National Grid 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate Governance

Directors’ Remuneration Report continued

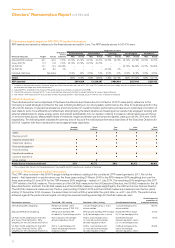

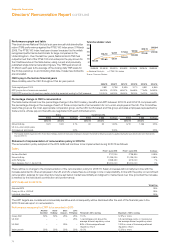

Annual

Performance Plan

Purpose and link to strategy: to incentivise and reward the achievement of annual nancial

andstrategic business targets and the delivery of annual individual objectives.

Operation Maximum levels

Performance metrics, weighting

and time period applicable

Performance metrics and targets are agreed at the start of

each financial year. Performance metrics are aligned with

strategic business priorities. Targets are set with reference

to the budget. Awards are paid in June.

For APP awards made in 2013/14, 50% of any award was

deferred into shares in the Deferred Share Plan (DSP). The

DSP has no performance conditions and vests after three

years, subject to continued employment. These shares are

subject to forfeiture for leavers in certain circumstances.

The DSP has been discontinued for APP awards made in

respect of years from 2014/15. Instead 50% of awards are

paid in shares, which (after any sales to pay tax) must be

retained until the shareholding requirement is met, and in

any event for two years after receipt.

Awards are subject to clawback and malus provisions.

The maximum award is 125%

ofsalary.

A significant majority of the APP

isbased on performance against

corporate financial measures,

withthe remainder based on

performance against individual

objectives. Individual objectives

arerole specific.

The Committee may use its

discretion to set measures that

itconsiders appropriate in each

financial year and reduce the

amount payable, taking account

ofsignificant safety or customer

service standard incidents,

environmental and governance

issues.

The payout levels at threshold,

target and stretch performance

levels are 0%, 50% and 100%

respectively.

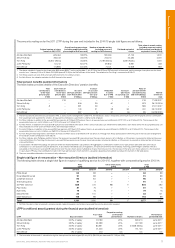

Long Term

Performance Plan

Purpose and link to strategy: to drive long-term performance, aligning Executive Director incentives

to key strategic objectives and shareholder interests.

Operation Maximum levels

Performance metrics, weighting

and time period applicable

Awards of shares may be granted each year, with vesting

subject to long-term performance conditions.

The performance metrics have been chosen as the

Committee believes they reflect the creation of long-term

value within the business. Targets are set each year with

reference to the business plan.

Awards are subject to clawback and malus provisions.

Notwithstanding the level of award achieved against the

performance conditions, the Committee may use its

discretion to reduce the amount vesting, and in particular

will take account of compliance with the dividend policy.

The maximum award for the CEO

is 350% of salary and it is 300%

of salary for the other Executive

Directors.

For awards made between

2011and 2013, the maximum

award for the CEO was 225%

ofsalary and 200% for the other

Executive Directors.

For awards between 2011 and

2013 the performance measures

and weightings were:

• adjusted EPS (50%) measured

over three years;

• TSR relative to the FTSE 100

(25%) measured over three

years; and

• UK or US RoE relative to allowed

regulatory returns (25%)

measured over four years.

From 2014, the performance

measures are:

• value growth and Group RoE

(forthe CEO and Finance

Director); and

• value growth, Group RoE and

UK or US RoE (for the UK and

US Executive Directors

respectively).

LTPP table continued opposite

64