LG 2001 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. The

43

rd Annual Report

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

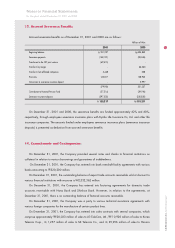

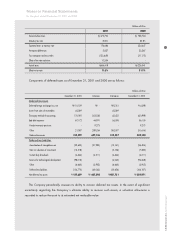

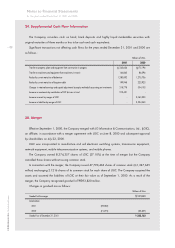

Millions of Won

2001 2000

Income before taxes 573,700 728,724

Statutory tax rate 30.8% 30.8%

Expected taxes at statutory rate 176,686 224,447

Permanent differences 2,827 33,267

Tax exemption and tax credits (123,649) (31,173)

Effect of tax rate reduction 10,554 -

Actual taxes 66,418 226,541

Effective tax rate 11.6% 31.1%

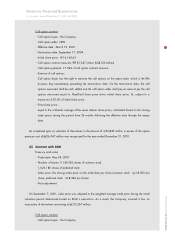

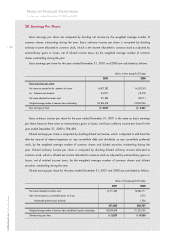

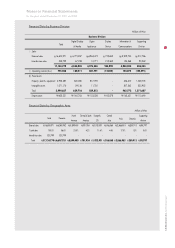

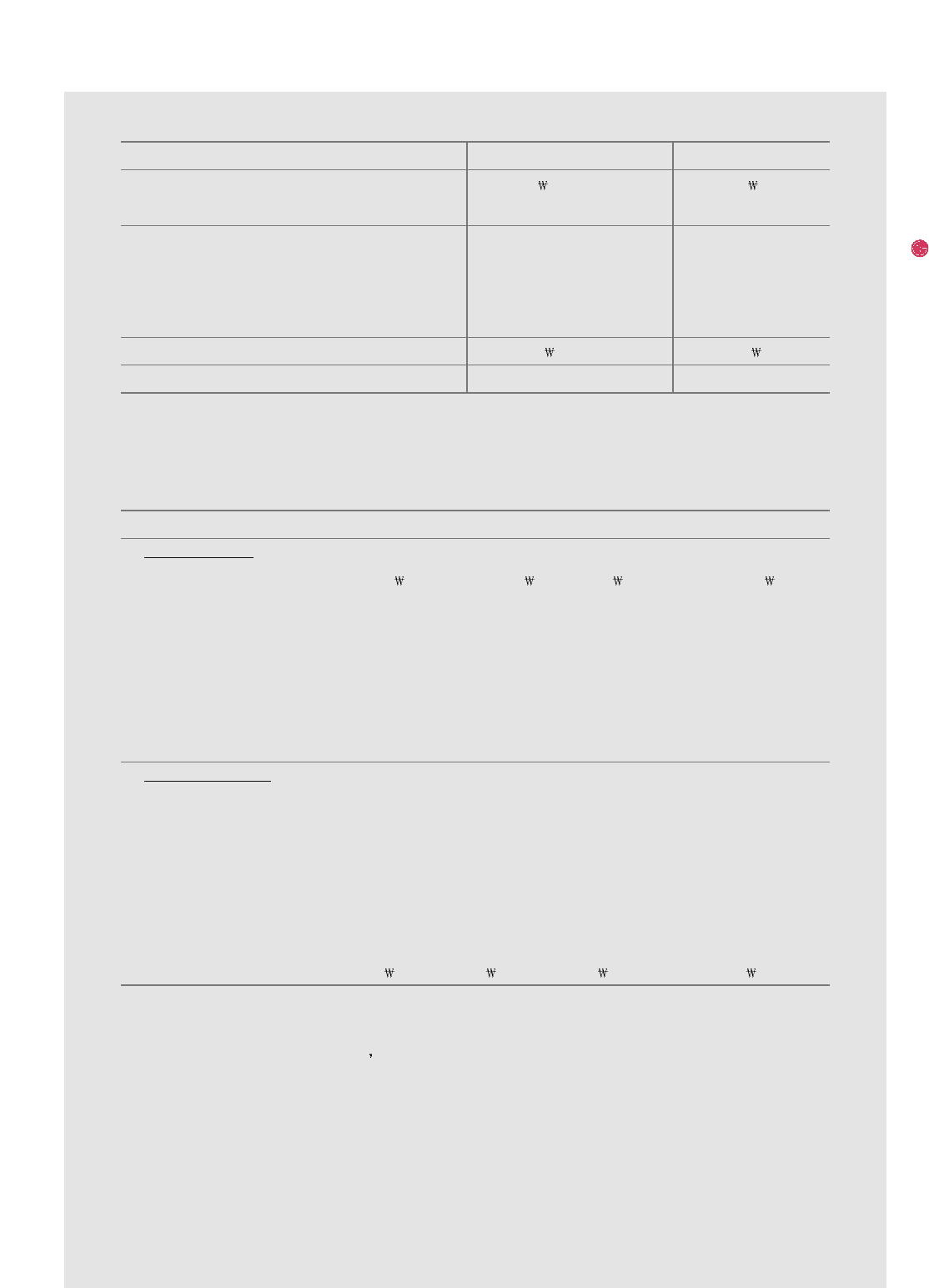

Components of deferred taxes as of December 31, 2001 and 2000 are as follows :

Millions of Won

December 31, 2000 Increases Decreases December 31, 2001

Deferred tax assets

Deferred foreign exchange loss, net 10,159 - 5,761 4,398

Losses from sales of receivables 45,569 - 45,569 -

The equity method of accounting 170,092 303,338 42,432 430,998

Bad debt expenses 67,172 44,991 56,058 56,105

Product warranty provision - 9,273 - 9,273

Other 21,387 289,534 362,537 (51,616)

Deferred tax assets 314,379 647,136 512,357 449,158

Deferred tax liabilities

Amortization of intangible assets (32,635) (31,930) (10,141) (54,424)

Gain on valuation of investments (12,518) - (5,136) (7,382)

Custom duty drawback (4,644) (4,211) (4,644) (4,211)

Reserve for technological development (98,313) - (4,045) (94,268)

Other (6,660) (3,902) (6,660) (3,902)

Deferred tax liabilities (154,770) (40,043) (30,626) (164,187)

Net deferred tax assets 159,609 607,093 481,731 284,971

The Company periodically assesses its ability to recover deferred tax assets. In the event of significant

uncertainty regarding the Company s ultimate ability to recover such assets, a valuation allowance is

recorded to reduce the asset to its estimated net realizable value.