dilution against these limits regularly and under these limits the Company, as at

31March 2015, had headroom of 4.12% and 7.95% respectively.

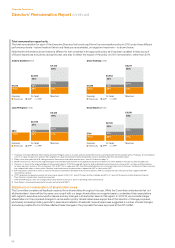

Statement of Directors’ shareholdings and share interests (audited information)

The Executive Directors are required to build up and hold a shareholding from vested share plan awards. Deferred share plan awards are

not taken into account for these purposes until the end of the deferral period. Shares are valued for these purposes at the 31 March 2015

price, which was 865 pence per share ($64.61 per ADS) except for Nick Winser whose shares are valued at the 28 July 2014 share price

of 879 pence per share.

The following table shows how each Executive Director complies with the shareholding requirement and also the number of shares

ownedby the Non-executive Directors, including connected persons. For Philip Aiken, Maria Richter and Nick Winser, the shareholding

isas at the date they stepped down from the Board. For all others it is as at 31 March 2015.

72