Mazda 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As regards short-term investments and investment securities, their fair values as well

as the financial standing of their issuing entities are monitored on a regular basis.

Ownership of available-for-sale securities are reviewed on a continuous basis.

Management of liquidity risks related to financing (i.e., risks of non-performance of

payments on their due dates)

The liquidity risks of the Group are managed mainly through the preparation and update of

the cash schedule by the Treasury Department.

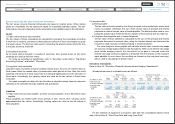

Fair values of financial instruments

As of March 31, 2014 and 2013, the carrying values on the consolidated balance sheet, the

fair values, and the differences between these amounts, respectively, of financial instruments

were as follows. Financial instruments for which fair value is deemed highly difficult to mea-

sure are excluded from the following table.

Millions of yen Thousands of U.S. dollars

As of March 31, 2014

Carrying

values

Fair

values Difference

Carrying

values

Fair

values Difference

Assets:

1) Trade notes and accounts

receivable ¥ 180,544 $ 1,752,854

Allowance for doubtful

receivables (*1) (175) (1,699)

Trade notes and accounts

receivable, net 180,369 ¥ 180,369 ¥ — 1,751,155 $ 1,751,155 $ —

2) Investment securities

Available-for-sale securities 9,141 9,141 — 88,748 88,748 —

3) Long-term loans receivable (*2) 6,829 66,301

Allowance for doubtful

receivables (*3) (2,509) (24,359)

Long-term loans receivable, net 4,320 4,320 — 41,942 41,942 —

Total ¥ 193,830 ¥ 193,830 ¥ — $ 1,881,845 $ 1,881,845 $ —

Liabilities:

1) Trade notes and accounts payable ¥ 331,678 ¥ 331,678 ¥ — $ 3,220,175 $ 3,220,175 $ —

2) Other accounts payable 38,469 38,469 — 373,485 373,485 —

3) Short-term loans payable 105,283 105,283 — 1,022,165 1,022,165 —

4) Long-term debt 637,452 654,766 17,314 6,188,854 6,356,951 168,097

Total ¥1,112,882 ¥1,130,196 ¥17,314 $10,804,679 $10,972,776 $168,097

Derivative instruments: (*4)

1) Hedge accounting not applied ¥ (1,046) ¥ (1,046) ¥ — $ (10,155) $ (10,155) $ —

2) Hedge accounting applied (1,903) (1,903) — (18,476) (18,476) —

Total ¥ (2,949) ¥ (2,949) ¥ — $ (28,631) $ (28,631) $ —

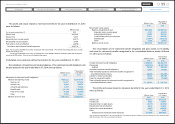

Millions of yen

As of March 31, 2013

Carrying

values

Fair

values Difference

Assets:

1) Trade notes and accounts receivable ¥ 171,770

Allowance for doubtful receivables (*1) (208)

Trade notes and accounts receivable, net ¥ 171,562 ¥ 171,560 ¥ (2)

2) Investment securities

Available-for-sale securities 6,884 6,884 —

3) Long-term loans receivable (*2) 5,750

Allowance for doubtful receivables (*3) (2,561)

Long-term loans receivable, net 3,189 3,189 —

Total ¥ 181,635 ¥ 181,633 ¥ (2)

Liabilities:

1) Trade notes and accounts payable ¥ 279,642 ¥ 279,642 ¥ —

2) Other accounts payable 22,146 22,146 —

3) Short-term loans payable 97,833 97,833 —

4) Long-term debt 621,150 636,170 15,020

Total ¥1,020,771 ¥1,035,791 ¥15,020

Derivative instruments: (*4)

1) Hedge accounting not applied ¥ (15,940) ¥ (15,940) ¥ —

2) Hedge accounting applied (24,025) (24,025) —

Total ¥ (39,965) ¥ (39,965) ¥ —

(*1) Allowance for doubtful receivables, which is recognized on the basis of each individual accounts receivable, is deducted.

(*2) Long-term loans receivable includes those due within one year, which are included in “other current assets” on the

consolidated balance sheets.

(*3) Allowance for doubtful receivables, which is recognized on the basis of each individual long-term loans receivable,

is deducted.

(*4) Receivables and payables resulting from derivative transactions are offset against each other and presented on a net

basis; when a net liability results, the net amount is shown in ( ).

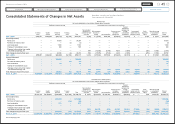

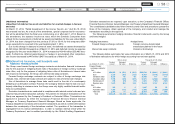

The financial instruments in the following table are excluded from “Assets 2) Investment

securities” in the above tables because measuring the fair value of these instruments is

deemed highly difficult: market prices of these instruments are not available and future

cash flows from these instruments are not contracted.

Millions of yen

Thousands of

U.S. dollars

Carrying values Carrying values

As of March 31 2014 2013 2014

Available-for-sale securities:

Non-listed equity securities ¥ 2,321 ¥ 2,928 $ 22,534

Investment in securities of affiliated companies 136,890 110,994 1,329,029

Total ¥139,211 ¥113,922 $1,351,563

51

Mazda Annual Report 2014

CONTENTS

Foundations Underpinning

Sustainable Growth

Financial Section

Review of Operations

Message from Management

Introduction

Brand Value Management