LG 2001 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. The

43

rd Annual Report

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

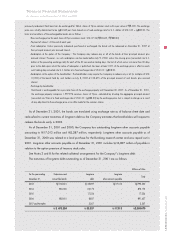

Termination date : 3 years after effective date (November 5, 2004)

Initial share price : 17,796.40

Call option contract amounts : 80,687 million

Call option premium : 18.3% of call option contract amounts

Exercise of call option :

Final call option buyer has the right to exercise the final call options on the termination date. On

the date two business days after the termination date, the final call options exercised shall be

cash settled and the final call option seller shall pay the final call option buyer an amount equal

to : (final share price initial share price) X number of final call options.

Final share price :

Determined as the average of all daily closing prices from the first business day following

effective date to the termination date subject to a minimum of initial share price.

Upper limit of daily closing price :

Starting on the first business day following the effective date at 170% of initial share price and

decreasing linearly on each subsequent business day down to 130% of initial share price on the

termination date.

An unrealized gain on valuation of derivatives in the amount of 22,189 million in excess of the option

premium cost of 14,857 million was recognized for the year ended December 31, 2001.

In order to reduce the impact of changes in exchange rates on future cash flows, the Company enters

into foreign currency forward contracts. The Company has outstanding forward contracts with Citibank for

selling US dollars amounting to US$ 40 million (contract rates : 1,283.85 : US$ 1~ 1,352.0 : US$ 1,

contract due dates : January through July 2002).

As of December 31, 2001, the Company has outstanding forward contracts with Bank of Tokyo-

Mitsubishi for selling US dollars and buying Japanese Yen amounting to US$ 4 million (contract rates :

121.11 : US$1 122.47 : US$1, contract due dates : January through February 2002).

As of December 31, 2001, the Company has outstanding forward contracts for selling Euro and buying

US Dollars amounting to US$ 24 million (contract rates : ?0.8766 : US$ 1~ ?0.8998 : US$ 1, contract due

dates : January through June 2002).

As a result of the above foreign currency forward contracts, an unrealized gain and loss of 109

million and 661 million, respectively, were charged to operations for the year ended December 31, 2001.

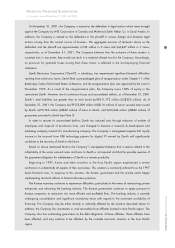

In order to reduce the impact of changes in interest rates, the Company enters into interest rate swap

contracts and an unrealized loss of 2,532 million was recorded as a capital adjustment. A summary of the

terms of outstanding interest rate swap contracts at December 31, 2001 is as follows (see Note 18) :

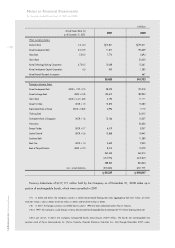

Amount (In millions) Buying rate (%) Selling rate (%) Contract due date

ABN AMRO Bank US$ 70 7.35% 6M LIBOR June 14, 2002