LG 2001 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. The

43

rd Annual Report

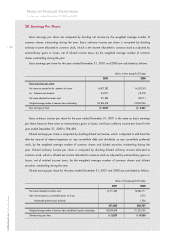

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

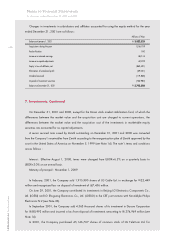

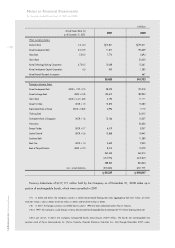

Call option contract

Call option buyer : the Company

Call option seller: CSFB

Effective date : March 19, 2001

Termination date: September 17, 2004

Initial share price : 14,140.62

Call option contract amounts: 155,547 million (US$120 million)

Call option premium: 17.34% of call option contract amounts

Exercise of call options:

Call option buyer has the right to exercise the call options on the expiry date, which is the fifth

business day immediately preceding the termination date. On the termination date, the call

options exercised shall be cash settled and the call option seller shall pay an amount per the call

options exercised equal to: Max(final share price minus initial share price, 0), subject to a

maximum of 30.0% of initial share price.

Final share price :

equal to the arithmetic average of the seven interim share prices, calculated based on the closing

trade prices during the period from 36 months following the effective date through the expiry

date.

An unrealized gain on valuation of derivatives in the amount of 20,849 million in excess of the option

premium cost of 26,947 million was recognized for the year ended December 31, 2001.

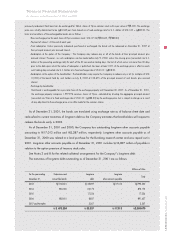

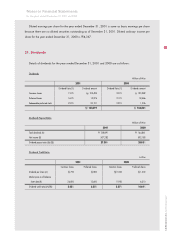

(2) Contract with BOA

Treasury stock sales

Trade date: May 24, 2001

Number of shares: 9,149,920 shares of common stock

1,023,180 shares of preferred stock

Sales price: the closing trade price on the trade date per share (common stock : 18,200 per

share, preferred stock : 8,340 per share)

Price adjustment:

On September 7, 2001, sales price was adjusted to the weighted average trade price during the initial

valuation period determined based on BOA s executions. As a result, the Company incurred a loss on

transaction of derivatives amounting to 25,267 million.

Call option contract

Call option buyer : the Company