LG 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

With the successful launch

of a CRT joint venture with

Philips, we generated $1.1

billion in proceeds, most of

which we put towards debt

reduction.

LG Electronics Inc. The

43

rd Annual Report

Message from CFO

2001Review

Despite turbulence in the global economy, LG Electronics managed to achieve its initial

target of 16.6 trillion won, laying a strong foundation for financial improvement. In 2001 we

went through a difficult restructuring process, fine-tuning our operations for a clean start

after the planned demerger. With the successful launch of a CRT joint venture with Philips,

we established ourselves as market leaders in the CRT industry and generated $1.1 billion

in proceeds, most of which we put towards debt reduction

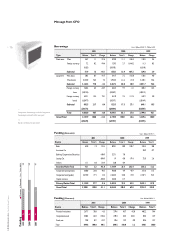

Operating Profit

Due to a slowdown in the IT industry, Digital Display & Media, which accounts for 41%

of our total sales, experienced severe pressure from our competitors. It also required

serious restructuring, with Telecommunication System suffering from reduced CAPEX

spending by major telecom operators. Digital Appliance, however, reasserted itself as a

reliable earning base by showing more than 12% operating margin, while Digital Handset

showed remarkable growth and improved profitability. All in all, operating profit for LGE

as a whole slid to 4.8%.

Recurring Profit

A recurring profit of 573.7 billon won reflects a variety of important developments.

We received about 1.4 trillion won in proceeds from CRT business spin-offs, while taking a

901.5 billion won loss from equity accounts, including the onetime goodwill amortization of

Dacom shares. With the sale of Dacom shares we incurred a loss of 374.9 billion won.

Net profit & EBITDA

Net profit remained at a level similar to that of 2000, due to lower tax payments.

EBIDTA with 625 billion won in depreciation posted 1.4 trillion won level, a similar level to

2001. Again, we find this encouraging considering much worse business environment in

2001.

Debt Position

US $1.1 billion received from CRT spin-off was used to pay off 640 billion won of our

debt as well as redeemed 544 billion won in redeemable preferred stock. As a result, we

were able to bring down our gearing level from 118% in 2000 to 95% in 2001. Residual

debt at the end of 2001 stood at 4.1 trillion won.

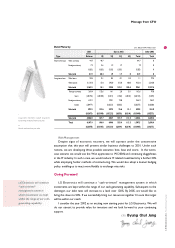

Capital

Debt Ratio

1999

2000

Debt / Unit : Trillion KRW

106

%

118

%

95

%

2001

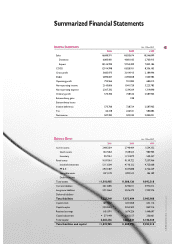

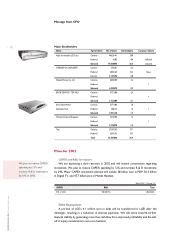

Operating profit 796.0 921.1 684.0

Ordinary profit 573.7 728.5 2,587.9

Net profit 507.3 502.2 2,005.0

2001 2000 1999

Unit : Blllion KRW

3

.

3

4

.

7

4

.

1

3

.

2

4

.

0

4

.

3

Profits