LG 2001 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

»76

LG Electronics Inc. The

43

rd Annual Report

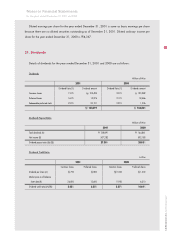

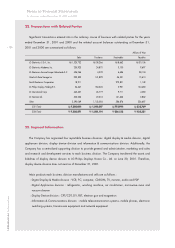

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

Call option seller: BOA

Effective date : September 7, 2001

Termination date: 3 years after effective date (September 7, 2004)

Initial share price : common stock 15,517, preferred stock 7,660

Call option contract amounts: common stock 141,979 million (US$110 million), preferred

stock 7,838 million (US$6 million)

Call option premium: 15% of call option contract amounts

Exercise of call options:

Call option buyer has the right to exercise the call options. On the termination date, the call

options exercised shall be cash settled and the call option seller shall pay an amount per the call

options exercised equal to: Max (final share price minus initial share price, 0), subject to a

maximum of 30.0% of initial share price.

Final share price :

Determined as the average of twelve monthly closing prices for the twelve months up to and

including the termination date, where each monthly closing price is taken as the arithmetic

average of the official closing price of the five business day period ending in and including the

monthly anniversary date relative to the termination date of each month.

An unrealized gain on valuation of derivatives in the amount of 23,761 million in excess of the option

premium cost of 22,477 million was recognized for the year ended December 31, 2001.

As of December 31, 2001, the Company has entered into Dacom Corporation stock sales and

derivatives contracts for its share in Dacom Corporation with Credit Suisse First Boston International (CSFB).

The terms and conditions of the contracts are as follows :

Sales of Shares in Dacom Corporation

Trade date : September 21, 2001

Number of shares : 4,563,000 shares of common stock

Sales price : the closing trade price on the trade date per share ( 17,750 per share)

Price adjustment :

On November 5, 2001, sales price was adjusted to the weighted average trade price during the

initial valuation period determined based on CSFB s executions.

As a result, the Company incurred a gain on transaction of derivatives amounting to 212

million.

Call option contract

Call option buyer : the Company

Call option seller : CSFB

Effective date : November 5, 2001