National Grid 2015 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

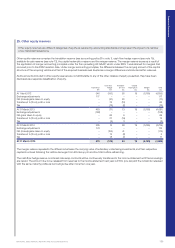

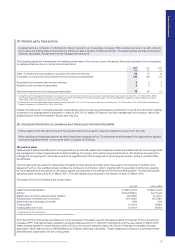

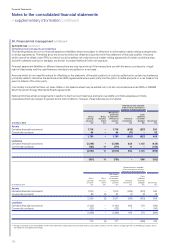

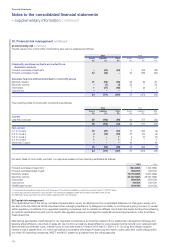

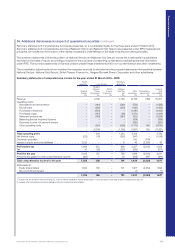

30. Financial risk management continued

(b) Liquidity risk

Our policy is to determine our liquidity requirements by the use of both short-term and long-term cash flow forecasts. These forecasts are

supplemented by a financial headroom analysis which is used to assess funding requirements for at least a 24 month period and maintain

adequate liquidity for a continuous 12 month period.

We believe our contractual obligations, including those shown in commitments and contingencies in note 27 can be met from existing

cash and investments, operating cash flows and other financings that we reasonably expect to be able to secure in the future, together

with the use of committed facilities if required.

Our debt agreements and banking facilities contain covenants, including those relating to the periodic and timely provision of financial

information by the issuing entity and financial covenants such as restrictions on the level of subsidiary indebtedness. Failure to comply

withthese covenants, or to obtain waivers of those requirements, could in some cases trigger a right, at the lender’s discretion, to require

repayment of some of our debt and may restrict our ability to draw upon our facilities or access the capital markets.

The following is an analysis of the contractual undiscounted cash flows payable under financial liabilities and derivative assets and liabilities

as at the reporting date:

At 31 March 2015

Less

than

1 year

£m

1 to 2

years

£m

2 to 3

years

£m

More

than

3 years

£m

Total

£m

Non-derivative financial liabilities

Borrowings, excluding finance lease liabilities (2,289) (1,179) (1,513) (20,235) (25,216)

Interest payments on borrowings1(790) (790) (766) (13,587) (15,933)

Finance lease liabilities (44) (41) (32) (86) (203)

Other non-interest bearing liabilities (2,744) (216) – – (2,960)

Derivative financial liabilities

Derivative contracts – receipts 602 244 411 1,194 2,451

Derivative contracts – payments (935) (318) (952) (1,631) (3,836)

Commodity contracts (116) (43) (21) –(180)

(6,316) (2,343) (2,873) (34,345) (45,877)

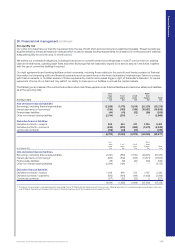

At 31 March 2014

Less

than

1 year

£m

1 to 2

years

£m

2 to 3

years

£m

More

than

3 years

£m

Total

£m

Non-derivative financial liabilities

Borrowings, excluding finance lease liabilities (3,091) (864) (1,140) (20,275) (25,370)

Interest payments on borrowings1(826) (812) (796) (14,571) ( 17, 0 0 5 )

Finance lease liabilities (18) (19) (20) (112) (169)

Other non-interest bearing liabilities (2,584) (190) – – (2,774)

Derivative financial liabilities

Derivative contracts – receipts 1,068 950 153 1,155 3,326

Derivative contracts – payments (556) (861) (144) (1,638) (3,199)

Commodity contracts (177) (30) (22) 2(227)

(6,18 4) (1,826) (1,969) (35,439) (45,418)

1. The interest on borrowings is calculated based on borrowings held at 31 March without taking account of future issues. Floating rate interest is estimated using a forward interest rate curve

as at 31 March. Payments are included on the basis of the earliest date on which the Company can be required to settle.

Financial Statements

NATIONAL GRID ANNUAL REPORT AND ACCOUNTS 2014/15 143