Mazda 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

increased ¥19.2 billion due to such factors as

strengthened sales promotion activities, and

other fixed costs increased ¥42.3 billion due to

growth investment for the future, such as R&D

cost and the Mexico Plant launch cost. Despite

these factors, operating income showed a sig-

nificant improvement over the previous fiscal

year due to the sales volume and product mix

improvement of ¥55.0 billion from an increase

in sales of SKYACTIV-equipped models, a cost

improvement of ¥22.0 billion due to the pro-

motion of Monotsukuri Innovation, and ¥112.7

billion from the effect of fluctuating foreign

exchange rates.

(Income before Income Taxes,

Net Income)

Income before income taxes amounted to

¥97.4 billion, an increase of ¥58.3 billion, or

149.1%, compared with the previous fiscal

year, due to such factors as a foreign

exchange loss of ¥42.2 billion and a reserve

for loss from business of affiliates of ¥36.6

billion.

Net income amounted to ¥135.7 billion, an

increase of ¥101.4 billion (295.6%) over the pre-

vious fiscal year, due to such factors as the

recording of ¥40.1 billion in deferred tax assets

at an overseas consolidated subsidiary. Net

income per share was ¥45.40, up from the

previous fiscal year’s ¥11.48.

(Segment Information)

In Japan, net sales amounted to ¥2,263.3 billion,

an increase of ¥369.7 billion, or 19.5%, over the

previous fiscal year, and operating income

amounted to ¥173.5 billion, an increase of ¥65.1

billion (60.1%). The main factors contributing to

the increase were the improvements in the sales

volume, product mix and, costs as well as the

effect of fluctuating foreign exchange rates.

In North America, net sales amounted to

¥843.6 billion, an increase of ¥193.7 billion

(29.8%), and operating income amounted to

¥1.3 billion, following the recording of a segment

loss of ¥48.9 billion in the previous fiscal year.

Despite the Mexico Plant launch cost, the main

factor contributing to the increase was U.S. sub-

sidiary profitability, brought about by the

improved sales volume and product mix and the

effect of fluctuating foreign exchange rates.

In Europe, net sales amounted to ¥540.5 bil-

lion, an increase of ¥185.8 billion (52.4%), and

operating income amounted to ¥8.5 billion, an

increase of ¥5.3 billion (171.2%). The main factor

contributing to the increase was the improve-

ment in the sales volume and product mix.

In other areas, net sales amounted to

¥414.2 billion, a decrease of ¥4.5 billion (1.1%),

and operating income amounted to ¥5.8 bil-

lion, a decrease of ¥11.0 billion (65.5%). One

of the main factors contributing to the

decrease was the fall in sales in Thailand,

where demand was stagnant.

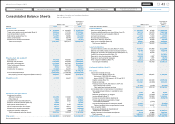

(Financial Position)

Total assets as of March 31, 2014, were

¥2,246.0 billion, for a ¥267.5 billion increase

from the end of the previous fiscal year on

growth in cash and time deposits, inventories,

and tangible fixed assets. The increase in tan-

gible fixed assets was due to investment in the

new Mexico Plant and a new transmission

plant in Thailand to reinforce business in

emerging countries and establish a global pro-

duction footprint.

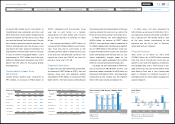

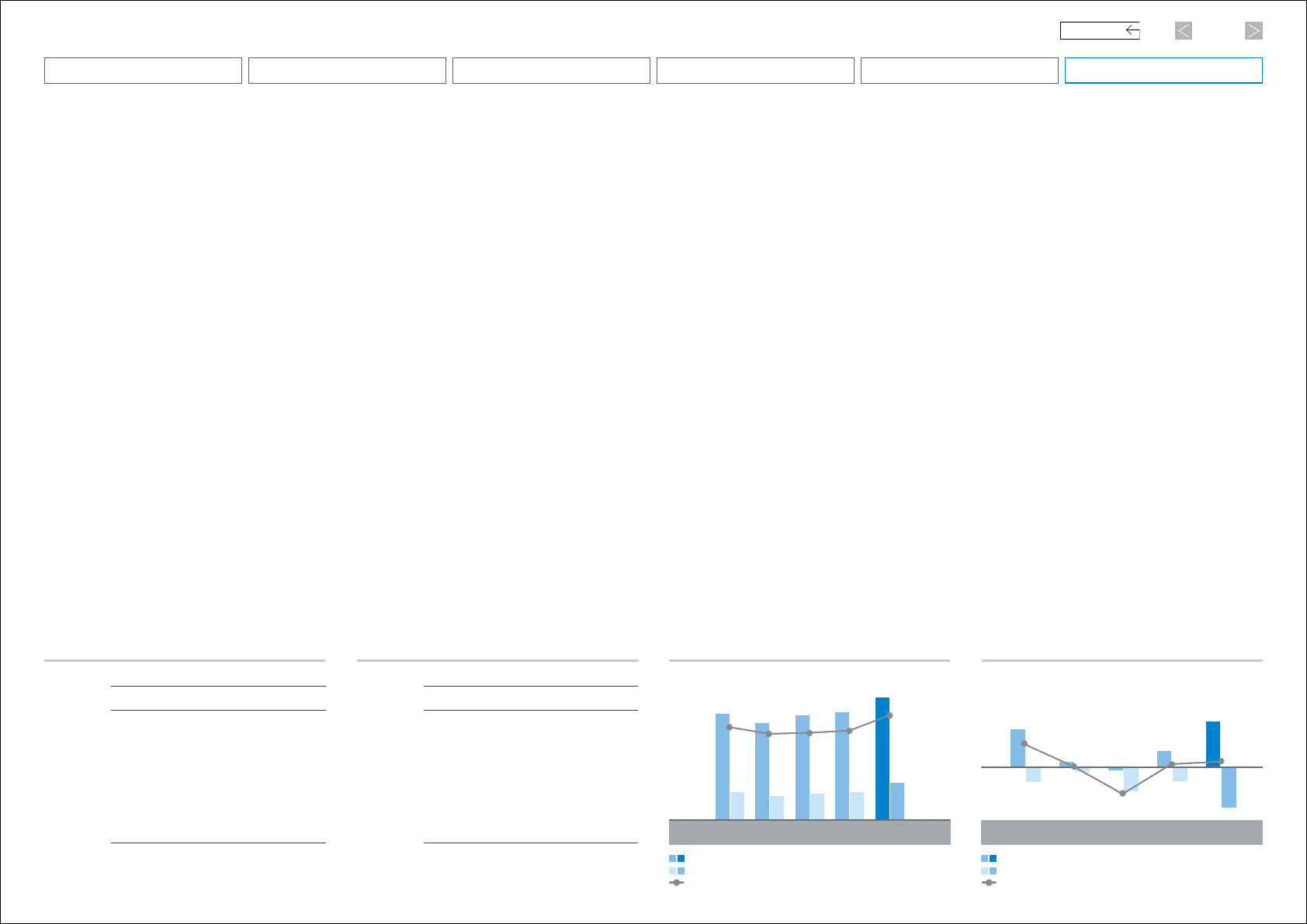

Sales by Segment* Billions of yen

(Years ended

March 31) 2010 2011 2012 2013 2014

Japan 1,867.2 1,999.5 1,745.0 1,893.6 2,263.3

North America 572.1 631.0 571.6 650.0 843.6

Europe 488.7 438.2 360.4 354.8 540.5

Other markets 225.2 310.4 294.2 418.7 414.2

Adjustment (989.3) (1,053.4) (938.1) (1,111.8) (1,369.4)

Consolidated 2,163.9 2,325.7 2,033.1 2,205.3 2,692.2

Operating Income (Loss) by Segment* Billions of yen

(Years ended

March 31) 2010 2011 2012 2013 2014

Japan 30.8 32.6 (18.4) 108.4 173.5

North America (19.3) (31.7) (40.3) (48.9) 1.3

Europe 3.5 7.9 5.6 3.1 8.5

Other markets 5.4 12.8 10.1 16.8 5.8

Adjustment (10.9) 2.2 4.3 (25.5) (7.0)

Consolidated 9.5 23.8 (38.7) 53.9 182.1

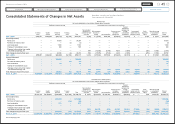

67.4

1.6

(79.4)

8.7 16.3

111.6

(44.3) (13.7) (9.1)

(70.3)

15.3

49.0

(40.3)

(120.1)

136.4

2010 2011 2012 2013 2014

Cash Flows

Billions of yen

1,947.8

1,771.8 1,915.9 1,978.6

676.8

513.2

474.4

430.5

509.8

2,246.0

2010 2011 2012 2013 2014

29.4

25.1

24.5

24.2

26.1

Total Assets / Net Assets / Equity Ratio

Billions of yen / %

Total Assets

Net Assets

Equity Ratio

Cash Flow from Operating Activities

Cash Flow from Investing Activities

Free Cash Flow

(As of March 31) (Years ended March 31)

* Net sales by geographic area based on reportable segments * Operating income by geographic area based on reportable segments

38

Mazda Annual Report 2014

CONTENTS

Foundations Underpinning

Sustainable Growth

Financial Section

Review of Operations

Message from Management

Introduction

Brand Value Management