Mazda 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

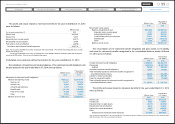

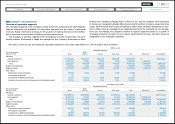

13 OTHER INCOME / (EXPENSES)

The components of “Other, net” in Other income/(expenses) in the consolidated statements

of income for the years ended March 31, 2014 and 2013 were comprised as follows:

Millions of yen

Thousands of

U.S. dollars

For the years ended March 31 2014 2013 2014

Gain on sale of investment in affiliates, net ¥ — ¥ 9,574 $ —

Loss on retirement and sale of property, plant and

equipment, net (4,230) (2,825) (41,068)

Rental income 2,910 2,088 28,252

Loss on sale of receivables (972) (813) (9,437)

Loss on impairment of long-lived assets (2,754) (2,795) (26,738)

Foreign exchange gain/(loss) (42,215) (19,538) (409,854)

Government subsidy — 2,746 —

Subsidy income(*1) 224 — 2,175

Compensation received for the exercise

of eminent domain 123 104 1,194

Reserve for loss from business of affiliates(*2) (36,616) — (355,495)

Reserve for environment measures (8) (60) (78)

Business restructuring costs(*3) — (1,212) —

Other (722) (1,080) (7,009)

Total ¥(84,260) ¥(13,811) $(818,058)

(*1) Restoration and construction subsidy for facilities and equipment of small and medium enterprises in Fukushima pre-

fecture, which was granted to our consolidated subsidiary, affected by the Great East Japan Earthquake.

(*2) Reserve for loss related to the losses of domestic and foreign subsidiaries’ and affiliates’ businesses.

(*3) Retirement benefits in some foreign consolidated subsidiaries and compensation payments to some dealers to imple-

ment structural reforms.

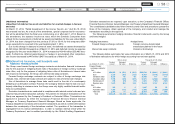

14 INCOME TAXES

The effective tax rate reflected in the consolidated statements of income for the years

ended March 31, 2014 and 2013 differs from the statutory tax rate for the following reasons.

For the years ended March 31 2014 2013

Statutory tax rate 37.8 % 37.8%

Valuation allowance (74.3) (31.3)

Equity in net income of affiliated companies (3.8) (9.7)

Effect of adjustment of gain on sales of stock for

subsidiaries and affiliates — 17.1

Decrease in deferred tax assets at end of year due to the

change in tax rate 3.5 —

Other (0.2) (2.1)

Effective tax rate (37.0)% 11.8%

Deferred tax assets and liabilities reflect the estimated tax effects of loss carryforwards

and accumulated temporary differences between assets and liabilities for financial

accounting purposes and those for tax purposes. The significant components of deferred

tax assets and liabilities as of March 31, 2014 and 2013 were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2014 2013 2014

Deferred tax assets:

Allowance for doubtful receivables ¥ 1,226 ¥ 1,528 $ 11,903

Employees' severance and retirement benefits —23,417 —

Liability for retirement benefits 24,034 —233,340

Loss on impairment of long-lived assets 4,539 5,308 44,068

Accrued bonuses and other reserves 33,734 19,226 327,515

Inventory valuation 5,659 6,613 54,942

Valuation loss on investment securities, etc. 1,405 1,399 13,641

Deferred gains/(losses) on hedges 672 9,043 6,524

Net operating loss carryforwards 88,189 119,359 856,204

Other 36,770 46,082 356,990

Total gross deferred tax assets 196,228 231,975 1,905,127

Less valuation allowance (84,089) (162,737) (816,398)

Total deferred tax assets 112,139 69,238 1,088,729

Deferred tax liabilities:

Asset retirement cost corresponding to asset

retirement obligations, and others (5,841) (7,050) (56,709)

Net deferred tax assets ¥106,298 ¥ 62,188 $1,032,020

The net deferred tax assets are included in the following accounts in the consolidated

balance sheets:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2014 2013 2014

Current assets—Deferred tax assets ¥ 54,897 ¥59,999 $ 532,981

Investments and other assets—Deferred tax assets 54,189 5,155 526,107

Current liabilities—Other current liabilities (59) (38) (573)

Long-term liabilities—Other long-term liabilities (2,729) (2,928) (26,495)

Net deferred tax assets ¥106,298 ¥62,188 $1,032,020

57

Mazda Annual Report 2014

CONTENTS

Foundations Underpinning

Sustainable Growth

Financial Section

Review of Operations

Message from Management

Introduction

Brand Value Management