Mazda 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

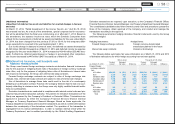

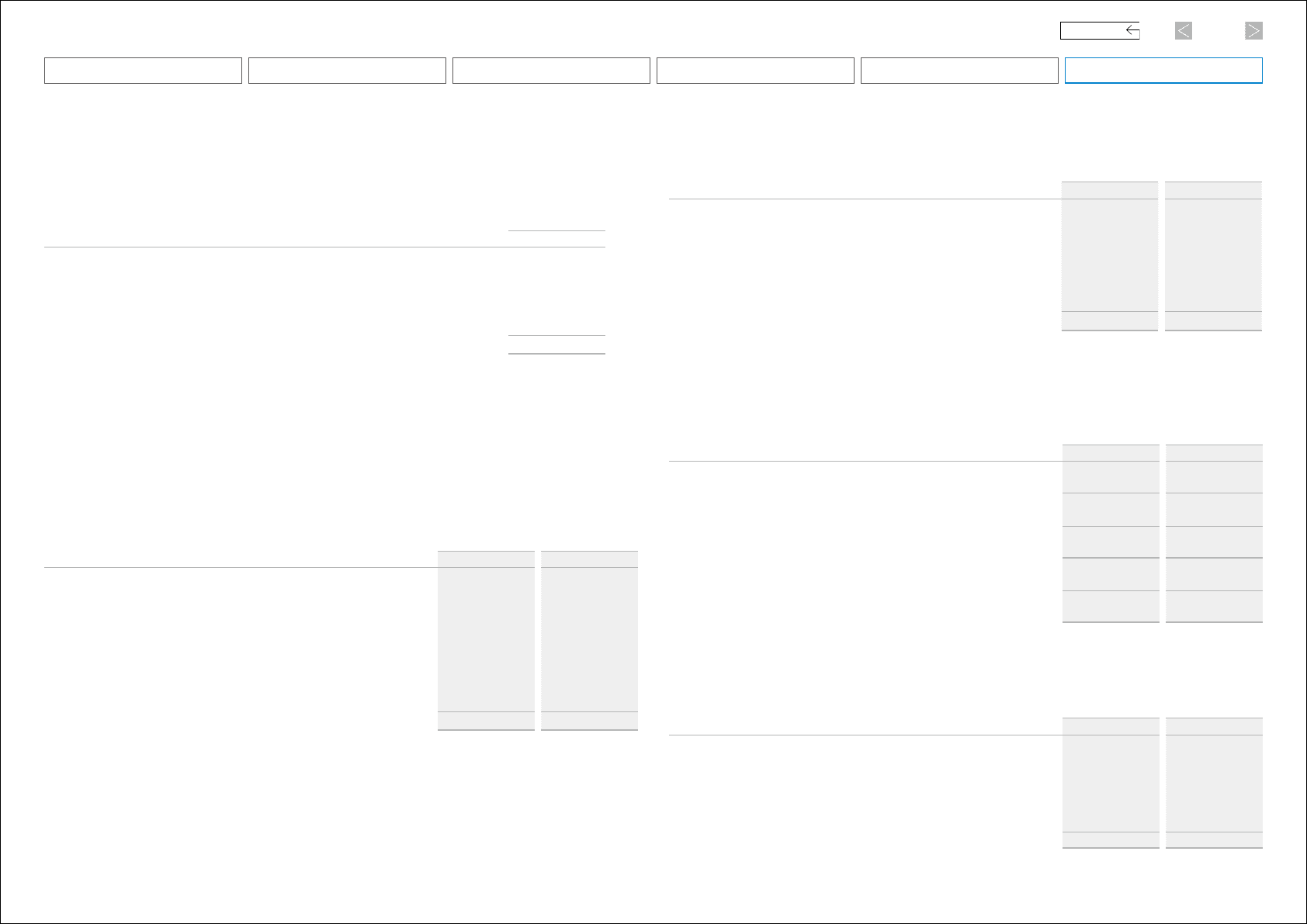

The profits and losses related to retirement benefits for the year ended March 31, 2013

were as follows:

Millions of yen

For the years ended March 31 2013

Service cost ¥10,530

Interest cost 5,477

Expected return on plan assets (3,517)

Net actuarial loss amortization 8,798

Past service costs amortization (2,570)

Severance and retirement benefit expenses ¥18,718

Note: For the year ended March 31, 2013, the discount rate was primarily 1.4% and the rate of expected return on plan

assets was primarily 1.5%.

For the year ended March 31, 2013, accrued pension costs related to defined contribution plans was charged to

income as ¥2,332 million. This cost is not included in the above.

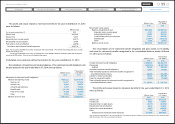

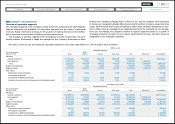

(2) Detailed notes relating to defined benefit plan for the year ended March 31, 2014

Reconciliations of beginning and ending balances of the retirement benefit obligations and

the plan assets for the year ended March 31, 2014 were as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2014

Movements in retirement benefit obligations:

Balance at beginning of year ¥300,322 $2,915,748

Service cost 10,417 101,136

Interest cost 4,694 45,573

Actuarial gains/(losses) 6,819 66,204

Benefits paid (16,311) (158,359)

Past service costs (7,456) (72,388)

Other 3,134 30,427

Balance at end of year ¥301,619 $2,928,341

Millions of yen

Thousands of

U.S. dollars

2014 2014

Movements in plan assets:

Balance at beginning of year ¥210,382 $2,042,544

Expected return on plan assets 4,157 40,359

Actuarial gains/(losses) 13,442 130,505

Contributions paid by the employer 17,011 165,155

Benefits paid (12,671) (123,019)

Other 1,195 11,602

Balance at end of year ¥233,516 $2,267,146

The reconciliation of the retirement benefit obligations and plan assets to the liability

and asset for retirement benefits recognized in the consolidated balance sheets of March

31, 2014 were as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2014

Funded retirement benefit obligations ¥ 288,762 $ 2,803,515

Plan assets (233,516) (2,267,146)

Subtotal 55,246 536,369

Unfunded retirement benefit obligations 12,857 124,825

Total net liability (asset) for retirement benefits recognized in

consolidated balance sheets 68,103 661,194

Liability for retirement benefits 70,149 681,058

Asset for retirement benefits (2,046) (19,864)

Total net liability (asset) for retirement benefits recognized in

consolidated balance sheets ¥ 68,103 $ 661,194

The profits and losses related to retirement benefits for the year ended March 31, 2014

were as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2014

Service cost ¥10,417 $101,136

Interest cost 4,694 45,573

Expected return on plan assets (4,157) (40,359)

Net actuarial loss amortization 8,413 81,680

Past service costs amortization (2,637) (25,602)

Other 770 7,476

Severance and retirement benefit expenses ¥17,500 $169,904

Note: For the year ended March 31, 2014, accrued pension costs related to defined contribution plans were charged to income as ¥3,397 million

($32,981 thousand). This cost is not included in the above.

55

Mazda Annual Report 2014

CONTENTS

Foundations Underpinning

Sustainable Growth

Financial Section

Review of Operations

Message from Management

Introduction

Brand Value Management