Kodak 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

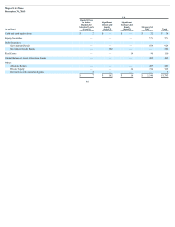

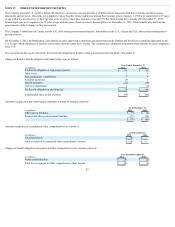

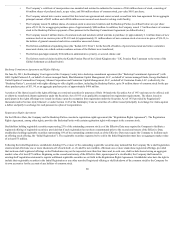

Other postretirement benefit cost included:

Successor Predecessor

(in millions)

Year Ended

December 31,

2015

Year Ended

December 31,

2014

Four Months

Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

Components of net postretirement benefit cost:

Service cost $ — $ — $ — $ —

Interest cost 3 4 1 3

Amortization of:

Prior service credit — — — (75)

Actuarial loss — — — 3

Other postretirement benefit cost (income) from continuing operations $ 3 $ 4 $ 1 $ (69)

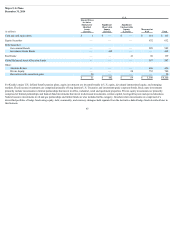

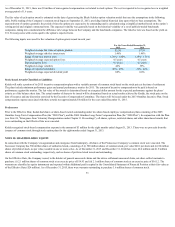

The weighted-average assumptions used to determine the net benefit obligations were as follows:

Year Ended December 31,

2015 2014

Discount rate 3.60% 3.49%

Salary increase rate 1.80% 2.60%

The weighted-average assumptions used to determine the net postretirement benefit cost were as follows:

Successor Predecessor

Year Ended

December 31,

2015

Year Ended

December 31,

2014

Four Months

Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

Discount rate 3.49% 4.28% 4.09% 3.23%

Salary increase rate 2.60% 2.50% 2.50% 2.50%

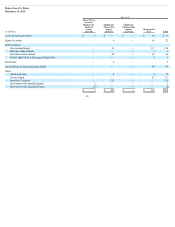

The weighted-average assumed healthcare cost trend rates used to compute the other postretirement amounts were as follows:

2015 2014

Healthcare cost trend 5.81% 6.47%

Rate to which the cost trend rate is assumed to decline (the ultimate trend rate) 4.21% 4.65%

Year that the rate reaches the ultimate trend rate 2022 2021

Assumed healthcare cost trend rates effect the amounts reported for the healthcare plans. A one-percentage point change in assumed healthcare cost trend rates

would have the following effects:

(in millions) 1% increase 1% decrease

Effect on total service and interest cost $ — $ —

Effect on postretirement benefit obligation 4 (4)

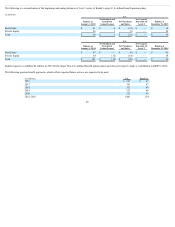

Kodak expects to make benefit payments of $5 million to these postretirement benefit plans in 2016.

50