Mazda 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

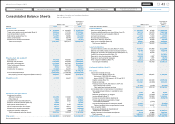

Total liabilities amounted to ¥1,569.2 billion,

an increase of ¥103.9 billion compared with the

end of the previous fiscal year, mainly reflect-

ing an increase in trade notes and accounts

payable as well as an increase in interest-bear-

ing debt, which increased by ¥23.8 billion from

the previous fiscal year. After deducting ¥479.8

billion in cash and cash equivalents at end of

period from interest-bearing debt, net interest-

bearing debt totaled ¥263.0 billion, a decrease

of ¥11.1 billion from the end of the previous fis-

cal year. The net debt-to-equity ratio improved

15.4 percentage points, to 39.8% (32.8% after

the recognition of the equity credit attributes

of the subordinated loans).

Net assets amounted to ¥676.8 billion, an

increase of ¥163.6 billion compared with the

end of the previous fiscal year, due mainly to

¥135.7 billion of net income. The equity ratio

increased by 4.3 percentage points from the

end of the previous fiscal year, to 29.4%.

(31.0% after the recognition of the equity

credit attributes of the subordinated loans).

(Cash Flows)

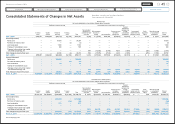

Net cash provided by operating activities was

¥136.4 billion, reflecting such components as

income before income taxes of ¥97.4 billion,

depreciation and amortization of ¥57.7 billion,

and income taxes paid of ¥14.7 billion. (In the

previous fiscal year, net cash provided by oper-

ating activities had amounted to ¥49.0 billion.)

Net cash used in investing activities was ¥120.1

billion, mainly reflecting capital expenditure

for the acquisition of tangible fixed assets,

such as facility investments in the new Mexico

Plant, of ¥110.8 billion. (In the previous fiscal

year, net cash used in investing activities had

amounted to ¥40.3 billion.)

As a result, consolidated free cash flow

(the total net cash flow from operating activi-

ties and investing activities) was positive in

the amount of ¥16.3 billion. (For the previous

fiscal year, consolidated free cash flow had

been positive in the amount of ¥8.7 billion.)

Despite making ongoing growth investments

for the future, a positive free cash flow is

being maintained.

Net cash provided by financing activities

was ¥10.5 billion, mainly reflecting proceeds

from long-term loans payable of ¥116.0 billion

partially offset by repayment of long-term

loans payable and redemption of bonds. (For

the previous fiscal year, net cash used in financ-

ing activities had amounted to ¥57.2 billion.)

(Consolidation of Shares and Change in

Number of Shares per Share Unit)

At the 148th Ordinary General Meeting of

Shareholders held on June 24, 2014, proposals

were approved relating to the consolidation of

shares (at a rate of one share for every five

shares) and a change in the number of shares

per share unit (changed from 1,000 shares to

100 shares). The consolidation of shares took

place on August 1, 2014. Due to the consolida-

tion of shares, the total number of shares

issued became 599,875,479 shares.

(Basic Dividend Policy, Dividends for

March 2014 and March 2015 Fiscal Years)

Mazda’s policy regarding the stock dividend is

to determine the amount of dividend pay-

ments, taking into account such factors as the

current fiscal year’s financial results, business

environment, and financial condition. Mazda is

striving to realize stable shareholder returns

and their future steady increase.

With regard to the dividend for the fiscal

year ended March 31, 2014, we resumed divi-

dend payments for the first time in four fiscal

years, a dividend of ¥1 per share. For the fiscal

year ending March 31, 2015, our current fore-

cast for dividends is ¥10 per share (after con-

sideration of share consolidation with a ratio

of five shares to one share). When converted

to the amount before share consolidation, the

current forecast for dividends is ¥2 per share.

Mazda will be utilizing its internal reserves

to invest in such areas as plant and equip-

ment and for R&D expenses to enhance its

competitiveness.

Forecast for the March 2015 Fiscal Year

Billions of yen

(Years ended

March 31) 2014 2015 (Forecast) Difference

Net sales 2,692.2 2,900.0 207.8

Operating

income 182.1 210.0 27.9

Ordinary

income 97.4 200.0 102.6

Net income 135.7 160.0 24.3

(Exchange

assumptions)

US$/Yen 100 100

€/Yen 134 135

Forecast for Global Sales Volume

Thousands of units

(Years ended

March 31) 2014 2015 (Forecast) Difference

Japan 244 230 (14)

North

America 391 440 49

Europe 207 220 13

China 196 230 34

Other markets 293 300 7

Tota l 1,331 1,420 89

39

Mazda Annual Report 2014

CONTENTS

Foundations Underpinning

Sustainable Growth

Financial Section

Review of Operations

Message from Management

Introduction

Brand Value Management