LG 2001 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. The

43

rd Annual Report

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

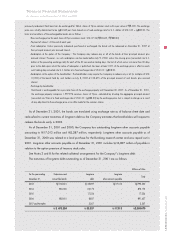

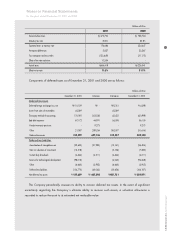

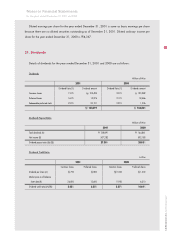

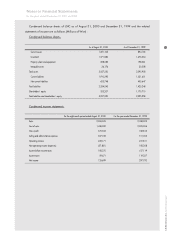

17. Retained Earnings

Retained earnings as of December 31, 2001 and 2000 are as follows:

Millions of Won

2001 2000

Legal reserve (*1)

69,888 55,999

Other reserves

Reserve for business rationalization (*2) 431,065 281,065

Reserve for improvement o financial structure (*3) 84,458 84,458

Reserve for technological development (*4) 866,561 708,680

Reserve for redemption of redeemable preferred stock - 544,000

1,382,084 1,618,203

Unappropriated retained earnings carried forward to subsequent year 19 24

1,451,991 1,674,226

(*1) The Commercial Code of the Republic of Korea requires the Company to appropriate, as a legal reserve, an amount equal to a

minimum of 10% of cash dividends paid until such reserve equals 50% of its issued capital stock. The reserve is not available for payment

of cash dividends, but may be transferred to capital stock through an appropriate resolution by the Company s board of directors or used

to reduce accumulated deficit, if any, through appropriate resolution by the Company s shareholders.

(*2) Pursuant to the Tax Exemption and Reduction Control Law, the Company is required to appropriate, as a reserve for business

rationalization, a portion of retained earnings equal to tax reductions arising from investment and other tax credits. This reserve is not

available for dividends but may be transferred to capital stock through an appropriate resolution by the Company s board of directors or

used to reduce accumulated deficit, if any, through appropriate resolution by the Company s shareholders.

(*3) In accordance with the regulations regarding securities issuance and disclosure (formerly, the provisions of the Financial Control

Regulation for publicly listed companies), the Company is required to appropriate, as a reserve for improvement of financial structure, a

portion of retained earnings equal to a minimum of 10% of its annual income plus at least 50% of the net gain from the disposal of

property, plant and equipment after deducting related taxes, until equity equals 30% of total assets. This reserve is not available for

dividends, but may be transferred to capital stock through an appropriate resolution by the Company s board of directors or used to reduce

accumulated deficit, if any, through an appropriate resolution by the Company s shareholders.

(*4) Pursuant to the Tax Exemption and Reduction Control Law, the Company is allowed to appropriate retained earnings as a reserve

for technological development. This reserve is not available for dividends until used for the specified purposes or reversed.