LG 2001 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. The

43

rd Annual Report

Message from CFO

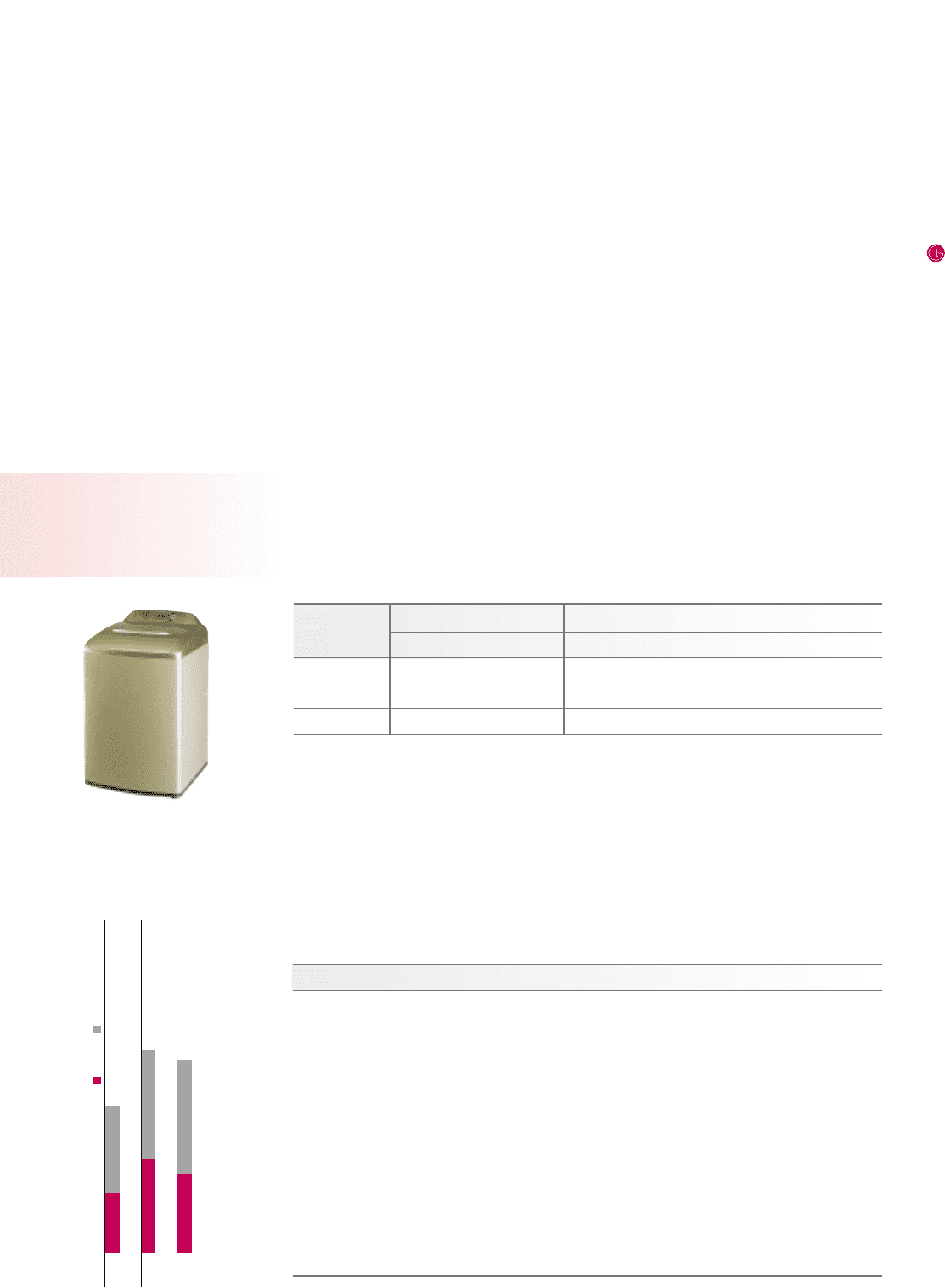

Investment Unit/ Billion KRW

R&D

1999

2000

Capex

2001

407

.

1

776

.

0

576

.

0

419

.

3826

.

4

1

,

481

.

7

1

,

334

.

8

705

.

7

758

.

8

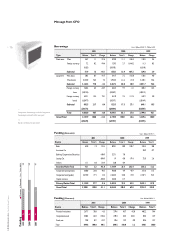

Interest Rates

With less debt and lower interest rates we saved approximately 44 billion won.

Average interest rates for 2001 improved to 8.5% from an average of 10.5% through 2000.

Funding Sources

Funding from the Korean financial market amounted to 3.2 trillion won including 3.135

trillion won from primary markets. We also drew approximately 900 billion won from

overseas financial markets. Besides the RPS issuance in 2000 we did not utilize capital markets.

Investment

In 2001 we made a total of 576 billion won in CAPEX investment and 759 billion won

in R&D investment. CAPEX investments included 91.6 billion won in PDP, 40.2 billion won

in PCB, and 48.1 billion won in Digital Handset business. The remainder was primarily

maintenance.

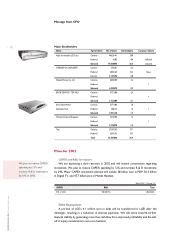

Stock Information

As we redeemed 32 million units of RPS with retained earning, there was no change in

total paid-in capital. As of Dec 2001, we have 155,118,070 common shares and 19,095,547

preferred shares. The major shareholders are LGCI, CITIBANK, Korea National Pension

Fund, Stock Market Stabilization Fund, Templeton, and Government of Singapore. The

percentage of foreign-held shares rose to 27.8% from 21.4% the previous year, reflecting a

continuing upward trend.

Type Balance Sales % Change Balance Sales % Change Balance Sales %

CAPEX 576.0 3.5 -25.8 776.0 5.2 90.6 407.1 3.9

R&D 758.8 4.6 7.5 705.7 4.8 68.3 419.3 4.0

Total 1,334.8 8.1 -9.9 1,481.7 10.0 79.3 826.4 7.9

2001 2000 1999

Investment Unit : Billion KRW, %

Date Type of change Type of shares Holding shares Face-value(won) Issue price(won) Capital stock after change(1000 won)

93. 2. 27 Stock dividend Common 1,572,681 5,000 5,000 452,911,100

93. 6. 26 Capital increase Common 5,700,000 5,000 10,100 481,411,100

94. 7. 15 GDR Preferred 1,870,657 5,000 30,179 490,764,385

95. 2. 25 Merger Common 2,327,304 5,000 5,000 502,400,905

(Goldstar) Preferred 212,230 5,000 5,000 503,462,055

95. 7. 14 Capital increase Common 6,300,000 5,000 21,700 534,962,055

95. 12. 14 CB, foreign currency Preferred 207 5,000 17,493 534,963,090

97. 5. 6 Capital reduction Preferred -2,069,405 5,000 5,000 524,616,065

98. 12. 24 Capital increase Common 21,500,000 5,000 8,800 632,116,065

00. 9. 4 Merger Common 47,790,404 5,000 871,068,085

00. 12. 23 Capital increase RPS 32,000,000 5,000 17,000 1,031,068,085

01. 07. 27 Redeemed PRS -32,000,000 5,000 1,031,068,085

Changes in Capital Stock

* The dates are standardized with the registration date

In 2001, we made a total of

576 billion won in CAPEX

investment and 759 billion

won in R&D investment.