Mazda 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

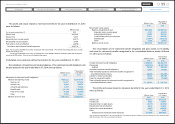

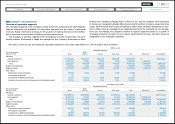

The breakdown of items of adjustments for retirement benefit (before tax) recognized in

other comprehensive income for the year ended March 31, 2014 were as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2014

Past service costs ¥ 15 $ 146

Actuarial differences 2,240 21,748

Other (3) (29)

Total ¥2,252 $21,865

The breakdown of items of adjustments for retirement benefit (before tax) recognized in

accumulated other comprehensive income as of March 31, 2014 were as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2014

Past service costs that are yet to be recognized ¥ 14,228 $ 138,136

Actuarial gains and losses that are yet to be recognized (22,476) (218,214)

Other 10 97

Total ¥ (8,238) $ (79,981)

The breakdown of plan assets by major category as of March 31, 2014 were as follows:

2014

Bonds 40%

Equity securities 27%

General accounts of the life insurance companies 18%

Other 15%

Total 100%

The major items of actuarial assumptions as of March 31, 2014 were as follows:

2014

Discount rate Primarily 1.3%

Long-term expected rate of return Primarily 1.5%

(Additional information)

Effective from April 1, 2014, the Company and its certain subsidiaries are going to change

the content of a part of their funded defined benefit pension plans to cash balance plan.

In connection with this change, according to “Accounting Treatment for Transfer

between Retirement Benefit Plans” (ASBJ Guidance No.1 issued on January 31, 2002)

and “Practical Solution on Accounting Treatment for Transfer between Retirement Benefit

Plans” (ASBJ Practical Issues Task Force (PITF) No.2 issued on February 7, 2007), the

retirement benefit obligations for the year ended March 31, 2014 decreased by ¥7,057 mil-

lion ($68,515 thousand) and the same amount of past service costs was incurred.

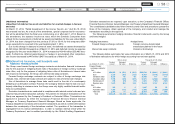

1 1 CONTINGENT LIABILITIES

Contingent liabilities as of March 31, 2014 and 2013 were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2014 2013 2014

Guarantees of loans and similar agreements ¥14,728 ¥18,110 $142,990

12 NET ASSETS

Under Japanese laws and regulations, the entire amount paid for new shares is required to

be designated as common stock. However, a company may, by a resolution of the Board of

Directors, designate an amount not exceeding one half of the price of the new shares as

additional paid-in capital, which is included in capital surplus.

Under the Corporate Law (“the Law”), in cases where dividend distribution of surplus is

made, the smaller of an amount equal to 10% of the dividend or the excess, if any, of 25%

of common stock over the total of additional paid-in capital and legal earnings reserve,

must be set aside as additional paid-in capital or legal earnings reserve. Legal earnings

reserve is included in retained earnings in the accompanying consolidated balance sheets.

Legal earnings reserve and additional paid-in capital could be used to eliminate or reduce

a deficit or could be capitalized by a resolution of the shareholders’ meeting.

Additional paid-in capital and legal earnings reserve may not be distributed as divi-

dends. Under the Law, all additional paid-in capital and legal earnings reserve may be

transferred to other capital surplus and retained earnings, respectively, which are poten-

tially available for dividends.

The maximum amount that the Company can distribute as dividends is calculated based

on the non-consolidated financial statements of the Company in accordance with the Law.

Cash dividends charged to retained earnings during the fiscal year are year-end cash divi-

dends for the preceding fiscal year and interim cash dividends for the current fiscal year. At

the annual shareholders’ meeting held on June 24, 2014, the cash dividends shareholders

approved amounting to ¥2,989 million ($29,019 thousand). Such appropriations have not

been accrued in the consolidated financial statements as of March 31, 2014. This type of

appropriations is recognized in the period in which they are approved by the shareholders.

56

Mazda Annual Report 2014

CONTENTS

Foundations Underpinning

Sustainable Growth

Financial Section

Review of Operations

Message from Management

Introduction

Brand Value Management