Mazda 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

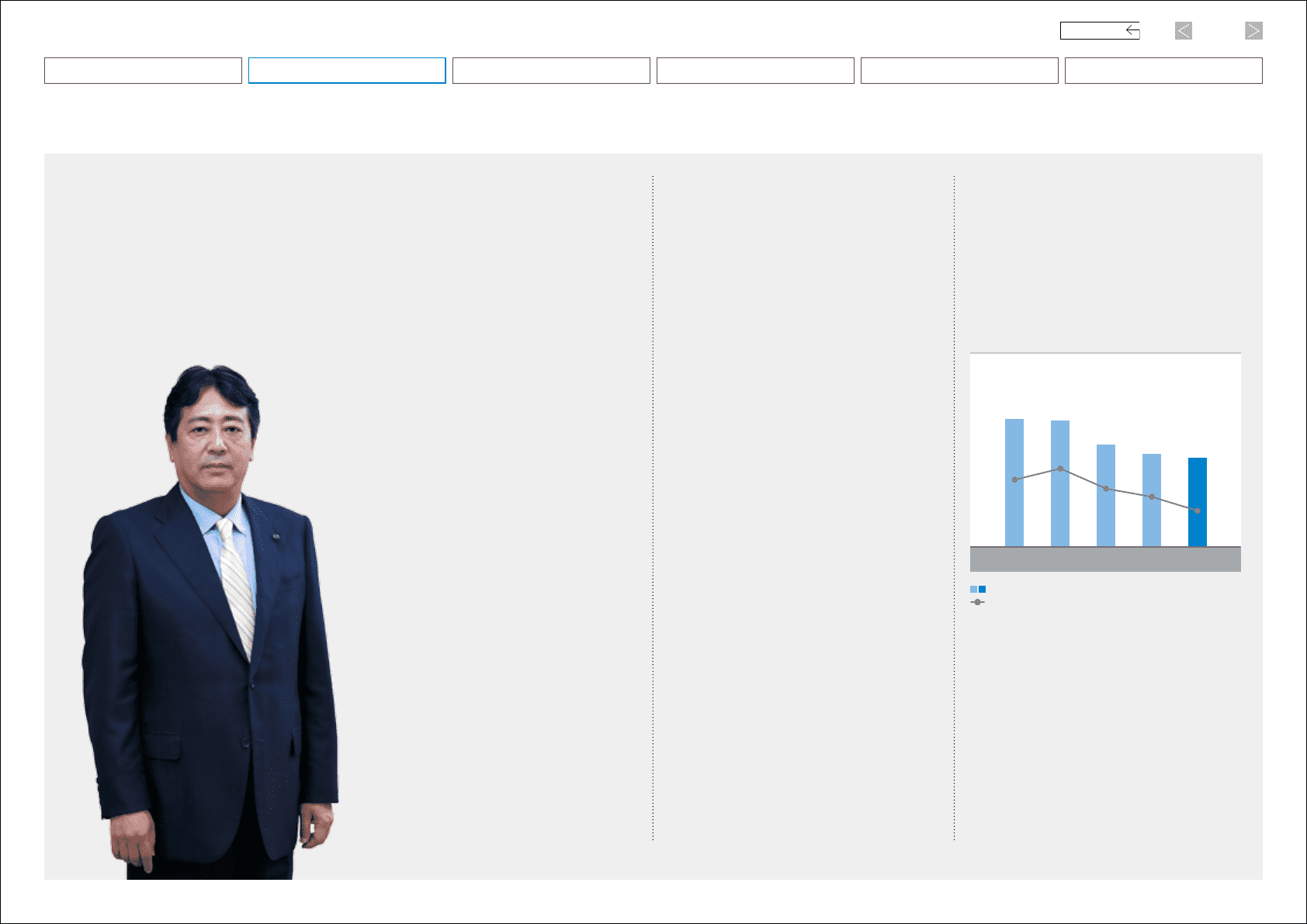

Interview with the Executive Vice President

Q1. Please tell us about Mazda’s

initiatives to raise future

profitability and the financial

structure you seek to achieve.

We have raised our initial target for March

2016 fiscal year operating income under the

Structural Reform Plan, to ¥230.0 billion from

¥150.0 billion. This is in part because of the

yen’s weakening compared with exchange

rate levels at the time of our initial forecast,

but also reflects expectations of: (1) curtailed

sales incentives and a shift to a right-price sales

policy from the introduction of SKYACTIV-

equipped models and (2) further cost improve-

ments through Monotsukuri Innovation.

We are making steady progress under

the Structural Reform Plan in these areas,

but going forward there are two challenges

for which we need to step up our efforts.

The first is to achieve sustainable growth.

As we have said previously, we are building

new plants in Mexico and Thailand to support

the increase of global sales, and these are

successively commencing operations. In

addition to releasing new products, we are

engaged in full-scale advertisement to

strengthen the Mazda brand. To offset this

investment burden and increase in market-

ing expenses, it will be important to fully

meet our plan for sales volume while main-

taining our right-price sales policy on a global

basis. In terms of costs, we will expand and

reinforce Monotsukuri Innovation globally.

Although we have always been promoting

cost improvement, we will further accelerate

cost improvement on and after the release of

the new Mazda2.

We will expand our lineup of SKYACTIV

products to maximize its effect in the areas

of brand, sales, and costs, to achieve sus-

tainable growth.

The second challenge is to establish a

solid financial base with enhanced resil-

ience to foreign exchange fluctuations.

We are restructuring our global produc-

tion footprint to increase our resilience to

foreign exchange fluctuations. To achieve

this, we will maintain our capacity utilization

at domestic plants at their current level and

respond to volume growth going forward with

increased production at overseas plants. We

will also move forward with the establishment

of a global supply chain for optimal parts pro-

curement in our main production regions of

Japan, China, ASEAN, and Mexico. This will

increase our foreign currency-denominated

parts procurement and enhance resilience to

foreign exchange fluctuations.

Our steady progress under the Structural

Reform Plan is bringing about major improve-

ments in Mazda’s earnings structure, but our

financial base is still in the process of recov-

ery. Going forward, I believe we need to

establish a solid financial base that is able to

withstand changes in the external environment,

including unforeseen economic crises, the

demand trend in major markets, and sharp

fluctuations in exchange rate levels. We are

working to achieve sustainable growth and

strengthen our financial base with an empha-

sis on increasing equity and reducing inter-

est-bearing debt.

Q2. Why did you lower your target for

global sales volume in the March

2016 fiscal year to 1.52 million

units from the initial 1.70 million?

We have revised our sales volume in light of

changes in global demand for automobiles

and sales trends that have emerged since

we announced our Structural Reform track

in February 2012. Sales are on track in

Working toward qualitative

growth, along with quantita-

tive growth, to establish a

stable earnings base for

sustainable growth.

Akira Marumoto

Representative

Director and

Executive

Vice President

375.8 370.2

263.0

300.8 274.1

74.0 86.3

64.2 55.2

39.8

Net Interest-bearing Debt /

Net Debt-to-equity Ratio

Billions of yen / %

2010 2011 2012 2013 2014

Net Interest-bearing Debt

Net Debt-to-equity Ratio

(As of March 31)

08

Mazda Annual Report 2014

CONTENTS

Message from Management

Introduction

Brand Value Management

Review of Operations

Foundations Underpinning

Sustainable Growth

Financial Section