National Grid 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

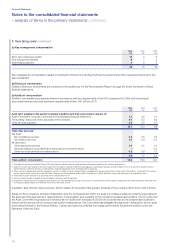

Unaudited commentary on the results of our principal operations by segment

As a business, we have three measures of operating profit that are

used on a regular basis and disclosed in this Annual Report.

Statutory operating profit: This is operating profit as calculated

under International Financial Reporting Standards (IFRS). Statutory

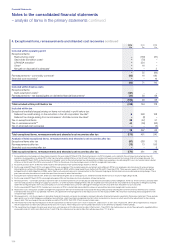

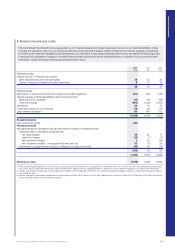

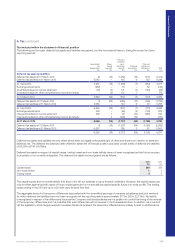

operating profit by segment is shown in note 2 on page 98.

Adjusted operating profit: Adjusted operating profit (business

performance) excludes items that if included could distort

understanding of our performance for the year and the comparability

between periods. Further details of items that are excluded in

adjusted operating profit are shown in note 4 on page 103.

Regulatory financial performance: This is particularly relevant

for our UK operations and is a measure of operating profit that

reflects the impact of the businesses’ regulatory arrangements

when presenting financial performance.

Reconciliations between statutory and adjusted operating profit

can be found on page 186. Reconciliations between adjusted

operating profit and regulatory financial performance for UK

Electricity Transmission, UK Gas Transmission and UK Gas

Distribution can be found on page 100.

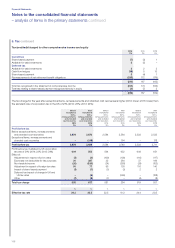

Commentary on segmental adjusted operating

profit results

We have summarised the results of our principal operating

segments here by segment to provide direct reference to

theresults as disclosed in note 2. This analysis has been

prepared based on adjusted operating profit (operating profit

before exceptional items, remeasurements and stranded cost

recoveries) as set out in note 2(b).

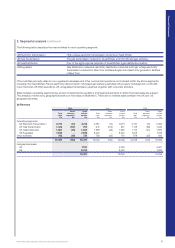

UK Electricity Transmission

For the year ended 31 March 2015, revenue in the UK Electricity

Transmission segment was £367m higher at £3,754m, and

adjusted operating profit increased by £150m to £1,237m.

Net regulated income after pass-through costs was £230m higher,

principally reflecting increases in allowed Transmission Owner

revenues this year and a £43m benefit relating to legal settlements.

This was partially offset by under-recoveries of allowed revenue

inthe year of £89m compared with under-recoveries of £60m in

the prior year. Regulated controllable costs were £14m higher

dueto inflation, organisational change costs and additional tower

maintenance costs. Depreciation and amortisation was £33m

higher reflecting the continued capital investment programme

(investment in the year was £1,074m). Other costs were £4m

higher than prior year.

UK Gas Transmission

Revenue in the UK Gas Transmission segment increased by £81m

in 2014/15 to £1,022m and adjusted operating profit increased by

£20m to £437m.

Net regulated income after pass-through costs was £42m higher

due to earned gas permit and constraints management incentives.

In addition, under-recoveries of allowed revenue in the year of £18m

were £3m favourable to last year’s under-recoveries of £21m.

Partially offsetting the revenue gains, regulated controllable costs

were £8m higher, mainly as a result of additional system operator

costs relating to EU work and some organisation change costs.

Other operating costs were also £17m higher, including a £13m

provision for decommissioning the Avonmouth LNG plant.

Capital investment remained around the same level as last year

at£184m.

UK Gas Distribution

UK Gas Distribution revenue decreased by £31m in 2014/15

to£1,867m, and adjusted operating profit decreased by £78m

to£826m.

Net regulated income after pass-through costs was £11m lower,

reflecting changes in allowed revenues for replacement expenditure

(repex). Timing differences reduced net revenues by a further

£16m, with£13m over-recoveries in 2014/15, compared with a

£29m over-recovery in the prior year. Regulated controllable costs

were £22m higher primarily due to inflation and some organisation

change costs. Depreciation andamortisation was£15m higher

reflecting the continued capital investment programme

(investment in the year was £498m). Other costs were£14m

higher, reflecting a provision for additional asset protection costs.

US Regulated

Revenue in our US Regulated businesses was £54m lower in

2014/15 at £7,986m, while adjusted operating profit increased

by£39m to£1,164m.

The stronger dollar increased operating profit in the year by £30m.

Excluding the impact of foreign exchange, net regulated income

increased by £81m, reflecting increased revenue from existing rate

plans, including capex trackers, together with additional income

from gas customer growth, partially offset by the impact of the

endof LIPA management services activities (MSA) in December

2013. In addition, over-recoveries of allowed revenues in the year

of £30m were £20m favourable to last year’s over-recoveries of

£10m. Regulated controllable costs increased by £17m excluding

the impact of foreign exchange, as a result of increased gas leak

and compliance work and additional costs incurred to improve

data quality and bring regulatory filings up to date, partly offset

bythe cessation of costs associated with the LIPA MSA activities.

Bad debt costs were £62m higher excluding the impact of foreign

exchange, following last year’s exceptionally cold winter. There

were no major storms affecting our operations in the years ended

31 March 2014 and 2015.

Our capital investment programme continues in the US, with a

further £1,501m invested in 2014/15, including gas leak reduction

programmes and electricity capacity and reinforcement work.

Other activities

Revenue in Other activities increased by £26m to £762m in the

year ended 31 March 2015. Adjusted operating profit was £68m

higher at £199m.

Operating profit in the French interconnector was £18m higher as

aresult of strong auction revenues this year. In the US, corporate

and other activities losses were £63m lower, mainly as a result

ofour finance system upgrade completing in the first half of this

year. Capital investment in our Other activities was £33m higher

at£213m.

Financial Statements

NATIONAL GRID ANNUAL REPORT AND ACCOUNTS 2014/15 99