National Grid 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statements

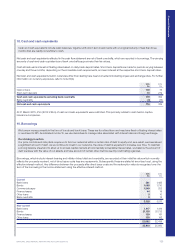

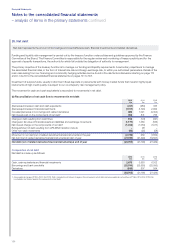

24. Share capital

Ordinary share capital represents the total number of shares issued which are publicly traded. We also disclose the number of treasury

shares the Company holds, which are shares that the Company has bought itself, predominantly to satisfy employee share option

planliabilities.

Share capital is accounted for as an equity instrument. An equity instrument is any contract that includes a residual interest in the

consolidated assets of the Company after deducting all its liabilities and is recorded at the proceeds received, net of direct issue costs,

with an amount equal to the nominal amount of the shares issued included in the share capital account and the balance recorded in

theshare premium account.

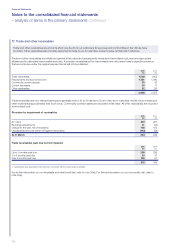

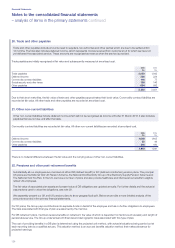

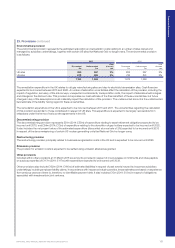

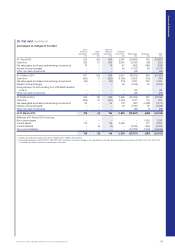

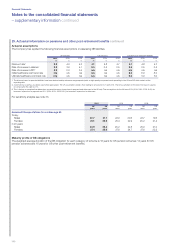

Allotted, called up

and fully paid

million £m

At 1 April 2013 3,795 433

Issued during the year in lieu of dividends159 6

At 31 March 2014 3,854 439

Issued during the year in lieu of dividends138 4

At 31 March 2015 3,892 443

1. The issue of shares under the scrip dividend programme is considered to be a bonus issue under the terms of the Companies Act 2006 and the nominal value of the shares is charged

tothe share premiumaccount.

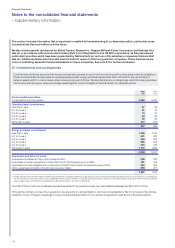

The share capital of the Company consists of ordinary shares of 1117⁄43 pence nominal value each including ADSs. The ordinary shares

andADSs allow holders to receive dividends and vote at general meetings of the Company. The Company holds treasury shares but may

notexercise any rights over these shares including the entitlement to vote or receive dividends. There are no restrictions on the transfer

orsale of ordinary shares.

In line with the provisions of the Companies Act 2006, the Company has amended its Articles of Association and ceased to have

authorised share capital.

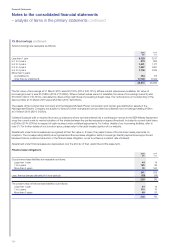

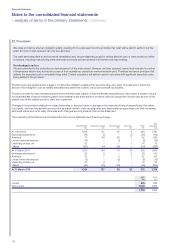

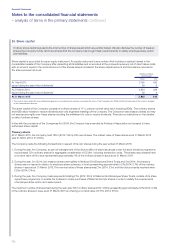

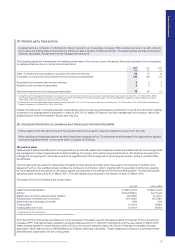

Treasury shares

At 31 March 2015, the Company held 153m (2014: 124m) of its own shares. The market value of these shares as at 31 March 2015

was£1,323m (2014: £1,019m).

The Company made the following transactions in respect of its own shares during the year ended 31 March 2015:

1. During the year, the Company, as part of management of the dilutive effect of share issuances under the scrip dividend programme,

repurchased 37m ordinary shares for aggregate consideration of £338m, including transaction costs. The shares repurchased have

anominal value of £4m and represented approximately 1% of the ordinary shares in issue as at 31 March 2015.

2. During the year, 3m (2014: 2m) treasury shares were gifted to National Grid Employee Share Trusts and 5m (2014: 3m) treasury

shareswere re-issued in relation to employee share schemes, in total representing approximately 0.2% (2014: 0.1%) of the ordinary

shares in issue as at 31 March 2015. The nominal value of these shares was £1m (2014: £1m) and the total proceeds received were

£23m (2014: £14m).

3. During the year, the Company made payments totalling £7m (2014: £3m) to National Grid Employee Share Trusts, outside of its share

repurchase programme, to enable the trustees to make purchases of National Grid plc shares in order to satisfy the requirements

ofemployee share option and reward plans.

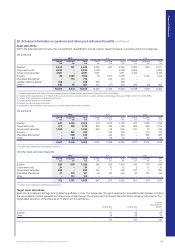

The maximum number of shares held during the year was 153m ordinary shares (2014: 129m) representing approximately 3.9% (2014: 3.4%)

of the ordinary shares in issue as at 31 March 2015 and having a nominal value of £17m (2014: £15m).

– analysis of items in the primary statements continued

Notes to the consolidated financial statements

132