LG 2001 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

»66

LG Electronics Inc. The

43

rd Annual Report

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

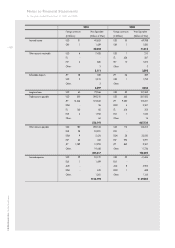

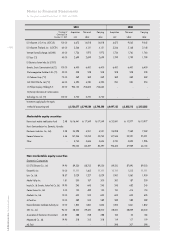

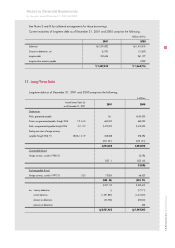

Changes in investments in subsidiaries and affiliates accounted for using the equity method for the year

ended December 31, 2001 are as follows :

Millions of Won

Balance at January 1, 2001 3,822,525

Acquisitions during the year 1,536,709

Reclassification 760

Increase in retained earnings 86,514

Increase in capital adjustments 60,392

Equity in loss of affiliates, net (862,421)

Elimination of unrealized profit (39,051)

Dividend received (119,868)

Disposal of investment securities (736,980)

Balance at December 31, 2001 3,748,580

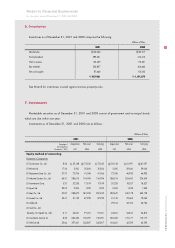

7. Investments, Continued

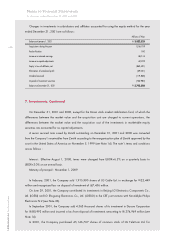

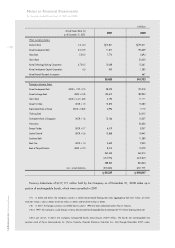

On December 31, 2001 and 2000, except for the Korea stock market stabilization fund, of which the

differences between the market value and the acquisition cost are charged to current operations, the

differences between the market value and the acquisition cost of the investments in marketable equity

securities are accounted for as capital adjustments.

A senior secured note issued by Zenith outstanding on December 31, 2001 and 2000 was converted

from the Company s receivables from Zenith according to the reorganization plan of Zenith approved by the

court in the United States of America on November 5, 1999 (see Note 14). The note s terms and conditions

are as follows :

Interest : Effective August 1, 2000, terms were changed from LIBOR+6.5% on a quarterly basis to

LIBOR+3.0% on an annual basis

Maturity of principal : November 1, 2009

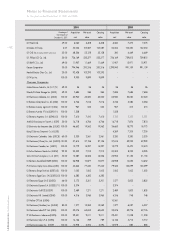

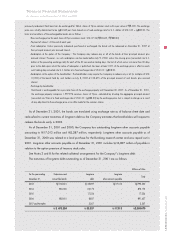

In February, 2001, the Company sold 1,915,900 shares of LG Cable Ltd. in exchange for 22,449

million and recognized loss on disposal of investment of 7,456 million.

On June 29, 2001, the Company contributed its investments in Beijing LG Electronics Components Co.,

Ltd. (LGEBJ) and LG Shuguang Electronics Co., Ltd. (LGESG) to the CRT joint venture with Koninklijke Philips

Electronics N.V.(see Note 26).

In September 2001, the Company sold 4,563 thousand shares of its investment in Dacom Corporation

for 80,993 million and incurred a loss from disposal of investments amounting to 374,969 million (see

Note 14).

In 2001, the Company purchased 45,146,767 shares of common stock of LG TeleCom Ltd. for