Kodak 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

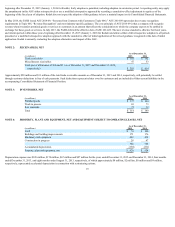

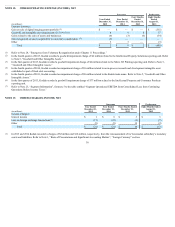

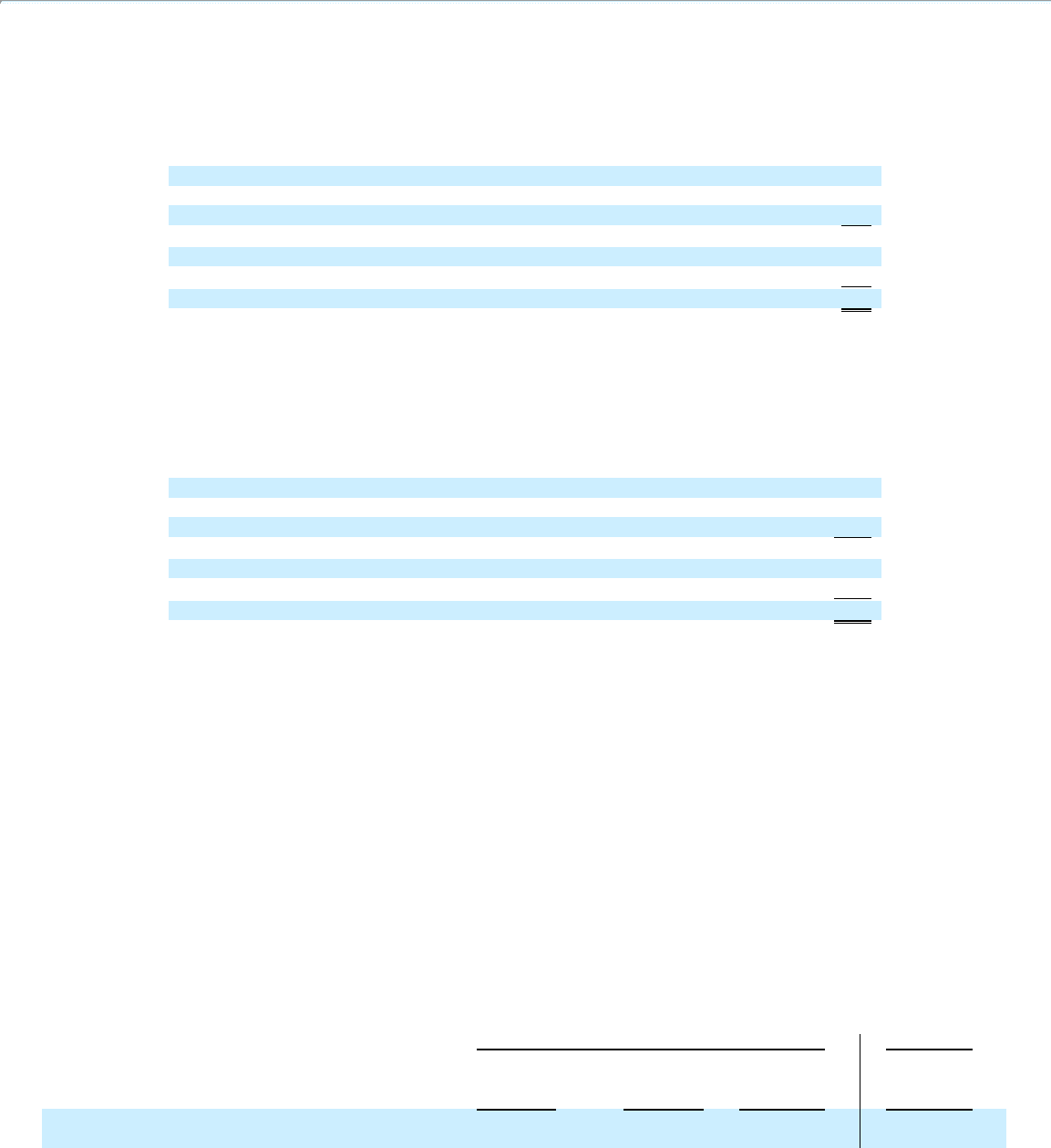

Warranty Costs

Kodak has warranty obligations in connection with the sale of its products and equipment. The original warranty period is generally one year or less. The costs

incurred to provide for these warranty obligations are estimated and recorded as an accrued liability at the time of sale. Kodak estimates its warranty cost at the

point of sale for a given product based on historical failure rates and related costs to repair. The change in Kodak’s accrued warranty obligations balance, which is

reflected in Other current liabilities in the accompanying Consolidated Statement of Financial Position, was as follows:

(in millions)

Accrued warranty obligations as of December 31, 2013 $ 13

Actual warranty experience (16)

Warranty provisions 8

Accrued warranty obligations as of December 31, 2014 5

Actual warranty experience (8)

Warranty provisions 7

Accrued warranty obligations as of December 31, 2015 $ 4

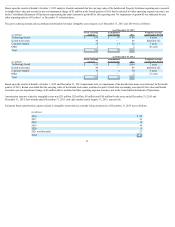

Kodak also offers its customers extended warranty arrangements that are generally one year, but may range from three months to five years after the original

warranty period. Kodak provides repair services and routine maintenance under these arrangements. Kodak has not separated the extended warranty revenues and

costs from the routine maintenance service revenues and costs, as it is not practicable to do so. Therefore, these revenues and costs have been aggregated in the

discussion that follows. The change in Kodak’s deferred revenue balance in relation to these extended warranty and maintenance arrangements, which is reflected

in Other current liabilities in the accompanying Consolidated Statement of Financial Position, was as follows:

(in millions)

Deferred revenue on extended warranties as of December 31, 2013 $ 30

New extended warranty and maintenance arrangements 194

Recognition of extended warranty and maintenance arrangement revenue (197)

Deferred revenue on extended warranties as of December 31, 2014 27

New extended warranty and maintenance arrangements 185

Recognition of extended warranty and maintenance arrangement revenue (185)

Deferred revenue on extended warranties as of December 31, 2015 $ 27

Costs incurred under these extended warranty and maintenance arrangements for the years ended December 31, 2015 and December 31, 2014 amounted to $135

million and $158 million, respectively.

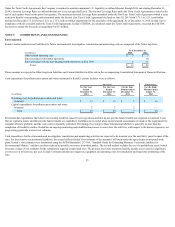

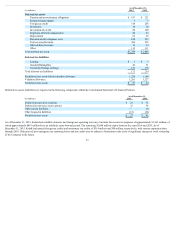

NOTE 11: FINANCIAL INSTRUMENTS

Kodak, as a result of its global operating and financing activities, is exposed to changes in foreign currency exchange rates and interest rates, which may adversely

affect its results of operations and financial position. Kodak manages such exposures, in part, with derivative financial instruments. Foreign currency forward

contracts are used to mitigate currency risk related to foreign currency denominated assets and liabilities, as well as forecasted foreign currency denominated

intercompany assets. Kodak’s exposure to changes in interest rates results from its investing and borrowing activities used to meet its liquidity needs. Kodak does

not utilize financial instruments for trading or other speculative purposes.

Kodak’s foreign currency forward contracts are not designated as hedges, and are marked to market through net (loss) earnings at the same time that the exposed

assets and liabilities are re-measured through net (loss) earnings (both in Other (charges) income, net in the Consolidated Statement of Operations). The notional

amount of such contracts open at December 31, 2015 and 2014 was approximately $384 million and $334 million, respectively. The majority of the contracts of

this type held by Kodak are denominated in Euros, British pounds, and Chinese renminbi. The net effect of foreign currency forward contracts in the results of

operations is shown in the following table:

Derivatives Not Designated as Hedging Instruments, Foreign Exchange Contracts

Successor Predecessor

(in millions)

For the Year

Ended

December 31,

2015

For the Year

Ended

December 31,

2014

For the Four

Months Ended

December 31,

2013

For the Eight

Months Ended

August 31,

2013

Net gain (loss) from derivatives not designated as hedging

instruments $ 14 $ 10 $ (14) $ 2

28