Mazda 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Review and Analysis

March 2014 Fiscal Year

Review of Operations

(Operating Environment)

The mood in the Mazda Group’s operating

environment in the March 2014 fiscal year

was guardedly hopeful; although the outlook

for the economies of emerging countries was

uncertain, overall the global economy contin-

ued to make a gradual recovery. The U.S.

economy continued its gradual improvement,

and signs of recovery were also seen in the

European economy. The Japanese economy

was on the way to a solid recovery as the

result of fiscal and monetary policies imple-

mented by the government and the Bank of

Japan, and last-minute demand was seen

prior to a recent hike in consumption tax.

Under these circumstances, while steadily

implementing the key initiatives of its

“Structural Reform Plan,” the Mazda Group

pressed forward with the global expansion of

sales of vehicles with its new-generation

technology, SKYACTIV, and strove to improve

its earning structure.

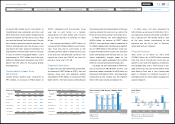

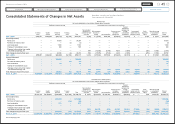

(Global Sales Volume)

In total, global sales volume for the fiscal year

ended March 31, 2014, was 1,331,000 units, up

7.8% year on year. The Mazda CX-5 and the

Mazda6 (Japanese name: Mazda Atenza)

drove global sales, and sales were also strong

of the Mazda3 (Japanese name: Mazda Axela)

newly introduced during the period.

By market, Japan’s domestic sales volume

was 244,000 units, up 12.6% year on year, as

orders for the new Axela far exceeded the tar-

get, and sales of the Atenza and CX-5 remained

strong. Sales volume in North America was

391,000 units, up 4.9% year on year, with

increased volume in the United States on

strong sales of the Mazda6 and CX-5 and

record sales in Mexico. In Europe, although

total demand remained on par with the previ-

ous fiscal year, sales in Germany, Russia, and

the United Kingdom were strong. As a result,

sales volume was 207,000 units, up 20.5%

year on year. In China, the locally manufac-

tured CX-5 drove sales, which were up 12.5%

year on year at 196,000 units. In other mar-

kets, although sales remained strong in

Australia, they declined in Thailand, where

demand was sluggish, and sales volume was

293,000 units, down 2.0% year on year.

In addition, consolidated wholesales rose

5.8%, to 1,115,000 units.

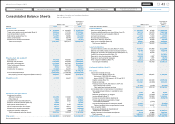

(Net Sales)

Net sales amounted to ¥2,692.2 billion, an

increase of ¥487.0 billion, or 22.1%, over the

previous fiscal year, owing to increasing sales

of SKYACTIV-equipped models in global mar-

kets. The breakdown of consolidated net

sales was an 11.5% increase for domestic

sales, to ¥655.7 billion, and a 25.9% increase

for overseas sales, to ¥2,036.5 billion.

By product, vehicle sales increased ¥426.9

billion (24.3%), to ¥2,180.7 billion, on improve-

ments in sales volume and the product mix.

Sales of knockdown parts for overseas pro-

duction increased ¥14.5 billion (25.8%), to

¥70.4 billion, on an increase in shipments to

China. Sales of parts increased ¥16.8 billion

(8.8%), to ¥206.5 billion, and other sales

were ¥28.8 billion (14.0%) higher, at ¥234.6

billion.

(Operating Income)

Operating income amounted to ¥182.1 billion,

an increase of ¥128.2 billion (237.7%) over the

previous fiscal year. Marketing expenses

221

307

239

196

230

206 206 216 244

391

207

196

293

372

172

175

300

372

183

223

263

342

212

236

277

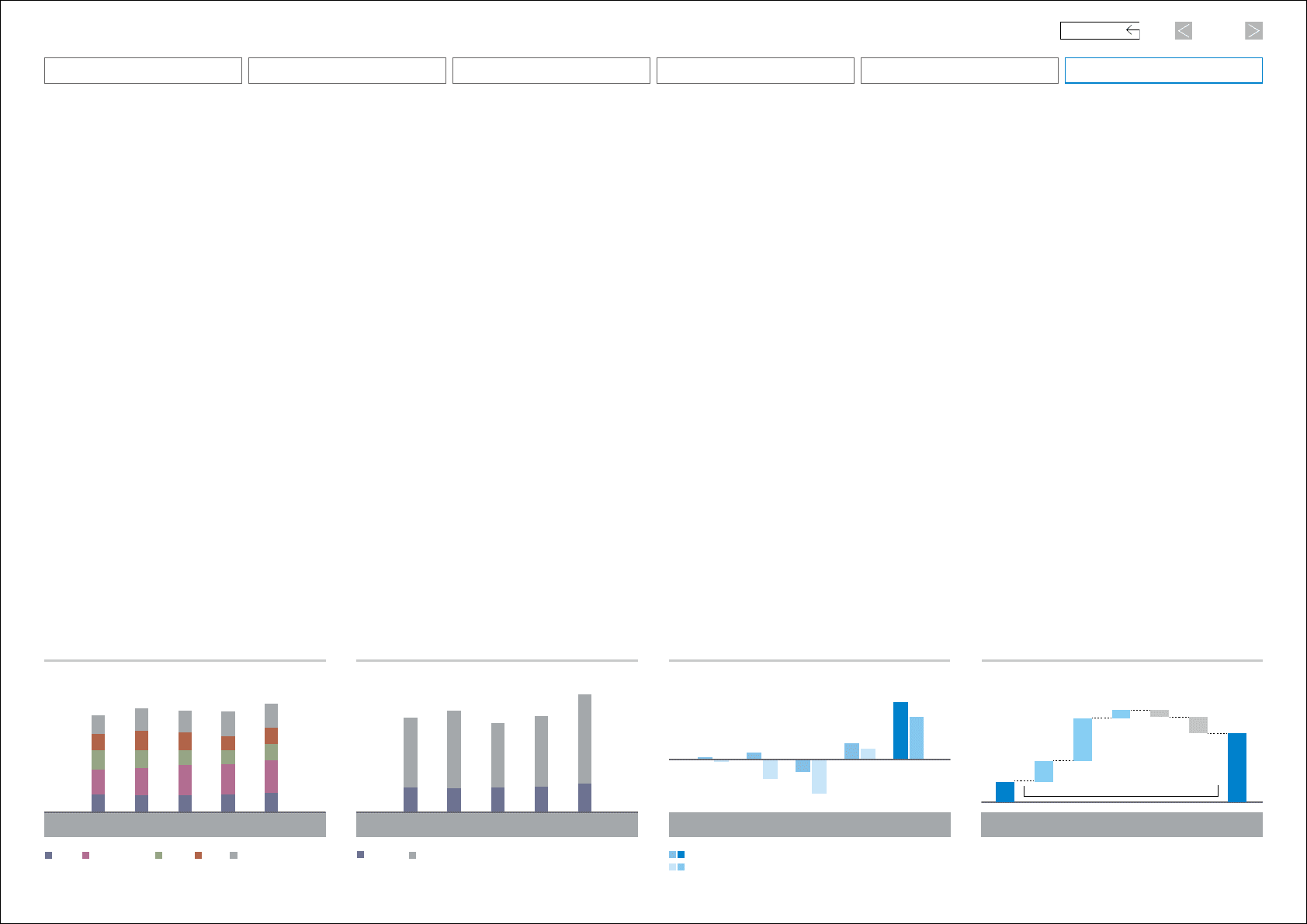

Sales Trend by Major Markets

Thousands of units

1,193 1,273 1,247 1,331

1,235

2010 2011 2012 2013 2014

Other markets

China

Europe

North America

Japan

(Years ended March 31)

2,692.2

2,163.9 2,325.7

2,036.5

1,588.9 1,784.2

541.5

2,033.1

1,472.9

560.2

575.0 655.7

2,205.3

1,617.3

588.0

2010 2011 2012 2013 2014

Overseas

Domestic

Net Sales

Billions of yen

(Years ended March 31)

9.5

(6.5)

(60.0) (38.7)

23.8 53.934.3

(107.7)

135.7

182.1

2010 2011 2012 2013 2014

Operating Income (Loss) / Net Income (Loss)

Billions of yen

Operating Income

Net Income

■ Improvement

■ Deterioration

(Years ended March 31) (Years ended March 31)

Volume and

mix

+55.0

YoY +128.2

Foreign

exchange

+112.7

Cost

improvements

+22.0

Marketing

expenses

(19.2) Others

(42.3)

53.9

182.1

Operating Income Change

Billions of yen

2013 2014

37

Mazda Annual Report 2014

CONTENTS

Foundations Underpinning

Sustainable Growth

Financial Section

Review of Operations

Message from Management

Introduction

Brand Value Management