LG 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

»58

LG Electronics Inc. The

43

rd Annual Report

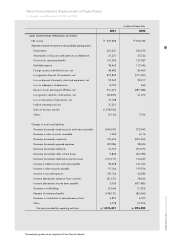

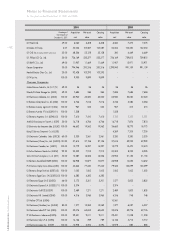

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

have effect on operations.

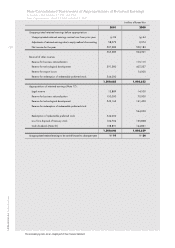

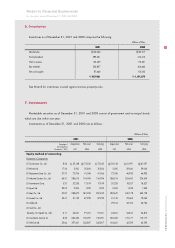

3. Restricted Financial Instruments

As of December 31, 2000, short-term financial instruments of 3,012 million and as of December 31,

2001 and 2000, long-term financial instruments of 10,528 million and 10,749 million, respectively,

are deposited in connection with maintaining checking accounts, various short-term borrowings and long-

term debt, and research and development projects funded by the government. The withdrawal of these

financial instruments is restricted (see Notes 10 and 11).

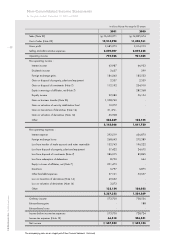

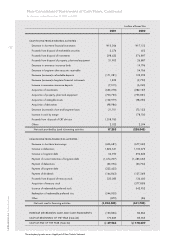

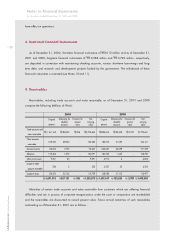

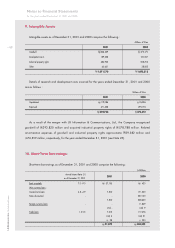

4. Receivables

Receivables, including trade accounts and notes receivable, as of December 31, 2001 and 2000

comprise the following (Millions of Won) :

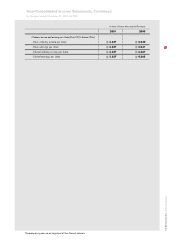

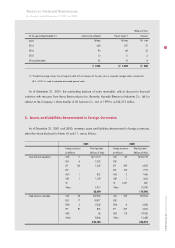

Maturities of certain trade accounts and notes receivable from customers which are suffering financial

difficulties and are in process of corporate reorganization under the court or composition are rescheduled

and the receivables are discounted to record present value. Future annual maturities of such receivables

outstanding as of December 31, 2001 are as follows :

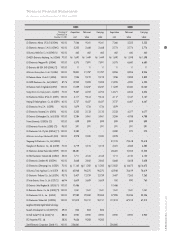

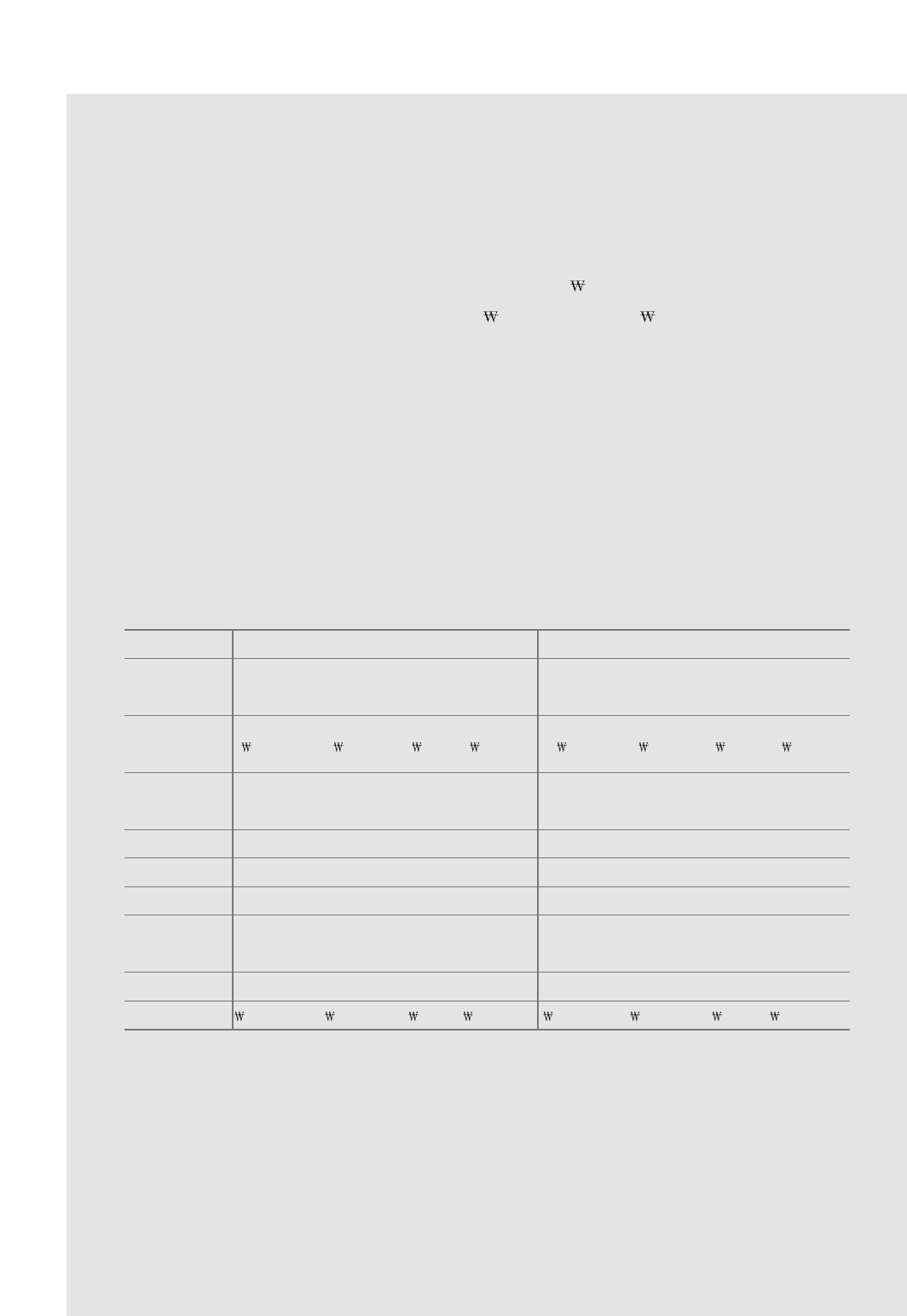

2001 2000

Trade accounts and

notes receivable 1,161,165 88,255 306 1,072,604 896,516 94,208 2,707 799,601

Other accounts

receivable 169,220 38,940 - 130,280 185,700 21,559 - 164,141

Accrued income 82,002 5,755 - 76,247 225,637 34,098 - 191,539

Advances 135,464 1,373 - 134,091 160,225 1,445 - 158,780

Other current assets 9,351 60 - 9,291 6,910 6 - 6,845

Long-term trade

accounts receivable 336 3 - 333 4,547 45 - 4,502

Long-term loans 133,474 22,745 - 110,729 148,082 31,105 - 116,977

1,691,012 157,131 306 1,533,575 1,627,617 182,525 2,707 1,442,385

Original

amount

Allowance for

doubtful

accounts

Discounts for

present

value

Net

carrying

value

Original

amount

Allowance for

doubtful

accounts

Discounts for

present

value

Net

carrying

value