National Grid 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

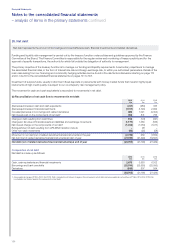

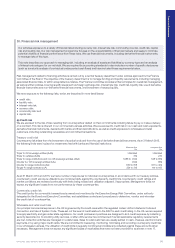

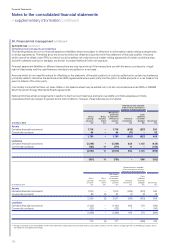

Financial Statements

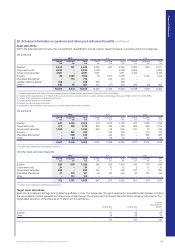

29. Actuarial information on pensions and other post-retirement benefits continued

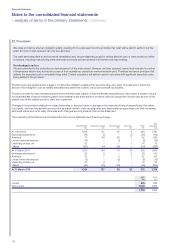

Actuarial assumptions

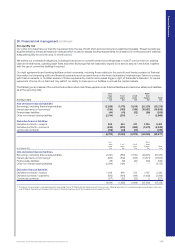

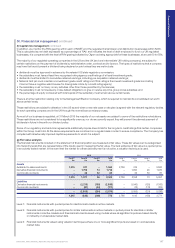

The Company has applied the following financial assumptions in assessing DB liabilities.

UK pensions US pensions US other post-retirement benefits

2015

%

2014

%

2013

%

2015

%

2014

%

2013

%

2015

%

2014

%

2013

%

Discount rate13.3 4.3 4.3 4.1 4.8 4.7 4.1 4.8 4.7

Rate of increase in salaries23.2 3.6 4.1 3.5 3.5 3.5 3.5 3.5 3.5

Rate of increase in RPI32.9 3.3 3.4 n/a n/a n/a n/a n/a n/a

Initial healthcare cost trend rate n/a n/a n/a n/a n/a n/a 8.0 8.0 8.0

Ultimate healthcare cost trend rate n/a n/a n/a n/a n/a n/a 5.0 5.0 5.0

1. The discount rates for pension liabilities have been determined by reference to appropriate yields on high-quality corporate bonds prevailing in the UK and US debt markets at the

reportingdate.

2. A promotional scale has also been used where appropriate. The UK assumption stated is that relating to service prior to 1 April 2014. The UK assumption for the rate of increase in salaries

forservice after this date is 2.1%.

3. This is the key assumption that determines assumed increases in pensions in payment and deferment in the UK only. The assumptions for the UK were 2.9% (2014: 3.3%; 2013: 3.4%) for

increases in pensions in payment and 2.1% (2014: 3.3%; 2013: 3.4%) for increases in pensions in deferment.

For sensitivity analysis see note 33.

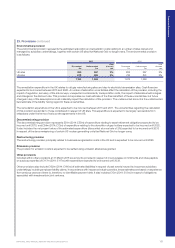

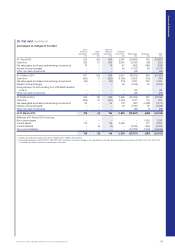

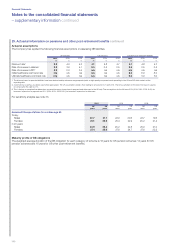

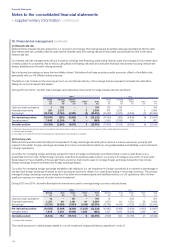

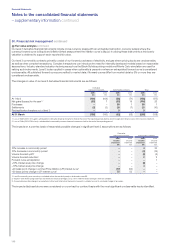

2015 2014 2013

UK

years

US

years

UK

years

US

years

UK

years

US

years

Assumed life expectations for a retiree age 65

Today:

Males 22.7 21.7 22.9 20.6 22.7 19.5

Females 25.1 23.9 25.4 22.9 25.2 21.4

In 20 years:

Males 24.9 23.4 25.2 22.8 25.0 21.0

Females 27.4 25.6 27.8 24.7 27.6 22.2

Maturity profile of DB obligations

The weighted average duration of the DB obligation for each category of scheme is 16 years for UK pension schemes; 14 years for US

pension schemes and 18 years for US other post-retirement benefits.

– supplementary information continued

Notes to the consolidated financial statements

140