Mazda 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Management System

Corporate Governance

Mazda views the enhancement of corporate gover-

nance as one of its most important management

issues, and along with statutory bodies including the

General Meeting of Shareholders, Board of Directors,

and Audit & Supervisory Board, the Company has

introduced an executive officer system to separate

execution and management functions.

This is intended to expedite decision-making

by increasing the effectiveness of the Board of

Directors as a supervisory body, by enhancing the

deliberations of the Board of Directors, and by

delegating authority to executive officers.

As of June 30, 2014, Mazda’s Board of Directors

is composed of nine members, two of whom are

outside corporate directors with a high degree of

independence.

Inauguration of an Outside

Corporate Director System

At the shareholders’ meeting held on June 24, 2011,

Mazda appointed two outside corporate directors,

inaugurating the Outside Corporate Director System

with the objective of further increasing manage-

ment soundness and transparency. The outside

corporate directors are expected to help strengthen

the auditing functions of the Board of Directors and

further boost the transparency of management by

offering advice on Mazda’s management activities

based on their knowledge, experience, and insights,

and by taking part in the decision-making process.

Management Auditing

Mazda’s Audit & Supervisory Board has five members,

including three outside audit & supervisory board

members who have no business relationship or other

interests with Mazda, and audits the directors in the

performance of their duties as per an annual audit

plan formulated by the Audit & Supervisory Board.

Aside from statutory attendance at the Board of

Directors meetings, the audit & supervisory board

members also attend management meetings, etc.

KPMG AZSA LLC is retained under contract as

Mazda’s independent auditor.

Cooperation among Parties

Responsible for Auditing

Audit & Supervisory Board members (full-time),

the auditing company, and the Global Auditing

Department hold the meetings below on a regular

basis to exchange information mainly on issues

related to internal controls.

■ Meeting between Audit & Supervisory Board

members (full-time) and the auditing company

■ Meeting between Audit & Supervisory Board

members (full-time) and the Global Auditing

Department

■ Three-party meeting between Audit & Super visory

Board members (full-time), the auditing company,

and the Global Auditing Department

Directors’ and Audit & Supervisory Board

Members’ Compensation

The total amount of compensation paid to directors

and audit & supervisory board members is within

the limit approved at the annual General Meeting of

Shareholders. Compensation paid to directors and

audit & supervisory board members during the

March 2014 fiscal year is indicated below.

Notes: 1. The numbers of directors and audit & supervisory board

members shown above include two directors and one

audit & supervisory board member who retired as of the

conclusion of the 147th Annual General Meeting of

Shareholders held on June 25, 2013.

2. The amounts paid to directors do not include the

employee’s portion of compensation for directors who

serve concurrently as employees. However, none of the 12

directors shown above serve concurrently as employees.

3. There is no director who earned compensation pay of

more than ¥100 million.

The established policy for determining the

amount of directors’ compensation is based on a

structure linked to the Company’s performance and

each individual director’s performance. Goals are

set at the beginning of the fiscal year, and an evalu-

ation is made at the end of the fiscal year according

to designated criteria and processes for measuring

the degree of achievement of those goals, and

based on this evaluation a final decision is made by

the president. Compensation for audit & supervisory

board members is decided by an agreement among

the audit & supervisory board members.

Makeup of Corporate Audit Compensation

Remuneration for the Company’s certified public

accountants is as follows.

Furthermore, as another important detail concerning

remuneration, the Company and its consolidated

subsidiaries entrust auditing certification work and

non-auditing work to offices that are affiliated closely

with KPMG and which belong to the same network as

the Company’s certified public accountants. In the

consolidated fiscal year under review, the total amount

of compensation paid by the Company and its consoli-

dated subsidiaries was ¥513 million.

To accounting auditors the Company entrusts

advisory work related to improvements in the finan-

cial reporting processes of its consolidated subsid-

iaries and work (non-auditing work) that falls outside

Article 2, Paragraph 1 of the Certified Public

Accountants Act.

The corporate audit compensation paid to the

Company’s certified public accountants is decided by

agreement with the Audit & Supervisory Board. Based

on audit duration estimates, which are based on the

audit plan for the next fiscal period, comprehensive

Category People Amount

(millions of yen)

Directors 12 499

Corporate Auditors 6 104

Total (of which, Outside

Auditors) 18 (5) 603

(65)

Category Previous consolidated

fiscal year

Consolidated fiscal year

under review

Compensation

based on audit

certification

work (millions

of yen)

Compensation

based on non-

auditing work

(millions of

yen)

Compensation

based on audit

certification

work (millions

of yen)

Compensation

based on non-

auditing work

(millions of

yen)

Mazda Motor

Corporation 206 — 210 7

Consolidated

subsidiaries 75 —76 —

Total 281 —286 7

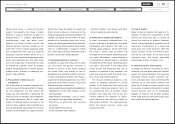

Corporate Governance Framework

Selection / Dismissal

Reporting,

Cooperation Audit

Reporting

Reporting

Cooperation

Audit

Supervise

Consultation

Selection / Dismissal Selection /

Dismissal

Executive Officers

Division General Managers, etc. Group Companies

Various Committees*

Department Managers

All Employees

Representative Directors Executive

Committee and

Other Advisory

Bodies

Board of Directors,

Directors

(Nine corporate directors, of

whom two are outside directors)

Independent Auditor

* Company-wide Safety and Health Committee Meeting, Quality Committee Meeting, Risk Compliance Committee, Human

Rights Committee, Security Export Control Committee, Security-Related Export Control Committee, etc.

Audit & Supervisory Board,

Audit & Supervisory

Board Members

(Five, of whom three are outside audit

& supervisory board members)

Internal Auditing Departments

General Meeting of Shareholders

31

Mazda Annual Report 2014

CONTENTS

Review of Operations

Foundations Underpinning

Sustainable Growth

Message from Management

Introduction

Brand Value Management

Financial Section