LG 2001 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2001 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. The

43

rd Annual Report

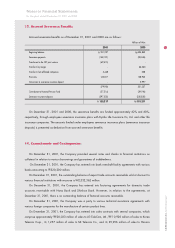

Notes to Financial Statements

for the years ended December 31, 2001 and 2000

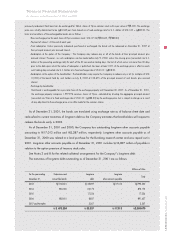

On December 31, 2001, the Company is named as the defendant in legal actions which were brought

against the Company by AVS Corporation in Canada and Mahmood Saleh Abbar Co. in Saudi Arabia. In

addition, the Company is named as the defendant or the plaintiff in various foreign and domestic legal

actions arising from the normal course of business. The aggregate amounts of domestic claims as the

defendant and the plaintiff are approximately 193 million in 9 cases and 4,447 million in 7 cases,

respectively, as of December 31, 2001. The Company believes that the outcome of these matters is

uncertain but, in any event, they would not result in a material ultimate loss for the Company. Accordingly,

no provision for potential losses arising from these claims is reflected in the accompanying financial

statements.

Zenith Electronics Corporation ( Zenith ), a subsidiary, has experienced significant financial difficulties

resulting from continuous losses. Zenith filed a pre-packaged plan of reorganization under Chapter 11 of the

Bankruptcy Code of the United States of America, and the reorganization plan was approved by the court in

November 1999. As a result of the reorganization plan, the Company owns 100% of equity in the

restructured Zenith. However due to continuous losses and accumulated deficits, as of December 31, 2001

Zenith s total liabilities are greater than its total assets by 311,773 million (US$235 million). As of

December 31, 2001, the Company has 153,800 million (US$116 million) of senior secured notes issued

by Zenith, 79,566 million (US$60 million) of loans to Zenith, and 53,044 million (US$40 million) of

guarantees provided to Zenith (see Note 7).

In order to recover its accumulated deficits, Zenith has reduced costs through reduction of number of

employees and disposal of production lines, and changed to become a research & development and

marketing company instead of a manufacturing company. The Company s management expects that royalty

income to be incurred from VSB technology patents for digital TV owned by Zenith will significantly

contribute to the recovery of Zenith in the future.

Based on above mentioned factors, the Company s management believes that a reserve related to the

collectibility of the senior secured notes and loans to Zenith is not required and that the possible exercise of

the guarantee obligation for indebtedness of Zenith is a remote possibility.

Beginning in 1997, Korea and other countries in the Asia Pacific region experienced a severe

contraction in substantially all aspects of their economies. This situation is commonly referred to as the 1997

Asian financial crisis. In response to this situation, the Korean government and the private sector began

implementing structural reforms to historical business practices.

The Korean economy continues to experience difficulties, particularly in the areas of restructuring private

enterprises and reforming the banking industry. The Korean government continues to apply pressure to

Korean companies to restructure into more efficient and profitable firms. The banking industry is currently

undergoing consolidation and significant uncertainty exists with regard to the continued availability of

financing. The Company may be either directly or indirectly affected by the situation described above. In

addition, the Company has investments in, and receivables from affiliates located in Asia Pacific region. The

Company also has outstanding guarantees on the debt obligations of these affiliates. These affiliates have

been affected, and may continue to be affected, by the unstable economic situation in the Asia Pacific

region.