LG 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. The

43

rd Annual Report

Report of Independent Accountants

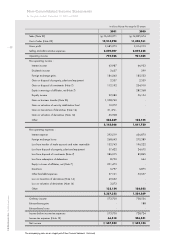

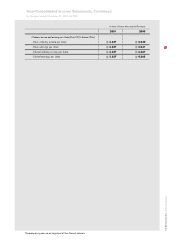

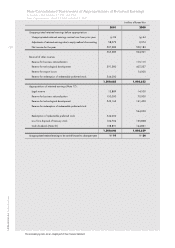

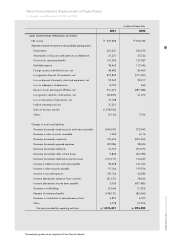

For the years ended December 31, 2001 and 2000

not related to the spun off businesses and a divested company, tentatively named LG Electronics Inc., to

engage in the electronics and information & communications businesses.

As discussed in Note 26 of the accompanying financial statements, pursuant to the resolution by the

board of directors on June 11, 2001, the Company established a joint venture (LG. Philips Displays Holding

B.V.) relating to its Cathode Ray Tubes ( CRT ) business with Koninklijke Philips Electronics N.V. on June 29,

2001. The Company transferred the assets and liabilities of the CRT business to LG. Philips Displays Korea

Co., Ltd., a subsidiary wholly owned by the joint venture, on June 30, 2001. As a result, the Company

recognized 1,358,760 million of gain on business transfer.

As discussed in Note 15 to the accompanying financial statements, pursuant to the resolution by the

board of directors on June 25, 2001, the Company redeemed 542,952 million (32,000,000 shares) of

redeemable preferred stock which were issued in December 2000.

As discussed in Notes 7 and 14 to the accompanying financial statements, on September 21, 2001, the

Company sold 4,563 thousand shares of its investment in Dacom Corporation for 80,993 million and

incurred a loss from disposal of investments amounting to 374,969 million.

Without qualifying our opinion, we draw attention to Note 14 of the financial statements which states

that the operations of the Company have been affected, and may continue to be affected for the foreseeable

future, by the general unstable economic conditions in the Republic of Korea and in the Asia Pacific region.

The ultimate effect of these uncertainties of the financial position of the Company as of the balance sheet

date cannot presently be determined and accordingly, no adjustments have been made in the

accompanying financial statements related to such uncertainties.

The accompanying financial statements are not intended to present the financial position, results of

operations and cash flows in accordance with accounting principles and practices generally accepted in

countries and jurisdictions other than the Republic of Korea. The procedures and practices utilized in the

Republic of Korea to audit such financial statements may differ from those generally accepted and applied in

other countries and jurisdictions. Accordingly, this report and the accompanying financial statements are not

intended for use by those who are not informed about Korean accounting principles or auditing standards

and their application in practice.

Seoul, Korea

January 28, 2002