Kodak 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

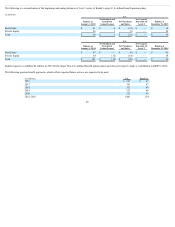

As of December 31, 2015, there was $5 million of unrecognized compensation cost related to stock options. The cost is expected to be recognized over a weighted

average period of 1.6 years.

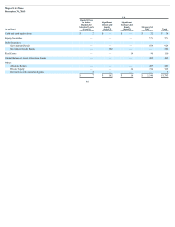

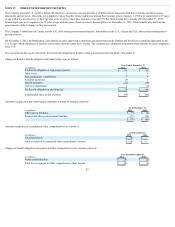

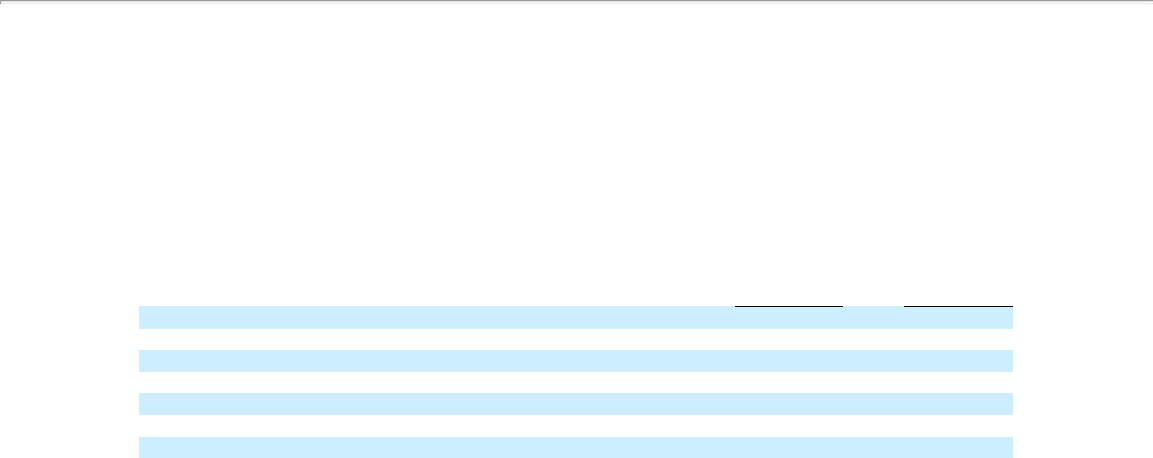

The fair value of each option award is estimated on the date of grant using the Black-Scholes option valuation model that uses the assumptions in the following

table. Public trading of the Company’s common stock began on September 23, 2013, providing limited historical data upon which to base assumptions. The

expected term of options granted is the period of time the options are expected to be outstanding and is calculated using a simplified method based on the option’s

vesting period and original contractual term. The expected volatility was generally based on the historical volatility of a set of publicly-traded benchmark

companies, taking into consideration the difference in leverage between the Company and the benchmark companies. The risk-free rate was based on the yield on

U.S. Treasury notes with a term equal to the option’s expected term.

The following inputs were used for the valuation of option grants issued in each year:

For the Years Ended December 31,

2015 2014

Weighted-average fair value of options granted $5.94 $7.74

Weighted-average risk-free interest rate 1.46% 1.46%

Range of risk-free interest rates 1.26% - 1.60% 1.39% - 1.51%

Weighted-average expected option lives 4.5 years 4.5 years

Expected option lives 4.5 years 4.5 years

Weighted-average volatility 46% 39%

Range of expected volatilities 40% - 49% 36% - 42%

Weighted-average expected dividend yield 0.0% 0.0%

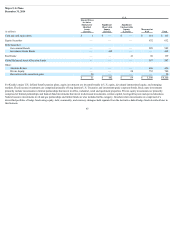

Stock-based Awards Classified as Liabilities

Kodak will settle a portion of its 2015 incentive compensation plans with a variable amount of common stock based on the stock price at the time of settlement.

The plans include minimum performance gates and annual performance metrics for 2015. The amount of incentive compensation to be paid is based on

performance against the metrics. The fair value of the awards is determined based on a targeted dollar amount for the expected performance against the plans’

criteria as of the balance sheet date. The actual number of shares to be issued will be determined based on actual results achieved by Kodak, the stock price on the

date of issuance and any discretion exercised by the Executive Compensation Committee. The shares will be issued under the 2013 Omnibus Incentive Plan. Stock

compensation expense associated with these awards was approximately $6 million for the year ended December 31, 2015.

Predecessor

Prior to the Effective Date, Kodak had shares or share-based awards outstanding under two share-based employee compensation plans consisting of the 2005

Omnibus Long-Term Compensation Plan (the “2005 Plan”), and the 2000 Omnibus Long-Term Compensation Plan (the “2000 Plan”). In conjunction with the Plan

(see Note 24, “Emergence from Voluntary Reorganization under Chapter 11 Proceedings”), all shares, options, restricted shares and other share-based awards that

were outstanding on the Effective Date were canceled.

Kodak recognized stock-based compensation expense in the amount of $3 million for the eight months ended August 31, 2013. There were no proceeds from the

issuance of common stock through stock option plans for the eight months ended August 31, 2013.

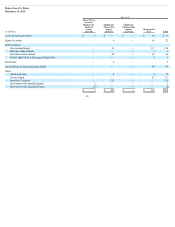

NOTE 20: SHAREHOLDERS’ EQUITY

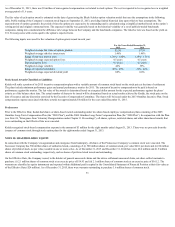

In connection with the Company’s reorganization and emergence from bankruptcy, all shares of the Predecessor Company’s common stock were canceled. The

Successor Company has 560 million shares of authorized stock, consisting of: (i) 500 million shares of common stock, par value $0.01 per share and (ii) 60 million

shares of preferred stock, no par value, issuable in one or more series. As of December 31, 2015 and December 31, 2014 there were 42.0 million and 41.9 million

shares of common stock outstanding, respectively, and no shares of preferred stock issued and outstanding.

On the Effective Date, the Company issued, to the holders of general unsecured claims and the retiree settlement unsecured claim, net-share settled warrants to

purchase: (i) 2.1 million shares of common stock at an exercise price of $14.93 and (ii) 2.1 million shares of common stock at an exercise price of $16.12. The

warrants are classified as equity instruments and reported within Additional paid in capital in the Consolidated Statement of Financial Position at their fair value as

of the Effective Date ($24 million). As of December 31, 2015, there were warrants outstanding to purchase 3.6 million shares of common stock.

53