National Grid 2015 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

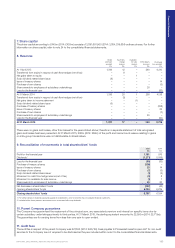

Because of its inherent limitations, internal control over financial

reporting may not prevent or detect misstatements. Also,

projections of any evaluation of effectiveness to future periods are

subject to risk that controls may become inadequate because of

changes in conditions, or that the degree of compliance with the

policies or procedures may deteriorate.

Management evaluation of the effectiveness of the Company’s

internal control over financial reporting was based on the revised

Internal Control-Integrated Framework (2013) issued by the

Committee of Sponsoring Organizations of the Treadway

Commission. Based on this evaluation, management concluded

that our internal control over financial reporting was effective as

at31 March 2015.

PricewaterhouseCoopers LLP, which has audited our consolidated

financial statements for the year ended 31 March 2015, has also

audited the effectiveness of our internal control over financial

reporting. Their attestation report can be found on page 85.

During the year, there were no changes in our internal control over

financial reporting that have materially affected, or are reasonably

likely to materially affect, it.

Risk factors

Management of our risks is an important part of our internal control

environment, as we describe on pages 38 to 41. In addition to the

principal risks listed we face a number of inherent risks that could

have a material adverse effect on our business, financial condition,

results of operations and reputation, as well as the value and

liquidity of our securities.

Any investment decision regarding our securities and any forward-

looking statements made by us should be considered in the light

ofthese risk factors and the cautionary statement set out on the

inside back cover. An overview of the key inherent risks we face

isprovided below.

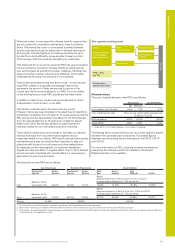

Disclosure controls

Working with management, including the Chief Executive and

Finance Director, we have evaluated the effectiveness of the design

and operation of our disclosure controls and procedures as at

31March 2015. Our disclosure controls and procedures are

designed to provide reasonable assurance of achieving their

objectives, however, the effectiveness of any system of disclosure

controls and procedures has limitations including the possibility of

human error and the circumvention or overriding of the controls

and procedures.

Even effective disclosure controls and procedures provide only

reasonable assurance of achieving their objectives. Based on the

evaluation, the Chief Executive and Finance Director concluded

that the disclosure controls and procedures are effective to provide

reasonable assurance that information required to be disclosed

inthe reports that we file and submit under the Exchange Act

isrecorded, processed, summarised and reported as and

whenrequired and that such information is accumulated and

communicated to our management, including the Chief Executive

and Finance Director, as appropriate, to allow timely decisions

regarding disclosure.

Internal control over financial reporting

Our management, including the Chief Executive and Finance

Director, has carried out an evaluation of our internal control over

financial reporting pursuant to the Disclosure and Transparency

Rules and Section 404 of the Sarbanes-Oxley Act 2002. As

required by Section 404, management is responsible for

establishing and maintaining an adequate system of internal control

over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f)

under the Exchange Act).

Our internal control over financial reporting is designed to provide

reasonable assurance regarding the reliability of financial reporting

and the preparation of financial statements for external purposes

inaccordance with generally accepted accounting principles.

Internal control and risk factors

Risk factors

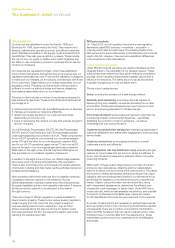

Potentially harmful activities

Aspects of the work we do could potentially harm employees,

contractors, members of the public or the environment.

Potentially hazardous activities that arise in connection with our

business include the generation, transmission and distribution of

electricity and the storage, transmission and distribution of gas.

Electricity and gas utilities also typically use and generate

hazardous and potentially hazardous products and by-products.

In addition, there may be other aspects of our operations that are

not currently regarded or proved to have adverse effects but could

become so, such as the effects of electric and magnetic fields.

A significant safety or environmental incident, or the failure of

oursafety processes or of our occupational health plans, as well

as the breach of our regulatory or contractual obligations or our

climate change targets, could materially adversely affect our

results of operations and our reputation.

We commit significant resources and expenditure to process

safety and to monitoring personal safety, occupational health

andenvironmental performance, and to meeting our obligations

under negotiated settlements.

We are subject to laws and regulations in the UK and US

governing health and safety matters to protect the public and our

employees and contractors, who could potentially be harmed by

these activities as well as laws and regulations relating to pollution,

the protection of the environment, and the use and disposal of

hazardous substances and waste materials.

These expose us to costs and liabilities relating to our operations

and properties, including those inherited from predecessor

bodies, whether currently or formerly owned by us, and sites

usedfor the disposal of our waste.

The cost of future environmental remediation obligations is often

inherently difficult to estimate and uncertainties can include the

extent of contamination, the appropriate corrective actions and

our share of the liability. We are increasingly subject to regulation

in relation to climate change and are affected by requirements to

reduce our own carbon emissions as well as to enable reduction

in energy use by our customers.

If more onerous requirements are imposed or our ability to recover

these costs under regulatory frameworks changes, this could

have a material adverse impact on our business, reputation,

results of operations and financial position.

Additional Information

NATIONAL GRID ANNUAL REPORT AND ACCOUNTS 2014/15 173