LG 2001 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

»82

LG Electronics Inc. The

43

rd Annual Report

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

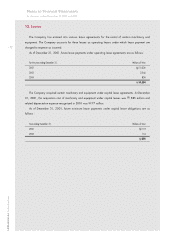

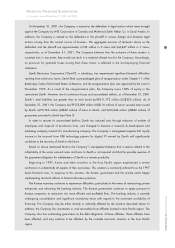

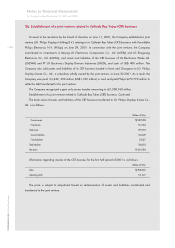

18. Capital Adjustments

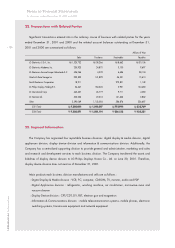

As of December 31, 2001 and 2000, capital adjustments are as follows:

Millions of Won

2001 2000

Treasury stock (494,235) (875,604)

Loss on valuation of investment securities (74,682) (175,462)

Loss on valuation of derivative financial instruments (Note 14) (2,532) (1,091)

(571,449) (1,052,157)

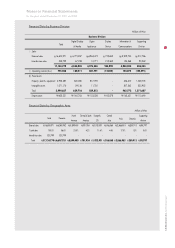

In 2000, the Company purchased its own stocks amounting to 40,835,200 shares of common stock and

1,508,876 shares of preferred stock mainly in relation to specified money trust agreements and the stock

repurchase request option executed by shareholders who objected to the merger with LG Information &

Communications, Ltd. As of December 31, 2001, the Company retains treasury stocks amounting to

17,126,361 shares of common stock and 16 shares of preferred stock. The Company has intention to sell

the treasury stock in the future.

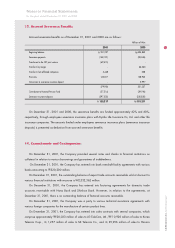

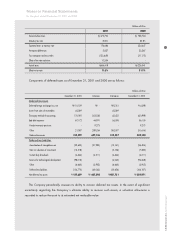

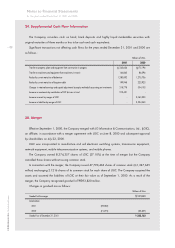

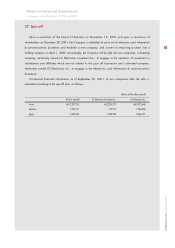

19. Income Taxes

Income tax expenses for the years ended December 31, 2001 and 2000 comprise the following:

Millions of Won

2001 2000

Current income taxes 173,650 196,960

Deferred income taxes (107,232) 29,581

66,418 226,541

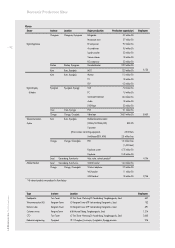

In 2001 and 2000, the statutory income tax rate applicable to the Company, including resident tax

surcharges, is approximately 30.8%. Effective in 2002, the statutory income tax rate applicable to the

Company will be reduced to 29.7% from 30.8%, and 29.7% is applied to calculate deferred income tax in

2001. The following table reconciles the expected amount of income tax expense based on statutory rates to

the actual amount of taxes recorded by the Company :