Mazda 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

developed markets including Japan, the

United States, and Europe, and the revision

was mainly a lowering of our targets in

emerging markets. Even though we have

revised our official target to 1.52 million, we

nevertheless recognize 1.70 million units as

a level that we should eventually achieve. At

the same time, however, we need to avoid

placing too much of a priority on achieving

the sales volume target and damaging the

Mazda brand by recklessly increasing sales

incentives. The achievement of qualitative

growth together with quantitative growth

will lead to a stable earnings structure that

makes sustainable growth possible. Going

forward, we will work to increase sales vol-

ume while strengthening right-price sales.

Q3. What is the plan for the expansion

of the product lineup and what

measures are you implementing to

maintain the competitiveness of

SKYACTIV-equipped models

going forward?

When we announced the Structural Reform

Plan, we stated that we intended to intro-

duce eight SKYACTIV-equipped models by

March 2016, and through the March 2014

fiscal year we released three: the CX-5, the

Mazda6, and the new Mazda3. During the

March 2015 fiscal year, we intend to release

two models including the new Mazda2, and

we plan to release the remaining three mod-

els during the March 2016 fiscal year.

These SKYACTIV-equipped models have a

strong product competitiveness, but the

problem of aging over the years after their

introduction cannot be avoided. Going for-

ward, we intend to maintain the competitive-

ness of our products through major product

improvements during the model cycle, while

fully conveying to customers the comprehen-

sive value that Mazda’s vehicles provide, to

further increase sales volume while keeping

sales incentives low.

By adding the latest technologies and

features, including powertrains, interiors and

exteriors, safety equipment, and connectiv-

ity systems, you can rest assured that we will

continue to deliver products with

driving

pleasure

and

outstanding environmental and

safety performance to customers

.

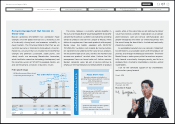

Q4. What is your plan for capital

expenditures, R&D costs, and

your basic investment policy?

With regard to capital expenditures, we will

continue to improve the efficiency of expen-

ditures through Monotsukuri Innovation. We

are currently restructuring our global pro-

duction footprint with the aim of migrating to

a business structure with a high resilience to

foreign exchange fluctuations. Our new plant

in Mexico began mass production of the new

Mazda3 in January 2014, and we plan to

maintain a high level of investment during

the March 2015 fiscal year to increase the

capacity of this plant, and for the construc-

tion of a new engine machining factory in

Mexico and a new plant for automatic trans-

missions in Thailand. Planned expenditures

are ¥150.0 billion, surpassing the previous

year’s ¥133.2 billion.

From the March 2016 fiscal year, we

intend to maintain capital expenditures at a

level that corresponds to depreciation and

amortization expenses.

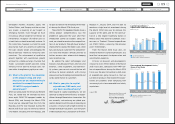

In terms of research and development,

we plan to invest ¥100.0 billion in the March

2015 fiscal year, compared with ¥99.4 bil-

lion of expenditures during the March 2014

fiscal year. We plan to maintain a high level

of expenditures going forward so that we

can deliver products that exceed the expec-

tations of customers while complying with

increasingly strict environmental and safety

regulations.

August 2014 Representative Director and

Executive Vice President

Akira Marumoto

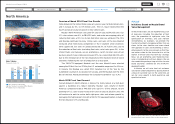

Capital Expenditures /

Depreciation and Amortization

Billions of yen

29.8

76.4

44.7

71.6 78.068.8 77.2

60.0 57.7

133.2

2010 2011 2012 2013 2014

Capital Expenditures

Depreciation and Amortization

(Years ended March 31)

85.2 91.0 91.7 89.9

99.4

3.9 3.9 4.5

4.1

3.7

Research and Development Costs /

Share of Net Sales

Billions of yen / %

2010 2011 2012 2013 2014

Research and Development Costs

Share of Net Sales

(Years ended March 31)

09

Mazda Annual Report 2014

CONTENTS

Message from Management

Introduction

Brand Value Management

Review of Operations

Foundations Underpinning

Sustainable Growth

Financial Section