National Grid 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statements

– analysis of items in the primary statements continued

Notes to the consolidated financial statements

3. Operating costs continued

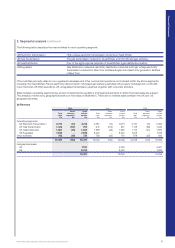

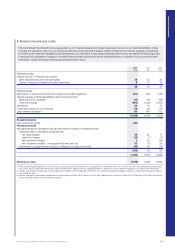

(c) Key management compensation

2015

£m

2014

£m

2013

£m

Short-term employee benefits 10 9 8

Post-employment benefits 91 3

Share-based payment 45 5

23 15 16

Key management compensation relates to the Board of Directors, including the Executive Directors and Non-executive Directors for the

years presented.

(d) Directors’ emoluments

Details of Directors’ emoluments are contained in the audited part of the Remuneration Report on page 69, which forms part of these

financial statements.

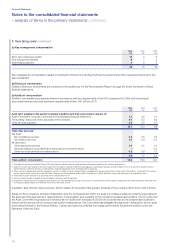

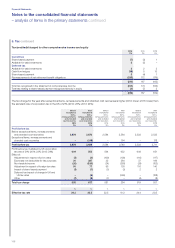

(e) Auditors’ remuneration

Auditors’ remuneration is presented below in accordance with the requirements of the UK Companies Act 2006 and the principal

accountant fees and services disclosure requirements of Item 16C of Form 20-F:

2015

£m

20141

£m

2013

£m

Audit fees2 payable to the parent Company’s auditors and their associates in respect of:

Audit of the parent Company’s individual and consolidated financial statements 1.3 0.9 1.1

The auditing of accounts of any associate of the Company 8.1 9.2 6.0

Other services supplied33.3 3.2 2.7

12.7 13.3 9.8

Total other services4

Tax fees5:

Tax compliance services 0.4 0.5 0.5

Tax advisory services 0.1 0.3 0.3

All other fees6:

Other assurance services 0.1 0.1 0.1

Services relating to corporate finance transactions not covered above ––0.3

Other non-audit services not covered above 0.3 0.8 1.1

0.9 1.7 2.3

Total auditors’ remuneration 13.6 15.0 12.1

1. The audit fees for the year ended 31 March 2014 have been restated to reflect the final audit fee following completion of the statutory audit process.

2. Audit fees in each year represent fees for the audit of the Company’s financial statements and regulatory reporting for the years ended 31 March 2015, 2014 and 2013, and the review of

interim financial statements for the six month periods ended 30 September 2014, 2013 and 2012 respectively.

3. Other services supplied represent fees payable for services in relation to other statutory filings or engagements that are required to be carried out by the auditors. In particular, this includes

fees for reports under section 404 of the US Public Company Accounting Reform and Investor Protection Act of 2002 (Sarbanes-Oxley) and audit reports on regulatory returns.

4. There were no audit related fees as described in Item 16C(b) of Form 20-F.

5. Tax fees include amounts charged for tax compliance, tax advice and tax planning.

6. All other fees include amounts relating to market research on the metering industry and sundry services, all of which have been subject to approval by the Audit Committee. Total other fees

forthe year ended 31 March 2015 were £0.4m (2014: £0.9m; 2013:£1.5m).

In addition, fees of £0.2m were incurred in 2015 in relation to the audits of the pension schemes of the Company (2014: £0.1m; 2013: £0.1m).

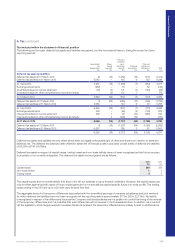

Subject to the Company’s Articles of Association and the Companies Act 2006, the Audit Committee is solely and directly responsible for

the approval of the appointment, reappointment, compensation and oversight of the Company’s independent auditors. It is our policy that

the Audit Committee must approve in advance all non-audit work in excess of £50,000 to be performed by the independent auditors to

ensure that the service will not compromise auditor independence. The Committee has delegated the approval in advance for all non-audit

work below this level to the Finance Director. Certain services are prohibited from being performed by the external auditors under the

Sarbanes-Oxley Act 2002.

102