LG 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. The

43

rd Annual Report

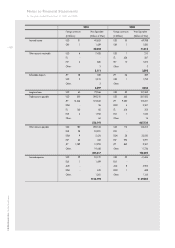

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

1. The Company

LG Electronics Inc. (the Company ) was incorporated in 1959 under the Commercial Code of the

Republic of Korea to manufacture and sell electronic products. The Company is a member of the LG Group,

which comprises affiliated companies under common management direction. In 1970, the Company offered

its shares for public ownership. As of December 31, 2001, the Company has outstanding capital stock of

1,031,068 million, including non-voting preferred stock of 95,478 million (see Note 15). The

Company s common shares are listed on the Korean stock exchange and its depositary receipts ( DRs ) are

listed on the London and Luxembourg stock exchanges.

The Company entered into a merger agreement with LG Information & Communications, Ltd. (LGIC), an

affiliate, which was in the business of selling and manufacturing mobile telecommunication systems, mobile

phones, electronic switching systems, transmission equipment, network equipment and other related

products, on June 8, 2000. The merger was approved at the shareholders meeting on July 22, 2000. As a

result, LGIC was merged into the Company effective September 1, 2000.

Pursuant to the resolution by the board of directors on June 11, 2001, the Company established a

50/50 joint venture (LG.Philips Displays Holding B.V.) of its Cathode Ray Tubes (CRT) business with

Koninklijke Philips Electronics N.V. in the Netherlands on June 29, 2001.

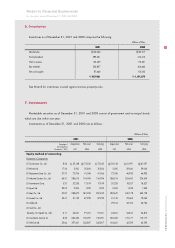

2. Summary of Significant Accounting Policies

The significant accounting policies followed by the Company in the preparation of its financial statements

are summarized below.

Basis of Financial Statement Presentation

The Company maintains its official accounting records in Korean Won and prepares statutory financial

statements in the Korean language in conformity with the accounting principles generally accepted in the

Republic of Korea. Certain accounting principles applied by the Company that conform with financial

accounting standards and accounting principles in the Republic of Korea may not conform with generally

accepted accounting principles in other countries. Accordingly, these financial statements are intended for

use by those who are informed about Korean accounting principles and practices. The accompanying

financial statements have been condensed, restructured and translated into English from the Korean

language financial statements. Some information including financial ratios, computation of value added,

employees welfare, donations and environmental efforts attached to the Korean language financial

statements, but not required for a fair presentation of the Company s financial position, results of operations

or cash flows, is not presented in the accompanying financial statements.

Accordingly, the accompanying financial statements are not intended to present the financial position,

results of operations and cash flows in accordance with accounting principles and practices generally