LG 2001 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. The

43

rd Annual Report

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

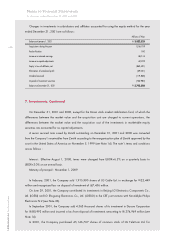

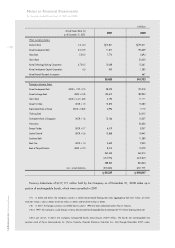

previously redeemed. Each bond can be exchanged for 266.4 shares of Hynix common stock with a par value of 5,000. The exchange

price was initially determined to be 33,345 per share based on a fixed exchange rate for U.S. dollars of US$1.00 = 888.30. The

terms and conditions of the exchangeable bonds are as follows :

Basic exchange price for each share of Hynix common stock : US$ 37.54 ( 33,345 / 888.30)

Payment of interest : At the end of each year

Final redemption :Unless previously redeemed, purchased or exchanged, the bonds will be redeemed on December 31, 2007 at

their principal amount, plus accrued interest.

Redemption at the option of the Company : The Company may redeem any or all of the bonds at their principal amount, plus

accrued interest. However, no such redemption can be made before July 9, 2002, unless the closing price (converted into U.S.

dollars at the prevailing exchange rate) for each of the 30 consecutive trading days, the last of which occurs not more than 30 days

prior to the date upon which the notice of redemption is published, has been at least 135% of the exchange price in effect on each

such trading day converted into U.S. Dollars at a fixed exchange rate of US$1.00 : 888.30.

Redemption at the option of the bondholders :The bondholders may require the Company to redeem any or all (in multiples of US$

10,000) of the bonds held by such holders on July 8, 2002 at 133.67% of the principal amount of such bonds, plus accrued

interest.

Exchange by bondholder

Each bond is exchangeable for a pro rata share of the exchange property until November 30, 2007. As of December 31, 2001,

the exchange property comprises 1,997,976 common shares of Hynix, calculated by dividing the aggregate principal amount

(converted into Won at a fixed exchange rate of US$1.00 : 888.30) by the exchange price, but is subject to change as a result

of any adjustment to the exchange price or an offer made for the common shares.

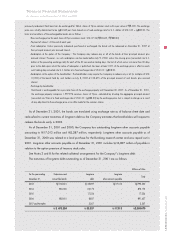

As of December 31, 2001, the bonds are translated using exchange rate as of balance sheet date and

reclassified to current maturities of long-term debt as the Company estimates that bondholders will request to

redeem the bonds early in 2002.

As of December 31, 2001 and 2000, the Company has outstanding long-term other accounts payable

amounting to 17,013 million and 2,287 million, respectively. Long-term other accounts payable as of

December 31, 2000 was related to a land purchase for the Bundang research center and was repaid out in

2001. Long-term other accounts payable as of December 31, 2001 includes 16,897 million of payable in

relation to the option premium of treasury stock sales.

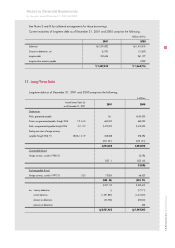

See Notes 3 and 8 for the related collateral arrangements for the Company s long-term debt.

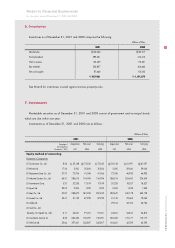

The maturities of long-term debt outstanding as of December 31, 2001 are as follows:

Millions of Won

For the year ending Debentures and Long-term Long-term

December 31, convertible bonds debt other accounts payable Total

2003 742,610 35,697 17,013 795,320

2004 850,000 23,172 - 873,172

2005 - 17,234 - 17,234

2006 882,610 8,827 - 891,437

2007 and thereafter - 3,307 - 3,307

2 ,475,220 88,237 17,013 2,580,470