LG 2001 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

»88

LG Electronics Inc. The

43

rd Annual Report

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

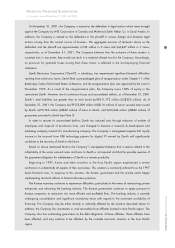

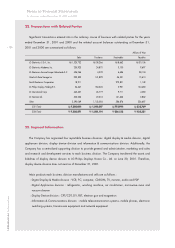

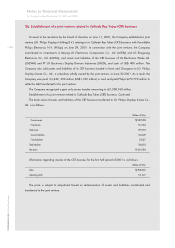

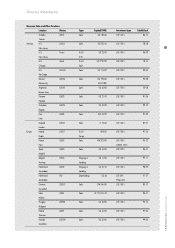

24. Supplemental Cash Flow Information

The Company considers cash on hand, bank deposits and highly liquid marketable securities with

original maturities of three months or less to be cash and cash equivalents.

Significant transactions not affecting cash flows for the years ended December 31, 2001 and 2000 are

as follows :

Millions of Won

2001 2000

Transfer to property, plant and equipment from construction in progress 245,626 75,196

Transfer to machinery and equipment from machinery in transit 164,865 86,596

Reclassify current maturities of debenture 1,283,892 1,275,736

Reclassify current maturities of long-term debt 199,948 223,923

Changes in retained earnings and capital adjustments by equity method of accounting on investments 218,778 304,103

Increase in investments by contribution of CRT division in kind 913,431 -

Increase in assets by merger of LGIC - 3,060,233

Increase in liabilities by merger of LGIC - 2,534,043

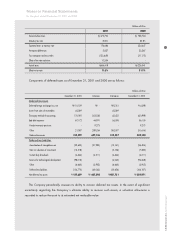

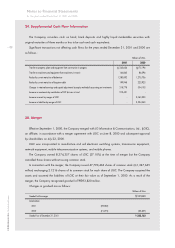

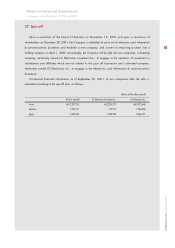

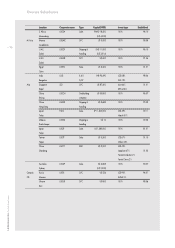

25. Merger

Effective September 1, 2000, the Company merged with LG Information & Communications, Ltd., (LGIC),

an affiliate, in accordance with a merger agreement with LGIC on June 8, 2000 and subsequent approval

by shareholders on July 22, 2000.

LGIC was incorporated to manufacture and sell electronic switching systems, transmission equipment,

network equipment, mobile telecommunication systems, and mobile phones.

The Company owned 8,374,357 shares of LGIC (27.10%) at the time of merger but the Company

cancelled those shares without issuing common stock.

In connection with the merger, the Company issued 47,790,404 shares of common stock ( 1,347,645

million) exchanging 2.1216 shares of its common stock for each share of LGIC. The Company acquired the

assets and assumed the liabilities of LGIC at their fair value as of September 1, 2000. As a result of the

merger, the Company recognized goodwill of 393,820 million.

Changes in goodwill are as follows :

Millions of Won

Goodwill at the merger 393,820

Amortization

2001 (39,382)

2000 (21,275) (60,657)

Goodwill as of December 31, 2001 333,163