LG 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

»54

LG Electronics Inc. The

43

rd Annual Report

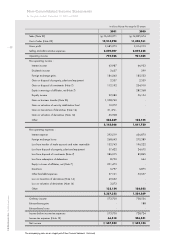

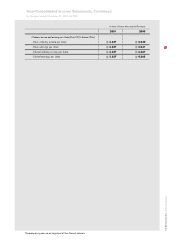

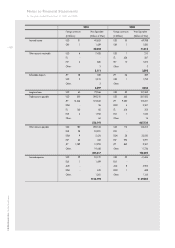

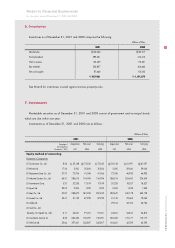

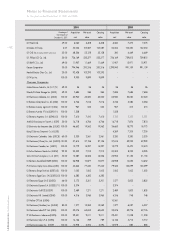

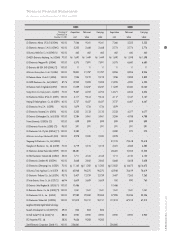

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

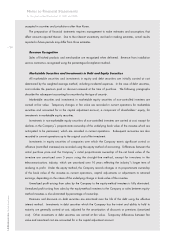

accepted in countries and jurisdictions other than Korea.

The preparation of financial statements requires management to make estimates and assumptions that

affect amounts reported therein. Due to the inherent uncertainty involved in making estimates, actual results

reported in future periods may differ from those estimates.

Revenue Recognition

Sales of finished products and merchandise are recognized when delivered. Revenue from installation

service contracts is recognized using the percentage-of-completion method.

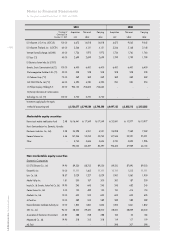

Marketable Securities and Investments in Debt and Equity Securities

All marketable securities and investments in equity and debt securities are initially carried at cost

determined by the weighted average method, including incidental expenses. In the case of debt securities,

cost includes the premium paid or discount received at the time of purchase. The following paragraphs

describe the subsequent accounting for securities by the type of security.

Marketable securities and investments in marketable equity securities of non-controlled investees are

carried at fair value. Temporary changes in fair value are recorded in current operations for marketable

securities and accounted for in the capital adjustment account, a component of shareholders equity, for

investments in marketable equity securities.

Investments in non-marketable equity securities of non-controlled investees are carried at cost, except for

declines in the Company s proportionate ownership of the underlying book value of the investee which are

anticipated to be permanent, which are recorded in current operations. Subsequent recoveries are also

recorded in current operations up to the original cost of the investment.

Investments in equity securities of companies over which the Company exerts significant control or

influence (controlled investees) are recorded using the equity method of accounting. Differences between the

initial purchase price and the Company s initial proportionate ownership of the net book value of the

investee are amortized over 5 years using the straight-line method, except for investees in the

telecommunications industry, which are amortized over 10 years reflecting the industry s longer term of

realizing its profit. Under the equity method, the Company records changes in its proportionate ownership

of the book value of the investee as current operations, capital adjustments or adjustments to retained

earnings, depending on the nature of the underlying change in book value of the investee.

Unrealized profit arising from sales by the Company to the equity-method investees is fully eliminated.

Unrealized profit arising from sales by the equity-method investees to the Company or sales between equity-

method investees is also eliminated by percentage of ownership.

Premiums and discounts on debt securities are amortized over the life of the debt using the effective

interest method. Investments in debt securities which the Company has the intent and ability to hold to

maturity are generally carried at cost, adjusted for the amortization of discounts or premiums (amortized

cost). Other investments in debt securities are carried at fair value. Temporary differences between fair

value and amortized cost are accounted for in the capital adjustment account.