Mazda 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

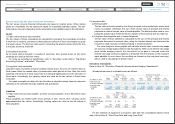

18 RELATED PARTY TRANSACTIONS

There were no transactions with related parties to be disclosed during the years ended

March 31, 2014 and 2013.

19 NOTES TO MATERIAL SUBSEQUENT EVENT

(Consolidation of shares)

At the Company’s Board of Directors meeting on February 5, 2014, it resolved to submit a

proposal for the consolidation of shares (at a rate of one share for every five shares), a

change in the number of shares per share unit (from 1,000 shares to 100 shares), and a

change in the total number of shares that may be issued (from 6 billion shares to 1.2 billion

shares) to the Company’s 148th ordinary general meeting of shareholders held on June 24,

2014. And its proposal was approved at the shareholders’ meeting.

1. Purpose of consolidation of shares

Under their “Action Plan for Consolidating Trading Units”, Japan’s stock exchanges,

including the Tokyo Stock Exchange, seek to standardize the stock trading units of listed

domestic corporations at 100 shares. As a listed corporation, the Company respects the

purport of this plan and is going to change its shares per share unit to 100 shares. The

Company is also going to consolidate five shares into one share in order to achieve an

investment unit deemed desirable by Japan’s stock exchanges (50,000 yen or more and

less than 500,000 yen) after the change in the share unit. Through the consolidation of

shares, the Company would also like to make its total number of outstanding shares more

appropriate relative to its market capitalization in comparison with other corporations in

the same industry or of approximately the same size listed on the Tokyo Stock Exchange

(first section).

2. Details of consolidation

(i) Class of stock to be consolidated: Common stock

(ii) Consolidation plan and ratio: Consolidates every five shares to one share

on August 1, 2014 by the number of shares

held by shareholders listed in the Register of

Shareholders as of the end of the day on July

31, 2014

(iii) Decrease in number of shares due to consolidation:

Number of outstanding shares before consolidation

(as of March 31, 2014) 2,999,377,399 shares

Decrease in number of shares after consolidation 2,399,501,920 shares

Number of outstanding shares after consolidation 599,875,479 shares

Note: “Decrease in number of shares after consolidation” and “Number of outstanding shares after consolidation” are theo-

retical values calculated based on the number of outstanding shares before consolidation and the consolidation ratio.

(iv) Handling of fractional shares:

If a fraction of less than one share is created due to the consolidation of shares, such

fractional shares will be sold together in accordance with Article 235 of the Companies

Act, and the proceeds will be distributed to shareholders who held the fractional shares

in proportion to the number of fractional shares they held.

3. Scheduled effective date of consolidation of shares

August 1, 2014

4. Impact on net income and net assets per share

Net income and net assets per share for the years ended March 31, 2014 and 2013

assuming that consolidation of shares had been carried out at the beginning of the year

ended March 31, 2013 are as follows:

Yen U.S. dollars

2014 2013 2014

Net income per share of common stock ¥ 226.99 ¥ 57.38 $ 2.20

Net assets per share of common stock 1,105.21 830.18 10.73

Note: For the years ended March 31, 2014 and 2013, only information on net income per share of common stock is

provided without information on diluted net income per share of common stock to reflect the diluting effect, because

there were no dilutive potential common stocks for the year ended March 31, 2014 and there were no dilutive

potential common stocks that have dilutive effects for the year ended March 31, 2013.

62

Mazda Annual Report 2014

CONTENTS

Foundations Underpinning

Sustainable Growth

Financial Section

Review of Operations

Message from Management

Introduction

Brand Value Management