LG 2001 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

»78

LG Electronics Inc. The

43

rd Annual Report

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

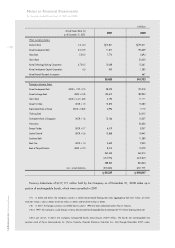

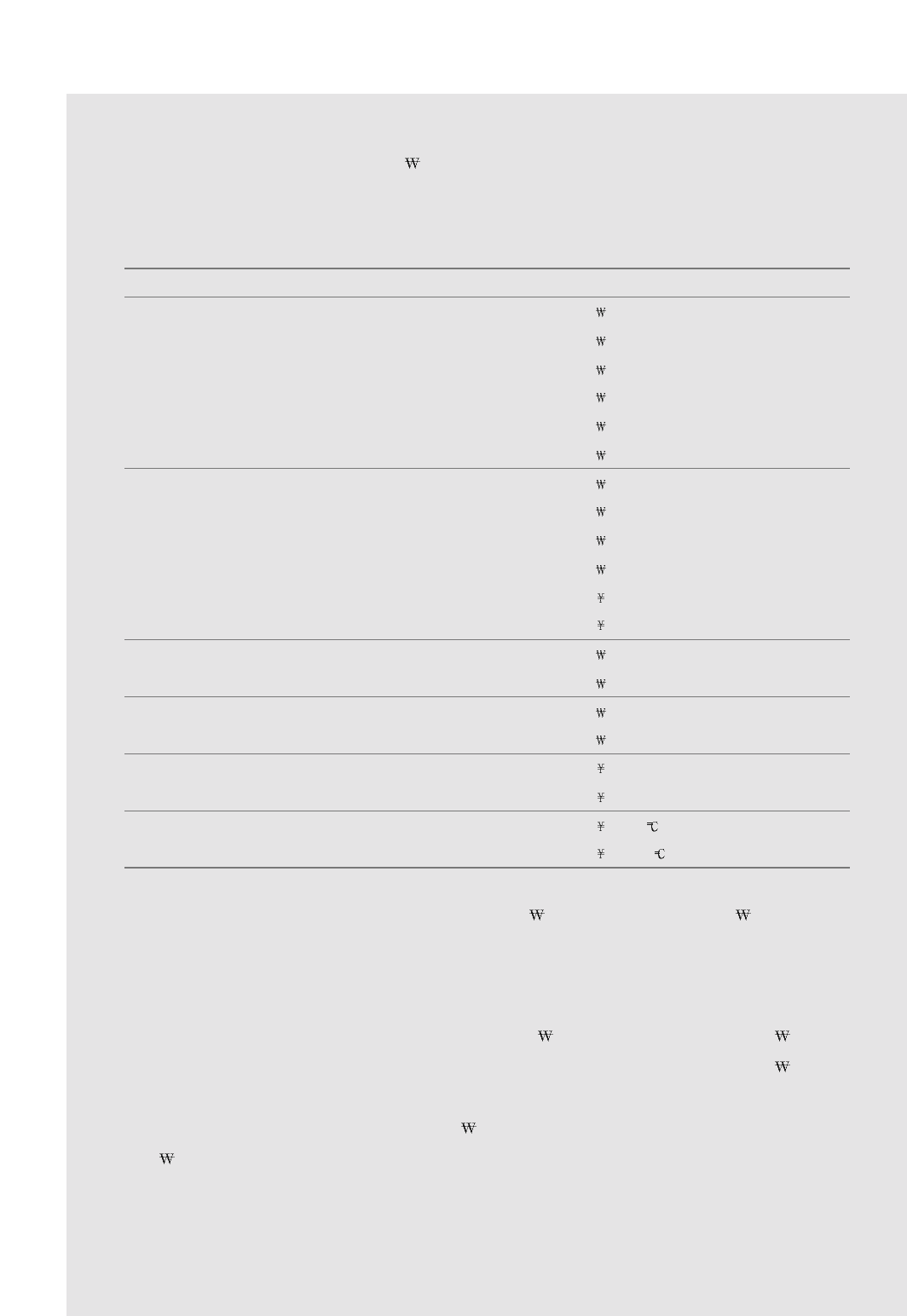

In order to reduce the impact of changes in exchange rates, the Company enters into foreign currency

option contracts. An unrealized loss of 2,412 million was charged to operations for the year ended

December 31, 2001. A summary of the terms of outstanding currency option contracts at December 31,

2001 is as follows :

Option Type Amount (In millions) Exercising price Contract due date

Citibank Put US$ 9.0 1,280.0/US$ 2002.3.11

Call US$ 9.0 1,343.5/US$ 2002.3.11

Put US$ 5.0 1,285.0/US$ 2002.1.14

Call US$ 10.0 1,285.0/US$ 2002.1.14

Put US$ 5.0 1,295.0/US$ 2002.2.26

Call US$ 10.0 1,295.0/US$ 2002.2.26

Deutsche Bank Put US$ 10.0 1,280.0/US$ 2002.3.11

Call US$ 10.0 1,343.0/US$ 2002.3.11

Put US$ 10.0 1,290.0/US$ 2002.4.12

Call US$ 10.0 1,337.0/US$ 2002.4.12

Put US$ 2.0 121.1/US$ 2002.6. 4

Call US$ 2.0 124.5/US$ 2002.6. 4

UBS Warburg Put US$ 10.0 1,280.0/US$ 2002.6. 5

Call US$ 10.0 1,305.0/US$ 2002.6. 5

Credit Lyonnais Put US$ 10.0 1,300.0/US$ 2002.6.18

Call US$ 10.0 1,329.0/US$ 2002.6.18

Standard Chartered Bank Put US$ 2.0 117.0/US$ 2002.4.9

Call US$ 2.0 120.05/US$ 2002.4.9

Credit Lyonnais Put EURO 4.0 117.0/ 2002.3.14

Call EURO 4.0 120.05/ 2002.3.14

As a result of the above derivatives contracts, a gain of 2,167 million and a loss of 15,395 million

were recognized for the year ended December 31, 2001.

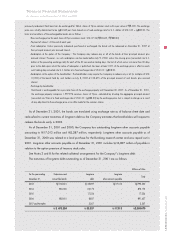

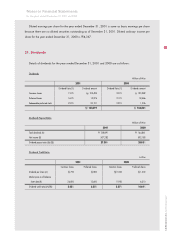

On December 14, 2000, the Company has entered into a leasehold deposits sales agreement with LG

Shinhan Securitization L.L.C. (SPC) to securitize the leasehold deposits owned by the Company. The

Company has sold leasehold deposits whose book value is 133,854 million to the SPC for 120,400

million, and in 2001 the Company repurchased a substantial portion of leasehold deposits for 119,898

million.

As of December 31, 2001, the Company has 13,700 million of subordinated bond issued by the SPC

and 3,300 million of long-term loan due from the SPC. The Company provides management services

related to the leasehold deposits owned by the SPC and receives a service fee from the SPC. The holders of

the bonds issued by the SPC based on the leasehold deposits have rights to request the Company to

purchase the bonds under certain adverse conditions within two years after the date upon which the bond

sales are completed.