Kodak 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

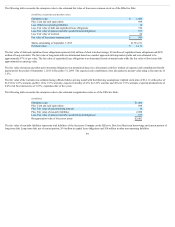

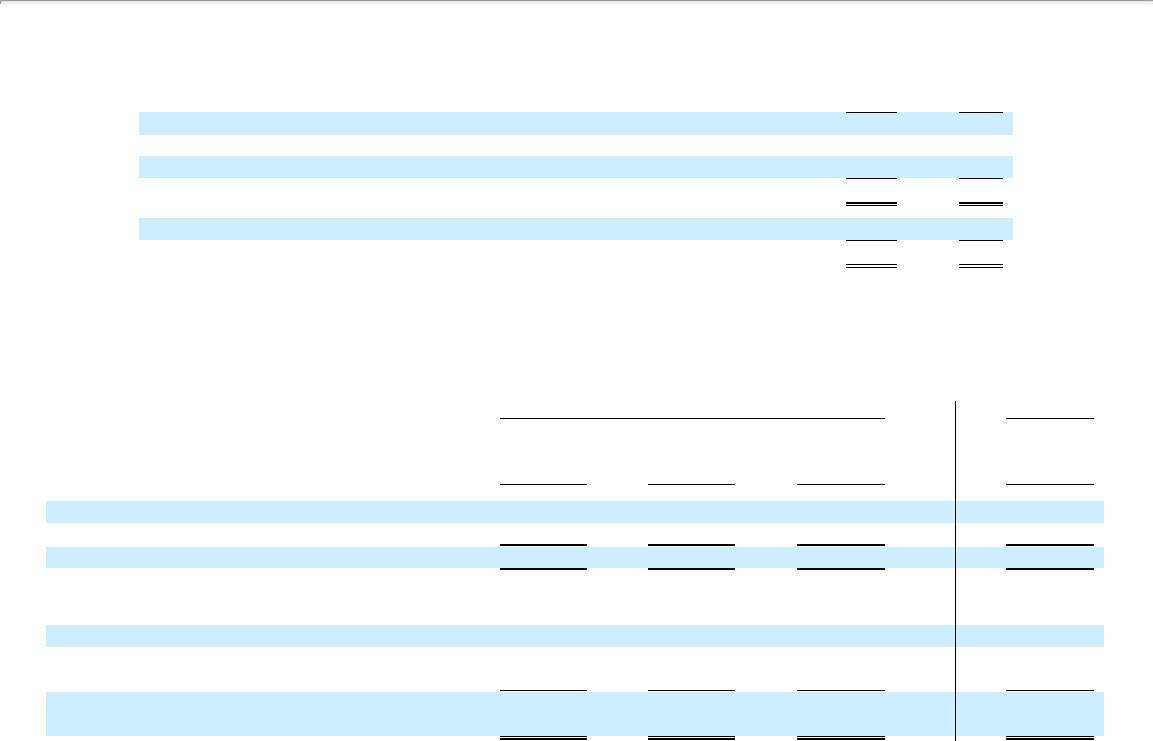

The following table summarizes the major classes of assets and liabilities related to the disposition of the Business which have been segregated and reported as part

of Current assets held for sale and Current liabilities held for sale in the Consolidated Statement of Financial Position:

As of December 31,

(in millions) 2015 2014

Inventories, net $ — $ 2

Property, plant and equipment, net — 4

Other assets — 6

Current assets held for sale $ — $ 12

Trade payables $ — $ 1

Current liabilities held for sale $ — $ 1

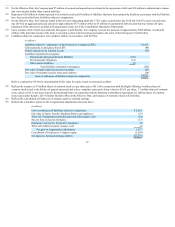

Discontinued operations of Kodak include the Business (excluding the consumer film business, for which Kodak entered into an ongoing supply arrangement with

one or more KPP Purchasing Parties) and other miscellaneous businesses.

The significant components of revenues and earnings (loss) from discontinued operations, net of income taxes are as follows:

Successor Predecessor

Year Ended

December 31,

2015

Year Ended

December 31,

2014

Four Months

Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

(in millions)

Revenues from Personalized and Document Imaging $ 1 $ 61 $ 77 $ 738

Revenues from other discontinued operations — — 1 23

Total revenues from discontinued operations $ 1 $ 61 $ 78 $ 761

Pre-tax (loss) earnings from Personalized and Document

Imaging $ (5) $ 9 $ 5 $ (217)

Pre-tax loss from other discontinued operations — — 1 (14)

(Provision) benefit for income taxes related to

discontinued operations (3) (5) (2) 96

Earnings (loss) from discontinued operations, net of

income taxes $ (8) $ 4 $ 4 $ (135)

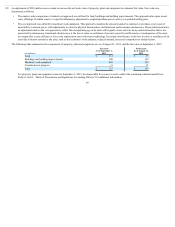

The $5 million in pre-tax loss recognized in 2015 represents costs incurred related to the final deferred closing.

Kodak was required to use a portion of the proceeds from the divestiture of the Business to repay $200 million of the Junior DIP Credit Agreement. Interest

expense on the debt that was required to be repaid as a result of the sale of the Business has therefore been allocated to discontinued operations ($14 million for the

eight months ended August 31, 2013).

Depreciation and amortization of long-lived assets of the Business included in discontinued operations ceased as of July 1, 2013.

Direct operating expenses of the discontinued operations are included in the results of discontinued operations. Indirect expenses that were historically allocated to

the discontinued operations have been included in the results of continuing operations. Prior period results have been reclassified to conform to the current period

presentation.

73