Mazda 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

with additional technologies for improved fuel efficiency,

achieves a powerful driving performance with torque

equal to 2.5-liter gasoline engine while providing a high

level of environmental performance. We will also continue

to expand our lineup of SKYACTIV-equipped models going

forward.

In terms of sales, our Sales Method Innovation that

leverages the product strength of SKYACTIV-equipped

models is producing results. We are achieving sales vol-

ume growth while curtailing sales incentives by promoting

right-price policy. Through these initiatives, our vehicles

will retain high residual value, and we will maintain appro-

priate inventory levels.

With regard to production, our new plant in Mexico

began production of the new Mazda3 for North America

in January 2014 as scheduled. The construction of our

new engine machining factory in Mexico and our new

transmission plant in Thailand are also on track. In line

with increasing global sales of SKYACTIV-equipped

models, in Japan we are increasing our annual production

capacity for SKYACTIV-G and SKYACTIV-D engines at our

engine plant in Hiroshima and for SKYACTIV transmis-

sions at our Hofu Plant as planned.

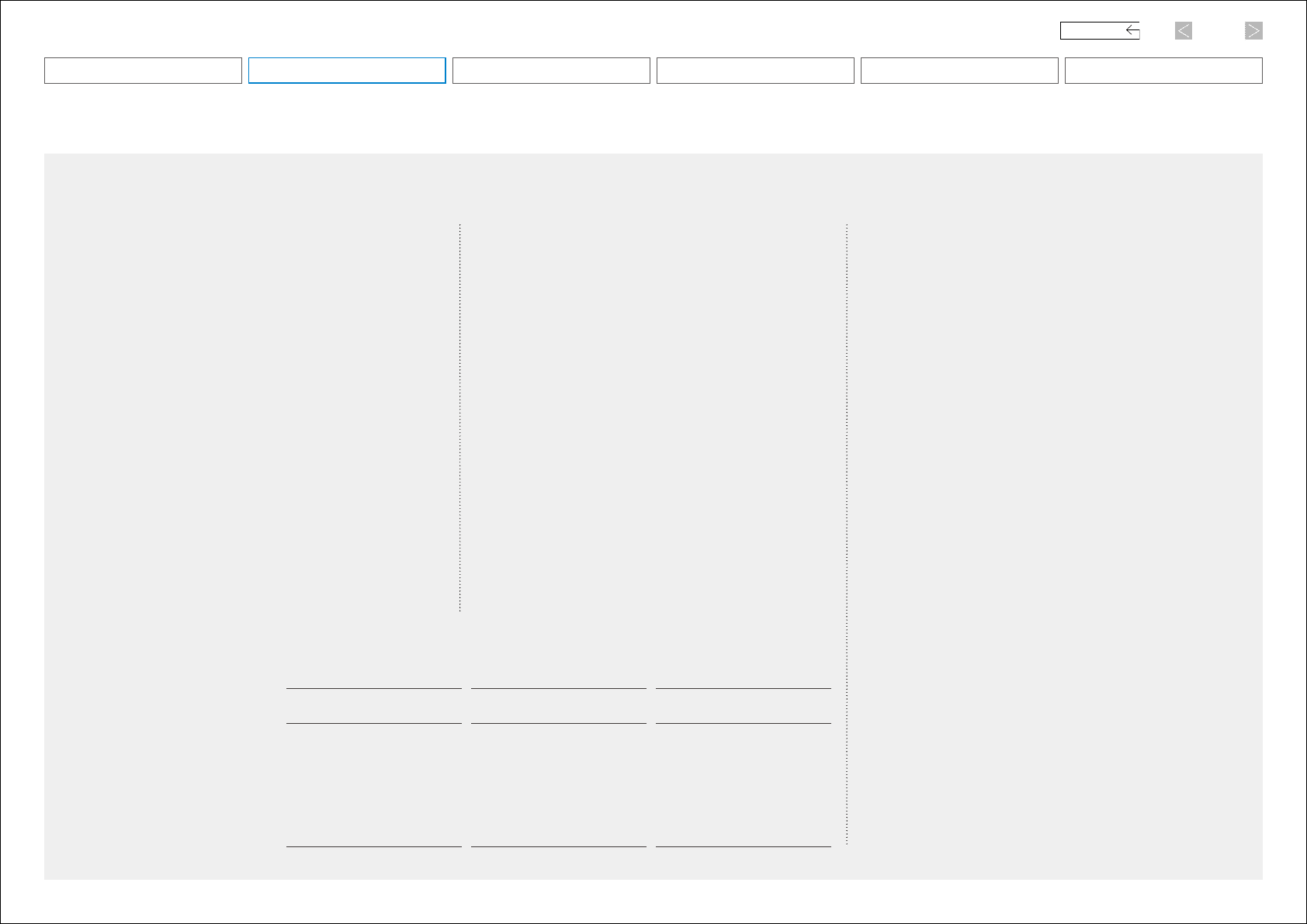

As a result, global sales volume in the March 2014 fis-

cal year grew 7.8% from the previous year, to 1,331,000

units, led by the CX-5, the Mazda6, and the new Mazda3.

Net sales rose ¥487.0 billion, to ¥2,692.2 billion, operat-

ing income increased ¥128.2 billion, to ¥182.1 billion, and

net income grew ¥101.4 billion, to ¥135.7 billion.

*1. Automotive Researchers’ & Journalists’ Conference of Japan

Forecast for the March 2015 fiscal year

In the March 2015 fiscal year, we are aiming for growth in

global sales volume on a full-year contribution from sales

of the new Mazda3, and our enhanced supply structure

from full-scale operations at the Mexico Plant. We will

also continue to curtail sales incentives and maintain

right-price sales, underpinned by the product strength of

SKYACTIV-equipped models, while stepping up our pro-

motional activities for our products and the Mazda brand

and strengthening our sales network. We are forecasting

a 6.7% increase in global sales volume, to 1,420,000

units, with net sales of ¥2,900.0 billion (an increase of

¥207.8 billion), operating income of ¥210.0 billion (an

increase of ¥27.9 billion) and net income of ¥160.0 billion

(an increase of ¥24.3 billion). We will also strengthen our

management base to achieve solid growth in sales vol-

ume and a stable earnings structure.

Returns to shareholders

We view returns to shareholders as a very important man-

agement issue. Our policy in determining the dividend is to

take into account results for the fiscal year, the operating

environment, and our financial position. This year we are

placing priority on our responsibility to provide returns to

shareholders as quickly as possible, and have restored the

dividend for the first time in four years. We set the dividend

amount at ¥1 per share, which represents a balance

between our level of retained earnings and other internal

reserves, with investments for future growth. We will con-

tinue to strive to maintain a stable dividend with steady

increases in the amount going forward. For the March 2015

fiscal year, we intend to pay a year-end dividend of ¥10 per

share.*2

*2. Dividend amount based on the number of shares following the share consolidation

that was carried out on August 1, 2014. Please see page 39 for more information

on the consolidation of shares.

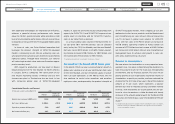

Consolidated Results and Forecast

(Fiscal years ended / ending March 31) 2013 2014 2015

Result Increase/

Decrease Result Increase/

Decrease Forecast Increase/

Decrease

Global sales volume (1,000 units) 1,235 (12) 1,331 +96 1,420 +89

Net sales (billion yen) 2,205.3 +172.2 2,692.2 + 4 87. 0 2,900.0 +2 0 7. 8

Operating income (billion yen) 53.9 +92.7 182.1 +128.2 210.0 +27.9

Net income (billion yen) 34.3 +142.0 135.7 +101.4 160.0 +24.3

05

Mazda Annual Report 2014

CONTENTS

Message from Management

Introduction

Brand Value Management

Review of Operations

Foundations Underpinning

Sustainable Growth

Financial Section