Kodak 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KPP Global Settlement

The Company had previously issued (pre-petition) a guarantee to Kodak Limited (the “Subsidiary”) and KPP Trustees Limited (“KPP” or the “Trustee”), as trustee

for the U.K. Pension Plan. Under that arrangement, EKC guaranteed to the Subsidiary and the Trustee the ability of the Subsidiary, only to the extent it became

necessary to do so, to (1) make contributions to the U.K. Pension Plan to ensure sufficient assets existed to make plan benefit payments, as they became due, if the

Subsidiary otherwise would not have sufficient assets and (2) make contributions to the U.K. Pension Plan such that it would achieve fully funded status by the

funding valuation for the period ending December 31, 2022.

The Subsidiary agreed to make certain contributions to the U.K. Pension Plan as determined by a funding plan agreed to by the Trustee. The Subsidiary did not pay

the annual contributions due by the funding plan for 2012 or 2013. The Trustee asserted an unsecured claim against the Company of approximately $2.8 billion

under the guarantee. The Subsidiary also asserted an unsecured claim under the guarantee for an unliquidated amount. The Trustee also asserted an unliquidated

claim against all Debtors, as financial support direction and contribution notice claims.

On April 26, 2013, Eastman Kodak Company, the Trustee, Kodak Limited and certain other Kodak entities entered into a global settlement agreement (the “Global

Settlement”) that resolved all liabilities of Kodak with respect to the U.K. Pension Plan. The Global Settlement also provided for the acquisition by KPP and/or its

subsidiaries of certain assets, and the assumption by KPP and/or its subsidiaries of certain liabilities of Kodak’s Personalized Imaging and Document Imaging

businesses (together the “Business”) under a Stock and Asset Purchase Agreement dated April 26, 2013 (the “SAPA”).

On August 30, 2013, the Company entered into an agreement (the “Amended SAPA”) amending and restating the SAPA. The Amended SAPA provided for,

among other things, a series of deferred closings to take place in certain foreign jurisdictions following the initial closing under the Amended SAPA. The deferred

closings implemented the legal transfer of the Business to KPP subsidiaries in the deferred closing foreign jurisdictions in accordance with local law. Pursuant to

the Amended SAPA, Kodak operated the Business relating to the deferred closing jurisdictions, subject to certain covenants, until the applicable deferred closing

occurred, and delivered to (or received from) a KPP subsidiary at each deferred closing a payment reflecting the actual economic benefit (or detriment) to the

Business in the applicable deferred closing jurisdiction(s) from September 1, 2013 through the time of the applicable deferred closing. Up to the time of the

deferred closing, the results of the operations of the Business were reported as Loss (earnings) from discontinued operations, net of income taxes in the

Consolidated Statement of Operations and the assets and liabilities of the Business were categorized as Assets held for sale or Liabilities held for sale in the

Consolidated Statement of Financial Position, as appropriate.

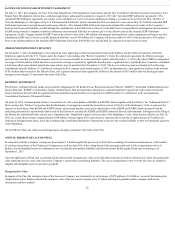

On the Effective Date, the following occurred pursuant to the Amended SAPA and Global Settlement:

• The acquisition by KPP Holdco Limited (“KPP Holdco”), a wholly owned subsidiary of KPP, and certain direct and indirect subsidiaries of KPP

Holdco (together with KPP Holdco, the “KPP Purchasing Parties”), of certain assets of the Business, and the assumption by the KPP Purchasing

Parties of certain liabilities of the Business, for a total purchase price, exclusive of the assumption of liabilities, of $650 million, of which a gross $525

million was paid in cash (net cash consideration of $325 million) and the balance of which was settled by a $125 million note issued by the KPP (the

“KPP Note”).

• The KPP Note was cancelled after being assigned by the Company to the Subsidiary and subsequently assigned by the Subsidiary to KPP as

settlement, by way of setoff, of an equal amount of outstanding pension liabilities of the Subsidiary to KPP.

• The cash consideration was comprised of $325 million sourced from assets of the U.K. Pension Plan and $200 million sourced from a payment by the

Subsidiary to KPP as payment for outstanding pension liabilities of the Subsidiary to KPP.

• Up to $35 million in aggregate of the purchase price is subject to repayment to KPP if the Business does not achieve certain annual adjusted EBITDA

targets over the four-year period ending December 31, 2018.

SECTION 363 ASSET SALES

On February 1, 2013, Kodak entered into a series of agreements related to the monetization of certain of its intellectual property assets, including the sale of its

digital imaging patents. Under these agreements, Kodak received approximately $530 million, a portion of which was paid by twelve licensees that received a

license to the digital imaging patent portfolio and other patents owned by Kodak. Another portion was paid by Intellectual Ventures Fund 83 LLC (“Intellectual

Ventures”) and Apple, Inc., each of which acquired a portion of the digital imaging patent portfolio, subject to the licenses granted to the twelve new licensees, and

previously existing licenses. In addition, Kodak retained a license to the digital imaging patents for its own use. In connection with this transaction, the Company

entered into a separate agreement with FUJIFILM Corporation (“Fuji”) whereby, among other things, Fuji granted Kodak the right to sub-license certain Fuji

patents to businesses Kodak ultimately sold as part of the Plan. The Debtors also agreed to allow Fuji a general unsecured claim against the Debtors in the amount

of $70 million that was discharged pursuant to the terms of the Plan.

61