LG 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

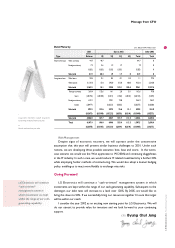

Risk Management

Despite signs of economic recovery, we will operate under the conservative

assumption that this year will present similar business challenges to 2001. Under such

notions, we are developing three possible scenarios: best, base and worst. In the worst-

case scenario we would see the Won appreciate to W1200/$ and continuing sluggishness

in the IT industry. In such a case, we would reduce IT related investments by a further 20%

while employing harder methods of restructuring. We would also adopt a keener hedging

policy, enabling us to react more flexibly to exchange rate risks.

Going Forward

LG Electronics will continue a “cash-oriented” management system in which

investments are kept within the range of our cash-generating capability. Subsequent to the

demerger, our debt ratio will increase to a level over 120%. By 2005, we would like to

bring this down to 50%. If we successfully bring our resources together I’m sure this target

will be within our reach.

I consider the year 2002 as an exciting new starting point for LG Electronics. We will

do our utmost to provide value for investors and we look forward to your continuing

support.

CFO Byung Chul Jung

LG Electronics Inc. The

43

rd Business Reprot

Message from CFO

*

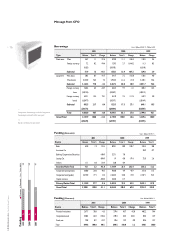

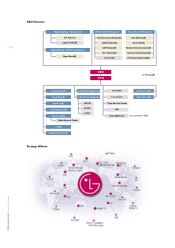

Long-term liabilities include long-term

borrowings matured within one year.

**

Bonds are based on par value

Unit : Billion KRW, Million USD

Type Balance 1Q 2Q 3Q 4Q Total Total

Short-term loan Won currency 44.7 44.7 44.7 0

Foreign currency 7.2 3.6 1.9 1.7 7.2 0

(U$5) (U$3) (U$1) (U$1) (U$5) 0

Sub-total 51.9 48.3 1.9 1.7 0 51.9 0

Long-term loan Won loans 28.5 0.1 0.5 0.1 0.4 1.1 27.4

Won bonds 3,135.0 15.0 295.0 515.0 100.0 925.0 2,210.0

Sub-total 3,163.5 15.1 295.5 515.1 100.4 926.1 2,237.4

Foreign currency 260.4 132.6 14.1 2.8 13.1 162.6 97.8

loans (U$196) (U$100) (U$11) (U$2) (U$10) (U$123) (U$73)

Foreign currency 632.1 293.1 73.8 366.9 265.2

bonds (U$477) (U$221) (U$56) (U$277) (U$200)

Sub-total 892.5 132.6 307.2 76.6 13.1 529.5 363.0

(U$673) (U$100) (U$232) (U$58) (U$10) (U$400) (U$273)

Sub-total 4,056.0 147.7 602.7 591.7 113.5 1,455.6 2,600.4

Total 4,107.9 196.0 604.6 593.4 113.5 1,507.5 2,600.4

(U$678) (U$103) (U$233) (U$59) (U$10) (U$405) (U$273)

2001 Due in 2002 After 2003

Debt Maturity

LG Electronics will continue

“cash-oriented”

management system in

which investments are kept

within the range of our cash-

generating capability.