National Grid 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

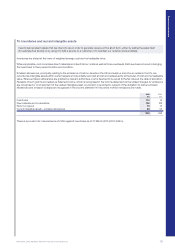

9. Goodwill

Goodwill represents the excess of what we paid to acquire businesses over the fair value of their net assets at the acquisition date.

Weassess whether goodwill is recoverable each year by performing an impairment review.

Goodwill is recognised as an asset and is not amortised, but is tested for impairment annually or more frequently if events or changes

incircumstances indicate a potential impairment. Any impairment is recognised immediately in the income statement and is not

subsequently reversed.

Goodwill and fair value adjustments arising on the acquisition of a foreign entity are treated as assets and liabilities of the foreign entity

andtranslated at the closing exchange rate.

Impairment

Goodwill is allocated to cash-generating units and this allocation is made to those cash-generating units that are expected to benefit from

the business combination in which the goodwill arose.

Impairments of goodwill are calculated as the difference between the carrying value of the goodwill and the estimated recoverable amount

of the cash-generating unit to which that goodwill has been allocated. Recoverable amount is defined as the higher of fair value less costs

to sell and estimated value-in-use at the date the impairment review is undertaken.

Value-in-use represents the present value of expected future cash flows, discounted using a pre-tax discount rate that reflects current

market assessments of the time value of money and the risks specific to the asset for which the estimates of future cash flows have not

been adjusted.

Impairments are recognised in the income statement and are disclosed separately.

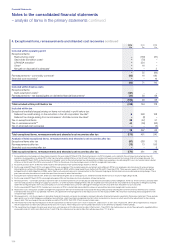

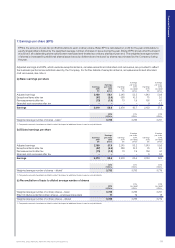

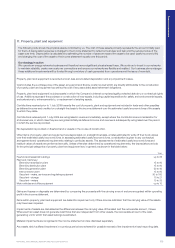

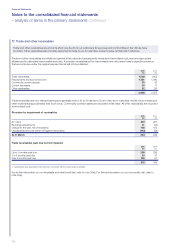

Total

£m

Net book value at 1 April 2013 5,028

Additions 12

Exchange adjustments (446)

Net book value at 31 March 2014 4,594

Impairment (12)

Exchange adjustments 563

Net book value at 31 March 2015 5,145

The cost of goodwill at 31 March 2015 was £5,157m (2014: £4,594m) with an accumulated impairment charge of £12m (2014: £nil).

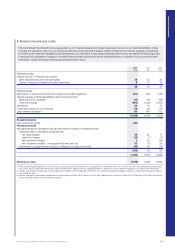

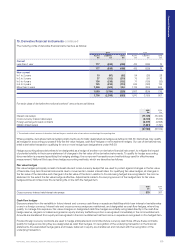

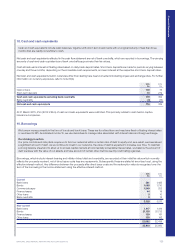

The amounts disclosed above as at 31 March 2015 include balances relating to the following cash-generating units: New York £2,964m

(2014:£2,640m); Massachusetts £1,108m (2014: £987m); Rhode Island £412m (2014: £367m); and Federal £661m (2014: £600m).

Goodwill is reviewed annually for impairment and the recoverability of goodwill has been assessed by comparing the carrying amount

ofour operations described above (our cash-generating units) with the expected recoverable amount on a value-in-use basis. In each

assessment, the value-in-use has been calculated based on five year plan projections that incorporate our best estimates of future cash

flows, customer rates, costs, future prices and growth. Such projections reflect our current regulatory rate plans taking into account

regulatory arrangements to allow for future rate plan filings and recovery of investment. Our plans have proved to be reliable guides in

thepast and the Directors believe the estimates are appropriate.

The future economic growth rate used to extrapolate projections beyond five years has been maintained at 2.25% (2014: 2.25%). The

growth rate hasbeen determined having regard to data on projected growth in US real gross domestic product (GDP). Based on our

business’ place in the underlying US economy, it is appropriate for the terminal growth rate to be based upon the overall growth in real

GDP and, given thenature of our operations, to extend over a long period of time. Cash flow projections have been discounted to reflect

the time value ofmoney, using a pre-tax discount rate of 9% (2014: 9%). The discount rate represents the estimated weighted average

cost ofcapital of these operations.

While it is possible that a key assumption in the calculation could change, the Directors believe that no reasonably foreseeable change

would result in an impairment of goodwill, in view of the long-term nature of the key assumptions and the margin by which the estimated

fair value exceeds the carrying amount.

As part of their review, the Directors specifically reviewed the carrying value of goodwill associated with Clean Line Energy Partners LLC.

This review resulted in a full impairment being recorded of £12m.

Financial Statements

NATIONAL GRID ANNUAL REPORT AND ACCOUNTS 2014/15 113