LG 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

»56

LG Electronics Inc. The

43

rd Annual Report

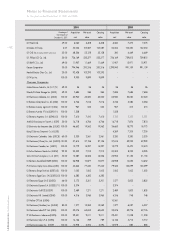

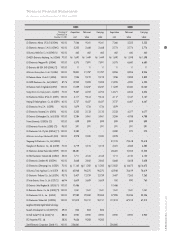

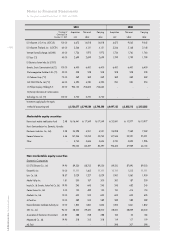

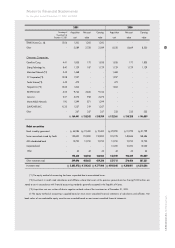

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

products of which the estimated future benefits are probable are recognized as intangible assets.

Amortization of development costs is computed using the straight-line method over five years from the

commencement of commercial production of related products. Such costs are subject to continual analysis of

recoverability. In the event that such amounts are estimated to be not recoverable, they are written-down or

written-off.

Intangible Assets

Intangible assets are stated at cost, net of accumulated amortization. Amortization is computed using the

straight-line method over the estimated useful lives ranging from five to ten years.

Discounts (Premiums) on Debentures

Discounts (premiums) on debentures are amortized using the effective interest rate method over the

repayment period of the debentures. The amortized amount is included in interest expense.

Treasury Debentures

When treasury debentures are acquired, the face value and any discount or premium are subtracted

from the related accounts. The difference between the book value and acquisition cost of the treasury

debentures is charged to current operations as a gain or loss on redemption of debentures.

Treasury stock

Treasury stocks are stated at cost and recorded as capital adjustment in shareholders equity. Gain on

disposal of treasury stock is recorded as capital surplus. Any loss on disposal of treasury stock is offset

against prior gains on disposal of treasury stock included in capital surplus. The remaining loss is offset

against retained earnings.

Product Warranty Provision

The Company provides product warranties relating to product defects for a specified period of time after

sale. Estimated costs of product warranties are charged to current operations at the time of sale and are

included in the accompanying balance sheet as a product warranty provision.

Accrued Severance Benefits

Employees and directors with more than one year of service are entitled to receive a lump-sum severance

payment upon termination of their employment with the Company, based on their length of service and rate

of pay at the time of termination. Accrued severance benefits represent the amount which would be payable

assuming all eligible employees and directors were to terminate their employment as of the balance sheet

date.

Contributions made under the National Pension Plan and severance insurance deposits are deducted

from accrued severance benefits. Contributed amounts are refunded from the National Pension Plan and the

insurance companies to employees on their retirement.