Kodak 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

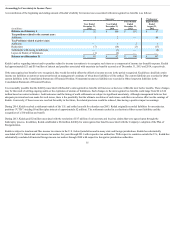

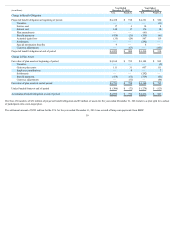

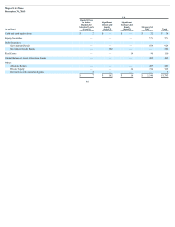

Accounting for Uncertainty in Income Taxes

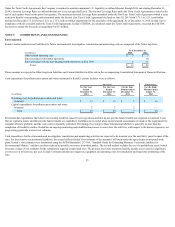

A reconciliation of the beginning and ending amount of Kodak’s liability for income taxes associated with unrecognized tax benefits is as follows:

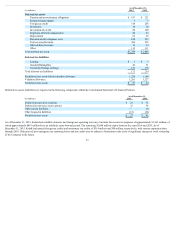

Successor Predecessor

(in millions)

Year Ended

December 31,

2015

Year Ended

December 31,

2014

Four Months

Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

Balance as of January 1 $ 92 $ 106 $ 107 $ 57

Tax positions related to the current year:

Additions 1 2 — 68

Tax Positions related to prior years:

Additions — 1 2 1

Reductions (7) (14) (3) (17)

Settlements with taxing jurisdictions — (1) — (2)

Lapses in Statute of limitations (1) (2) — —

Balance as of December 31 $ 85 $ 92 $ 106 $ 107

Kodak’s policy regarding interest and/or penalties related to income tax matters is to recognize such items as a component of income tax (benefit) expense. Kodak

had approximately $21 and $18 million of interest and penalties associated with uncertain tax benefits accrued as of December 31, 2015 and 2014, respectively.

If the unrecognized tax benefits were recognized, they would favorably affect the effective income tax rate in the period recognized. Kodak has classified certain

income tax liabilities as current or noncurrent based on management’s estimate of when these liabilities will be settled. The current liabilities are recorded in Other

current liabilities in the Consolidated Statement of Financial Position. Noncurrent income tax liabilities are recorded in Other long-term liabilities in the

Consolidated Statement of Financial Position.

It is reasonably possible that the liability associated with Kodak’s unrecognized tax benefits will increase or decrease within the next twelve months. These changes

may be the result of settling ongoing audits or the expiration of statutes of limitations. Such changes to the unrecognized tax benefits could range from $0 to $10

million based on current estimates. Audit outcomes and the timing of audit settlements are subject to significant uncertainty. Although management believes that

adequate provision has been made for such issues, there is the possibility that the ultimate resolution of such issues could have an adverse effect on the earnings of

Kodak. Conversely, if these issues are resolved favorably in the future, the related provision would be reduced, thus having a positive impact on earnings.

During 2014, Kodak reached a settlement outside of the U.S. and settled an audit for calendar year 2003. Kodak originally recorded liabilities for uncertain tax

positions (“UTPs”) totaling $8 million (plus interest of approximately $2 million). The settlement resulted in a reduction in Other current liabilities and the

recognition of a $10 million tax benefit.

During 2013, Kodak paid $2 million associated with the resolution of $17 million of various state and local tax claims that were agreed upon through the

bankruptcy process. In addition, Kodak established a $64 million liability for unrecognized tax benefits associated with the Company’s adoption of the Plan of

Reorganization.

Kodak is subject to taxation and files income tax returns in the U.S. federal jurisdiction and in many state and foreign jurisdictions. Kodak has substantially

concluded all U.S. federal and state income tax matters for years through 2011 with respective tax authorities. With respect to countries outside the U.S., Kodak has

substantially concluded all material foreign income tax matters through 2008 with respective foreign tax jurisdiction authorities.

35