Kodak 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The undistributed earnings of Kodak’s foreign subsidiaries are not considered permanently reinvested. Kodak has recognized a deferred tax liability (net of related

foreign tax credits) on the foreign subsidiaries’ undistributed earnings.

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

In April 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2015-07, Fair Value Measurement (Topic 820):

Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent). ASU 2015-07 removes the requirement to categorize

within the fair value hierarchy all investments for which fair value is measured using the net asset value per share expedient. The ASU is effective for fiscal years,

and interim periods within those years, beginning after December 15, 2015 (January 1, 2016 for Kodak) with retrospective application to all periods presented.

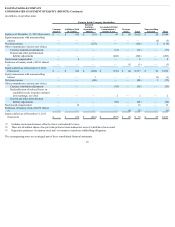

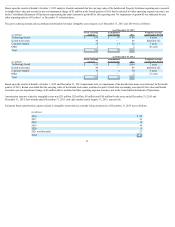

Kodak early adopted ASU 2015-07 effective December 31, 2015. The retrospective adoption resulted in a reduction in Level 3 assets for the U.S. plans of $1,837

million and $1,721 million at December 31, 2014 and January 1, 2014, respectively, and a reduction in Level 3 assets for the non-U.S. plans of $106 million at both

December 31, 2014 and January 1, 2014. In addition, Level 2 assets for the U.S. and non-U.S. plans decreased by $1,761 million and $251 million, respectively, at

December 31, 2014. Refer to Note 16, “Retirement Plans.”

In April 2014, the FASB issued ASU 2014-08, “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360).” ASU 2014-08

defines a discontinued operation as a disposal of a component (or group of components) of an entity that was disposed of or is classified as held for sale and

represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results. ASU 2014-08 expands the disclosures when an entity

retains a significant continuing involvement with a discontinued operation as well as for disposals of individually material components that do not qualify as

discontinued operations. The amendments in the update were effective prospectively for fiscal years, and interim periods within those years, beginning after

December 15, 2014 (January 1, 2015 for Kodak) to new disposals and new disposal groups classified as held for sale after the effective date. The adoption of this

guidance did not have a material impact on Kodak’s Consolidated Financial Statements.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). ASU 2016-02 requires lessees to recognize most leases on their balance sheets as lease

liabilities with corresponding right-of-use assets and eliminates certain real estate-specific provisions. The new leasing standard is effective for fiscal years, and for

interim periods within those fiscal years, beginning after December 15, 2018 (January 1, 2019 for Kodak). Early adoption is permitted. Kodak is currently

evaluating the impact of this ASU.

In January 2016, the FASB issued ASU 2016-01, Financial Instruments–Overall: Recognition and Measurement of Financial Assets and Financial Liabilities. ASU

2016-01 primarily affects the accounting for equity investments, financial liabilities under the fair value option, and the presentation and disclosure requirements

for financial instruments. Under the ASU all equity investments in unconsolidated entities (other than those accounted for using the equity method of accounting)

will generally be measured at fair value through earnings. In addition, the FASB clarified guidance related to the valuation allowance assessment when recognizing

deferred tax assets resulting from unrealized losses on available-for-sale debt securities. The classification and measurement guidance will be effective for Kodak

beginning January 1, 2018, including interim periods within those fiscal years. Kodak is currently evaluating the impact of this ASU.

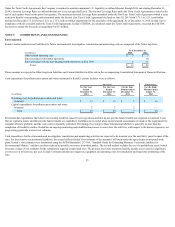

In November 2015, the FASB issued ASU 2015-17, Income Taxes (Topic 740) Balance Sheet Classification of Deferred Taxes. ASU 2015-17 amends the

accounting for income taxes and requires all deferred tax assets and liabilities to be classified as non-current on the consolidated balance sheet. ASU 2015-17 is

effective for fiscal years and interim reporting periods within those years beginning after December 15, 2016 (January 1, 2017 for Kodak), with early adoption

permitted in any annual or interim period. ASU 2015-17 may be adopted either prospectively or retrospectively. Kodak is currently evaluating the method of

adoption and expects ASU 2015-17 will have an impact on the consolidated balance sheet. The current deferred tax assets in excess of valuation allowance were

$22 million as of December 31, 2015.

In April 2015, the FASB issued ASU 2015-03, Imputation of Interest (Sub-Topic 835.30): Simplifying the Presentation of Debt Issuance Costs. ASU 2015-03

requires debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt

liability, consistent with debt discounts. In August 2015, the FASB issued ASU 2015-15 clarifying the application of this guidance to line of credit arrangements.

The amendments in the ASUs are effective retrospectively for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2015

(January 1, 2016 for Kodak). Early adoption is permitted for financial statements not previously issued. Kodak does not expect the adoption of this guidance to

have a material impact on its Consolidated Financial Statements.

In February 2015, the FASB issued ASU 2015-02, “Consolidation (Topic 810): Amendments to the Consolidation Analysis”. The amendments in ASU 2015-02

change the analysis that a reporting entity must perform to determine whether it should consolidate certain types of legal entities. The amendments in this ASU are

effective for fiscal years, and for interim periods within those fiscal years,

18