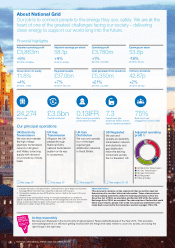

National Grid 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In focus:

The Board is proposing

a recommended

full-year dividend of

42.87p

(2013/14: 42.03p)

Strategic Report

It’s been a challenging year for the energy sector. Energy policies in the UK and

US have continued to evolve against a backdrop of political uncertainty, seeking

an acceptable balance between affordability to consumers, security of supply

and sustainability considerations.

Chairman’s statement

In the UK, we saw debate around the cost of living

lead to a sharper focus on the costs of energy and

the competitiveness of energy markets. This focus

has included an Energy and Climate Change Select

Committee inquiry into energy network costs, as well

as an investigation by the Competition and Markets

Authority into the supply and acquisition of energy

inGreat Britain.

In the UK, Electricity Market Reform (EMR) was

implemented successfully, and we saw developments

in significant interconnector projects (see page 27).

Inthe US, there were mid-term US congressional

and gubernatorial elections and debate continued on

essential infrastructure, resilience andsustainability.

Transparency

In January we announced our decision to stop

publishing formal Interim Management Statements

(IMSs), following the changes in legislation that

removed this requirement. Mandatory requirements

to publish information canfrequently provide an

unnecessary focus on matters of little relevance

toalong-term business such as National Grid.

Alongside our major announcements at the half year

and full year we will continue to provide updates

covering market and Company developments.

We also continue to provide commentary on both

our IFRS reported results and underlying economic

(regulatory) performance, including reconciliations

between the key metrics for both results. To help

explain this more fully, we have increased the

commentary on our regulatory performance on

page23, and have included further analysis of our

regulatory performance by segment on page 100.

We support the development of an accounting

standard for rate-regulated activities, which would

reduce the need for additional explanations of our

results, and submitted a response to the IASB’s

project in January this year.

Dividend

The Board has recommended an increase in the final

dividend to 28.16 pence per ordinary share ($2.1866

per American Depositary Share). If approved, this

willbring the full-year dividend to 42.87 pence per

ordinary share ($3.3584 per American Depositary

Share), an increase of 2.0% over the 42.03 pence per

ordinary share in respect of the financial year ending

31 March 2014.

In August 2014 we began a share buyback

programme designed to operate alongside our scrip

dividend option, which we offered for the interim

dividend and will offer again for the full-year dividend.

The buyback programme, which operates under

authorities granted at our 2014 AGM, is designed to

balance shareholders’ appetite for the scrip dividend

option with our desire to operate an efficient balance

sheet with appropriate leverage.

Effective governance

In July 2014, John Pettigrew, who joined the Board

inApril 2014, became Executive Director, UK and

Nick Winser and Maria Richter both stepped down

from the Board.

02