Mazda 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

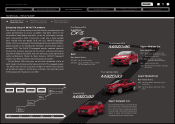

CX-5 (China specification) CX-5 (Australia specification)

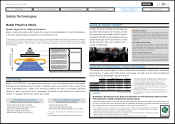

1.3 1.2

0.9

0.9

236 223

175 196

230

201420132012

2011 2015 (Forecast)

Sales Volume

Thousands of units / %

Sales Volume

Market Share

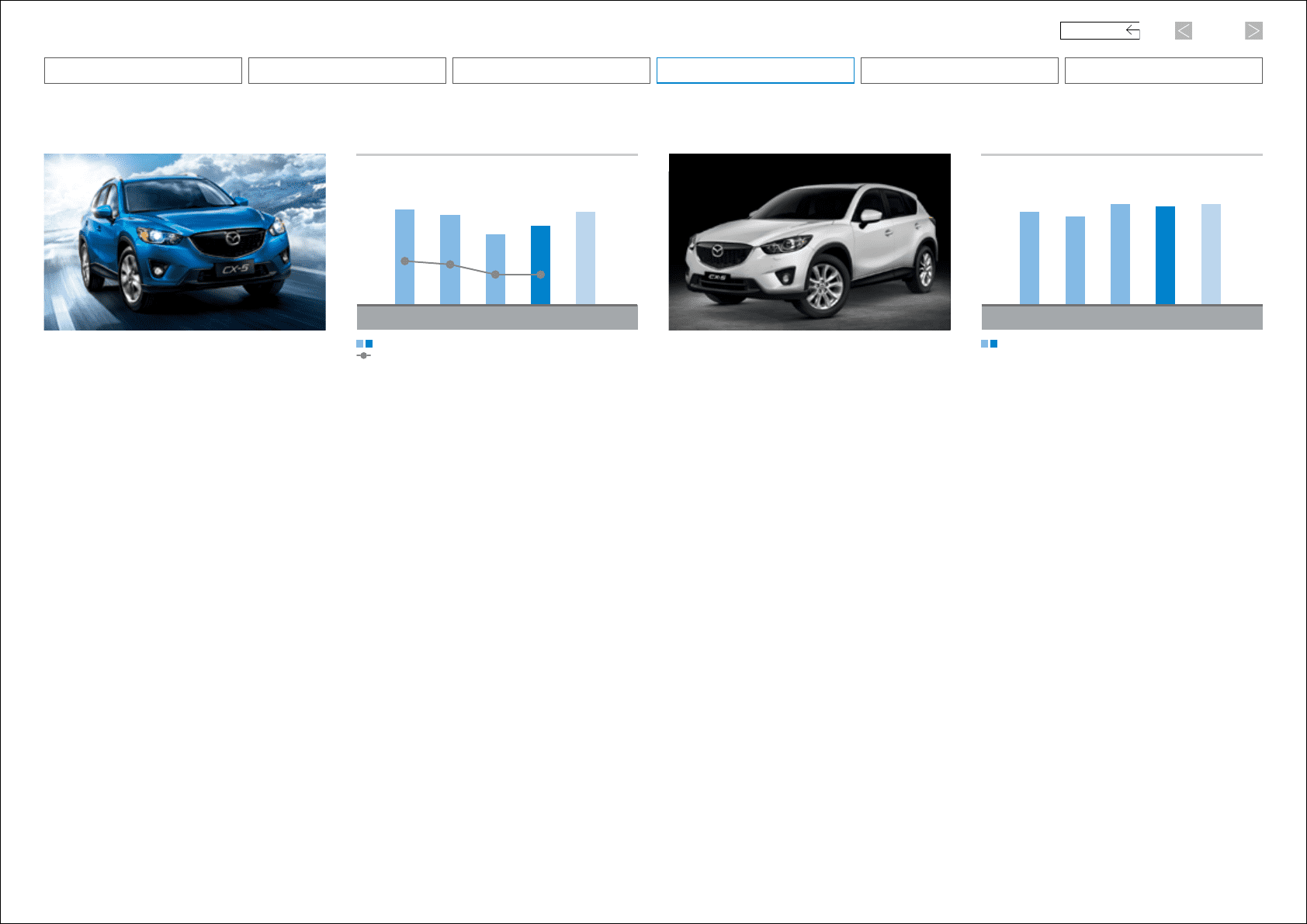

277 263

300 293 300

201420132012

2011 2015 (Forecast)

Sales Volume

Thousands of units

Sales Volume

(Years ended March 31) (Years ended March 31)

China Other Markets

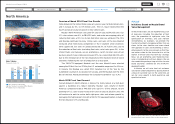

Overview of March 2014 Fiscal Year Results

In China, total demand rose 13% year on year, to 22.48 million units. In the first

half, Mazda struggled to maintain sales volume amid the lasting effect of ter-

ritorial disputes, but the Company’s sales volume gained traction from

September 2013 onward due to the introduction of the locally produced CX-5.

Sales remained strong, and Mazda achieved record-high monthly sales volume

in January 2014. Second-half sales volume increased 39%, and sales volume

for the full fiscal year increased 12% year on year, to 196,000 units.

March 2015 Fiscal Year Forecast

We are planning for sales volume to increase 17% year on year, to 230,000

units. We will be expanding the lineup through the addition of the locally pro-

duced CX-7 in addition to the new, SKYACTIV TECHNOLOGY-equipped Mazda6

Atenza and Mazda3Axela. We are also planning to increase the number of

sales outlets, from 435 at the end of March 2014 to 460 by the end of March

2015. In addition to the ongoing reinforcement of Mazda brand advertising

focusing on the SKYACTIV TECHNOLOGY and KODO–“Soul of Motion” design

theme, we will implement sales promotion initiatives and fully utilize events

such as more extensive participation at motor shows in China and the holding

of large-scale test-drive events.

In the March 2014 fiscal year, sales volume in other markets decreased 2%, to 293,000 units. In the

March 2015 fiscal year, we envisage that sales volume will increase 2%, to 300,000 units. In addition

to ongoing strong sales of the CX-5, we are aiming to achieve our plan on the back of the full-year

contribution of the new Mazda3. Our results and forecasts for major other markets are as follows.

Australia

Total demand edged up 0.4%, to 1.13 million units. Maintaining strong sales at 104,000 units,

equaling those of the previous fiscal year, Mazda is Australia’s third-highest maker and has a

market share of 9.2%. By automobile type, in addition to the CX-5 being the top-seller over the

full year in its segment, the new Mazda3 has made a strong start since its launch in February

2014. We are planning for a 1% increase, to 105,000 units, for the March 2015 fiscal year.

ASEAN Market

Due to a sales decline in Thailand being partially offset by other markets, Mazda’s sales volume

in the ASEAN region fell 26%, to 74,000 units, in the March 2014 fiscal year. In Thailand, sales

volume fell 45%, to 43,000 units, due to a slump in demand caused by political unrest and a

reaction to the conclusion of the subsidy program for first-time buyers. In Indonesia, sales vol-

ume was on par with that of the previous fiscal year, at 12,000 units. In Malaysia, where strong

sales were recorded by the Mazda6 and, following its introduction in May 2013, by the locally

produced CX-5, sales volume increased 24%, to 10,000 units.

We are planning for an 8% increase in sales, to 80,000 units, in the ASEAN region in the

March 2015 fiscal year. Although we expect the overall slump to continue in our main market of

Thailand, we are aiming for an increase in sales volume due to the increased supply of the CX-5

and full-scale sales of the new Mazda3.

21

Mazda Annual Report 2014

CONTENTS

Message from Management

Review of Operations

Introduction

Brand Value Management

Foundations Underpinning

Sustainable Growth

Financial Section